Frontier Communications 2005 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-19

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

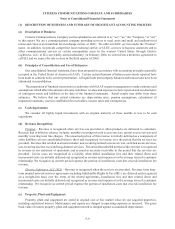

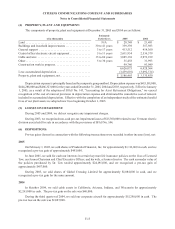

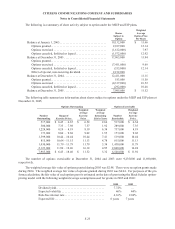

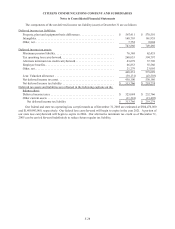

(11) LONG-TERM DEBT:

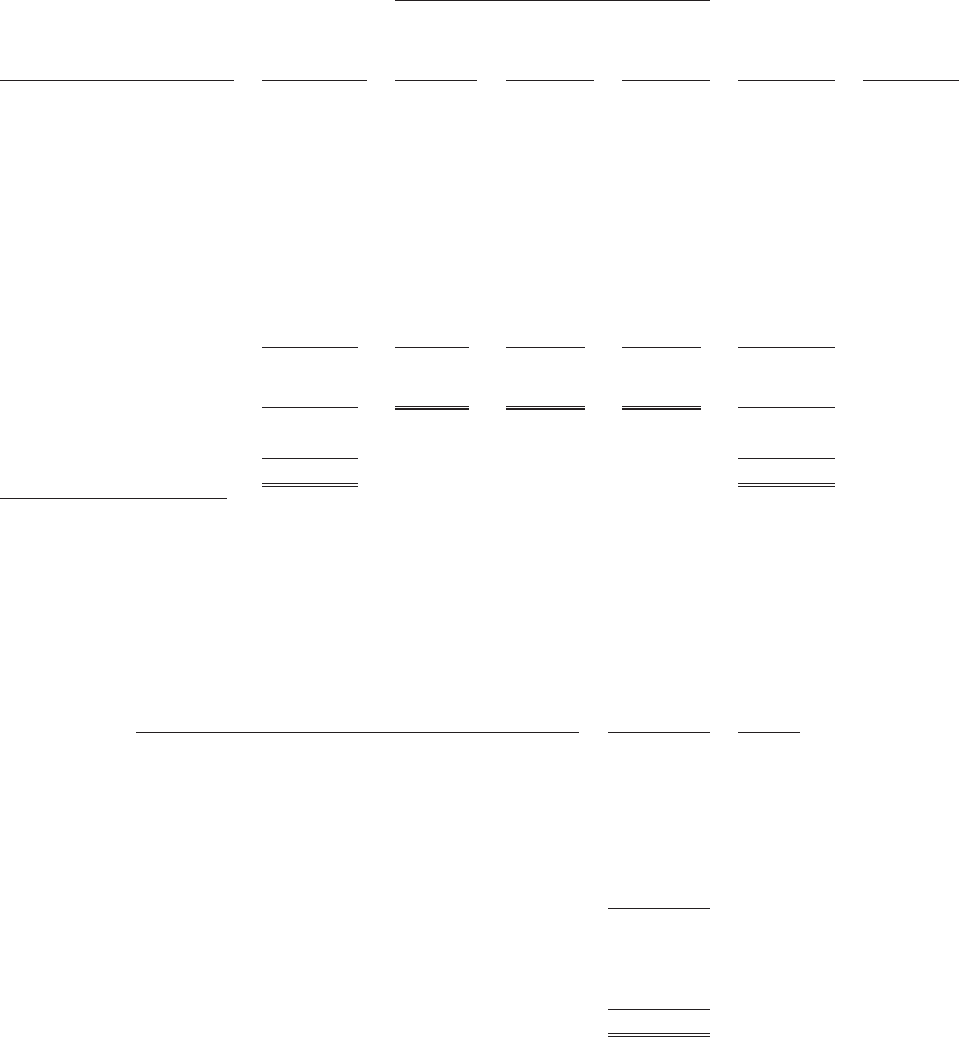

The activity in our long-term debt from December 31, 2004 to December 31, 2005 is summarized as follows:

December 31,

2004

Twelve Months Ended

December 31,

2005($ in thousands) Payments

Interest

Rate Swap Other

Interest

Rate* at

December 31,

2005

Rural Utilities Service Loan

Contracts . . . . . . . . . . . . $ 29,108 $ (6,299) $ — $ — $ 22,809 6.070%

Senior Unsecured Debt . . . . 4,131,803 — (13,193) 2,171 4,120,781 8.117%

EPPICS** (reclassified as a

result of adopting

FIN 46R) . . . . . . . . . . . . 63,765 — — (29,980) 33,785 5.000%

ELI Capital Leases . . . . . . . 4,421 (134) — — 4,287 10.364%

Industrial Development

Revenue Bonds . . . . . . . 58,140 — — — 58,140 5.559%

TOTAL LONG TERM

DEBT . . . . . . . . . . . . . . $ 4,287,237 $ (6,433) $ (13,193) $ (27,809) $ 4,239,802

Less: Debt Discount . . . . . (13,859) (12,692)

Less: Current Portion . . . . (6,380 ) (227,734)

$ 4,266,998 $ 3,999,376

* Interest rate includes amortization of debt issuance expenses, debt premiums or discounts. The interest rate for

Rural Utilities Service Loan Contracts, Senior Unsecured Debt, and Industrial Development Revenue Bonds

represent a weighted average of multiple issuances.

** In accordance with FIN 46R, the Trust holding the EPPICS and the related Citizens Utilities Capital L.P. are

now deconsolidated (see Note 15).

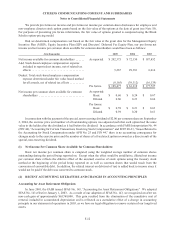

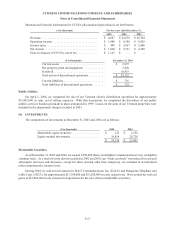

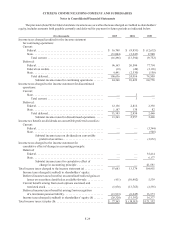

Additional information regarding our Senior Unsecured Debt at December 31, 2005 is as follows:

($ in thousands)

Principal

Outstanding

Interest

Rate

Senior Notes:

Due 8/17/2006 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 51,770 6.750%

Due 8/15/2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 698,470 7.625%

Due 5/15/2011 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,044,256 9.250%

Due 10/24/2011 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 200,000 6.270%

Due 1/15/2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 698,537 6.250%

Due 8/15/2031 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 748,006 9.000 %

3,441,039

Debentures due 2006 - 2046 . . . . . . . . . . . . . . . . . . . . . 643,742 7.263 %

Subsidiary Senior

Notes due 12/1/2012 . . . . . . . . . . . . . . . . . . . . . . . . 36,000 8.050 %

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,120,781

In February 2006, our Board of Directors authorized us to repurchase up to $150.0 million of our outstanding

debt securities over the following twelve-month period. These repurchases may require us to pay premiums, which

would result in pre-tax losses to be recorded in other income (loss), net.