Frontier Communications 2005 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

obligation. Although a liability exists for the removal of poles and asbestos, sufficient information is not available

currently to estimate our liability, as the range of time over which we may settle theses obligations is unknown or

cannot be reasonably estimated. The adoption of FIN 47 during the fourth quarter of 2005 had no impact on our

financial position or results of operations.

Accounting Changes and Error Corrections

In May 2005, the FASB issued SFAS No. 154, “Accounting Changes and Error Corrections,” a replacement of

APB Opinion No. 20 and FASB Statement No. 3. SFAS No. 154 changes the accounting for, and reporting of, a change

in accounting principle. SFAS No. 154 requires retrospective application to prior period’s financial statements of

voluntary changes in accounting principle, and changes required by new accounting standards when the standard does

not include specific transition provisions, unless it is impracticable to do so. SFAS No. 154 is effective for accounting

changes and corrections of errors made in fiscal years beginning after December 15, 2005.

Partnerships

In June 2005, the FASB issued EITF No. 04-5, “Determining Whether a General Partner, or the General

Partners as a Group, Controls a Limited Partnership or Similar Entity When the Limited Partners Have Certain

Rights,” which provides new guidance on how general partners in a limited partnership should determine whether

they control a limited partnership. EITF No. 04-5 is effective for fiscal periods beginning after December 15, 2005.

The Company does not expect the adoption of EITF No. 04-5 to have a material impact on our financial position, results

of operations or cash flows.

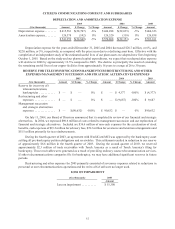

(b) RESULTS OF OPERATIONS

REVENUE

Frontier revenue is generated primarily through the provision of local, network access, long distance and data

services. Such services are provided under either a monthly recurring fee or based on usage at agreed upon rates and

are not dependent upon significant judgments by management, with the exception of a determination of a provision

for uncollectible amounts.

CLEC revenue is generated through local, long distance, data and long-haul services. These services are

primarily provided under a monthly recurring fee or based on usage at agreed upon rates and are not dependent upon

significant judgments by management with the exception of the determination of a provision for uncollectible

amounts and realizability of reciprocal compensation. CLEC usage based revenue includes amounts determined

under reciprocal compensation agreements. While this revenue is governed by specific contracts with the counterparty,

management defers recognition of disputed portions of such revenue until realizability is assured. Revenue earned

from long-haul contracts is recognized over the term of the related agreement.

Consolidated revenue decreased $5.9 million in 2005. The decrease in 2005 is primarily due to a $9.7 million

decrease resulting from the sale in 2004 of our electric utility property, partially offset by an increase of $3.8 million

in ILEC and ELI revenue.

Consolidated revenue decreased $255.8 million, or 11% in 2004. The decrease in 2004 was primarily due to

$228.9 million of decreased gas and electric revenue primarily due to the disposition of our Arizona gas and electric

operations, The Gas Company in Hawaii and our Vermont electric division and $26.9 million of decreased

telecommunications revenue.

Consolidated revenue decreased $223.5 million, or 8% in 2003. The decrease in 2003 was primarily due to

$192.7 million of decreased gas and electric revenue primarily due to the disposition of our Arizona gas and electric

operations and The Gas Company in Hawaii division and $30.8 million of decreased telecommunications revenue.

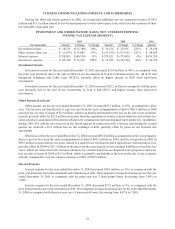

On March 15, 2005, we completed the sale of our conferencing service business. As a result of the sale, we

have classified the results of operations as discontinued operations in our consolidated statement of operations and

restated prior periods.