Frontier Communications 2005 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-32

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

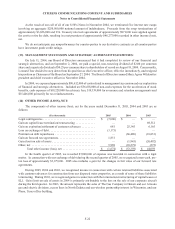

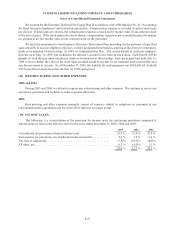

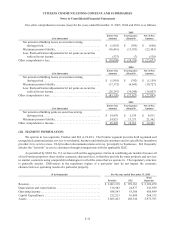

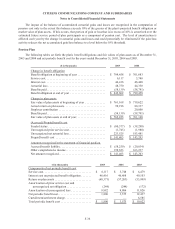

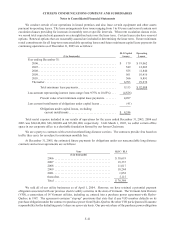

Our other comprehensive income (loss) for the years ended December 31, 2005, 2004 and 2003 is as follows:

2005

($ in thousands)

Before-Tax

Amount

Tax Expense/

(Benefit)

Net-of-Tax

Amount

Net unrealized holding losses on securities arising

during period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (1,055 ) $ (395 ) $ (660 )

Minimum pension liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (36,416 ) (13,933 ) (22,483 )

Less: Reclassification adjustments for net gains on securities

realized in net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (537 ) (7 ) (530 )

Other comprehensive loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (38,008 ) $ (14,335 ) $ (23,673 )

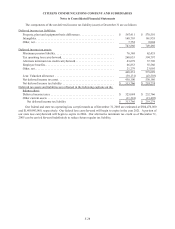

2004

($ in thousands)

Before-Tax

Amount

Tax Expense/

(Benefit)

Net-of-Tax

Amount

Net unrealized holding losses on securities arising

during period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (1,901 ) $ (742 ) $ (1,159)

Minimum pension liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (17,372 ) (6,645 ) (10,727 )

Less: Reclassification adjustments for net gains on securities

realized in net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (26,247 ) (10,240 ) (16,007 )

Other comprehensive loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (45,520 ) $ (17,627 ) $ (27,893)

2003

($ in thousands)

Before-Tax

Amount

Tax Expense/

(Benefit)

Net-of-Tax

Amount

Net unrealized holding gains on securities arising

during period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 14,470 $ 5,539 $ 8,931

Minimum pension liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34,935 13,373 21,562

Other comprehensive income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 49,405 $ 18,912 $ 30,493

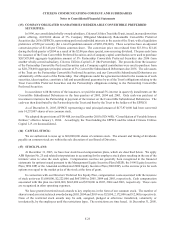

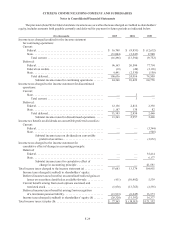

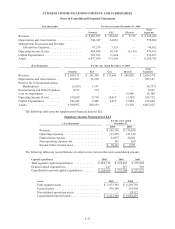

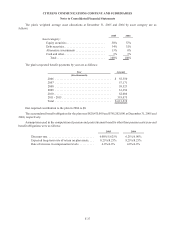

(22) SEGMENT INFORMATION:

We operate in two segments, Frontier and ELI (a CLEC). The Frontier segment provides both regulated and

unregulated communications services to residential, business and wholesale customers and is typically the incumbent

provider in its service areas. ELI provides telecommunications services, principally to businesses. ELI frequently

obtains the “last mile” access to customers through arrangements with the applicable ILEC.

As permitted by SFAS No. 131, we have utilized the aggregation criteria in combining our markets because all

of our Frontier properties share similar economic characteristics, in that they provide the same products and services

to similar customers using comparable technologies in all of the states that we operate in. The regulatory structure

is generally similar. Differences in the regulatory regime of a particular state do not impact the economic

characteristics or operating results of a particular property.

($ in thousands) For the year ended December 31, 2005

Frontier ELI

Total

Segments

Revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,003,318 $ 159,161 $ 2,162,479

Depreciation and Amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 516,982 24,977 541,959

Operating Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 588,543 18,306 606,849

Capital Expenditures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 252,213 16,099 268,312

Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,805,423 168,342 5,973,765