Frontier Communications 2005 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

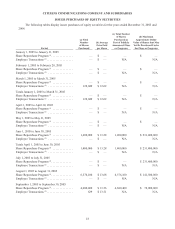

Issuance of Debt Securities

On November 8, 2004, we issued an aggregate $700.0 million principal amount of 6.25% senior notes due

January 15, 2013 through a registered underwritten public offering. Proceeds from the sale were used to redeem our

outstanding $700.0 million of 8.50% Notes due 2006.

Debt Reduction and Debt Exchanges

For the year ended December 31, 2005, we retired an aggregate principal amount of $36.4 million of debt,

including $30.0 million of 5% Company Obligated Mandatorily Redeemable Convertible Preferred Securities due

2036 (EPPICS) that were converted into our common stock. During the second quarter of 2005, we entered into two

debt-for-debt exchanges of our debt securities. As a result, $50.0 million of our 7.625% notes due 2008 were exchanged

for approximately $52.2 million of our 9.00% notes due 2031. The 9.00% notes are callable on the same general terms

and conditions as the 7.625% notes exchanged. No cash was exchanged in these transactions, however a non-cash

pre-tax loss of approximately $3.2 million was recognized in accordance with EITF No. 96-19, “Debtor’s Accounting

for a Modification or Exchange of Debt Instruments,” which is included in other income (loss), net. In February

2006, our Board of Directors authorized us to repurchase up to $150.0 million of our outstanding debt securities over

the following twelve-month period. These repurchases may require us to pay premiums, which would result in pre-

tax losses to be recorded in other income (loss), net.

For the year ended December 31, 2004, we retired an aggregate $1,362.0 million of debt (including $148.0

million of EPPICS conversions), representing approximately 28% of total debt outstanding at December 31, 2003.

During August and September 2004, we repurchased an additional $108.2 million of our 6.75% notes which, in

addition to the $300.0 million we purchased in July, resulted in a pre-tax charge of approximately $20.1 million

during the third quarter of 2004, but resulted in an annual reduction in interest expense of about $27.6 million per

year. See the discussion below concerning EPPICS conversions for further information regarding the issuance of

common stock.

We may from time to time repurchase our debt in the open market, through tender offers or privately negotiated

transactions. We may also exchange existing debt obligations for newly issued debt obligations.

Interest Rate Management

In order to manage our interest expense, we have entered into interest rate swap agreements. Under the terms

of the agreements, which qualify for hedge accounting, we make semi-annual, floating rate interest payments based

on six month LIBOR and receive a fixed rate on the notional amount. The underlying variable rate on these swaps

is set in arrears.

The notional amounts of fixed-rate indebtedness hedged as of December 31, 2005 and December 31, 2004 were

$500.0 million and $300.0 million, respectively. Such contracts require us to pay variable rates of interest (average

pay rates of approximately 8.60% and 6.12% as of December 31, 2005 and 2004, respectively) and receive fixed rates

of interest (average receive rates of 8.46% and 8.44% as of December 31, 2005 and 2004, respectively). All swaps are

accounted for under SFAS No. 133 (as amended) as fair value hedges. For the years ended December 31, 2005 and

2004, the cash interest savings resulting from these interest rate swaps totaled approximately $2.5 million and $9.4

million, respectively.

During September 2005, we entered into a series of forward rate agreements that fixed the underlying variable

rate component of some of our swaps at the market rate as of the date of execution for certain future rate-setting

dates. At December 31, 2005, the rates obtained under these forward rate agreements were below market rates.

Changes in the fair value of these forward rate agreements, which do not qualify for hedge accounting, are recorded

in other income (loss), net. Gains of $1.3 million and $0.6 million, respectively, were recorded during the third and

fourth quarters of 2005.