Frontier Communications 2005 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F-13

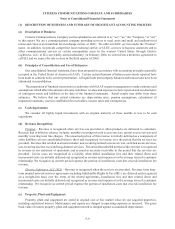

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

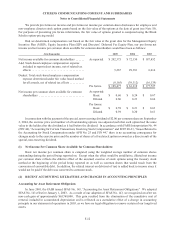

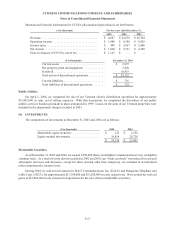

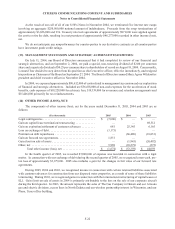

Stock-Based Compensation

In December 2002, the FASB issued SFAS No. 148, “Accounting for Stock-Based Compensation – Transition

and Disclosure, an amendment of FASB Statement No. 123, “Accounting for Stock-Based Compensation.” SFAS No.

148 provides alternative methods of transition for a voluntary change to the fair value based method of accounting

for stock-based compensation and amends the disclosure requirements of SFAS No. 123 to require prominent

disclosures in both annual and interim financial statements. This statement is effective for fiscal years ending after

December 15, 2002. We have adopted the expanded disclosure requirements of SFAS No. 148.

In December 2004, the FASB issued SFAS No. 123 (revised 2004), “Share-Based Payment,” (SFAS No. 123R).

SFAS No. 123R requires that stock-based employee compensation be recorded as a charge to earnings. In April 2005,

the Securities and Exchange Commission required adoption of SFAS No. 123R for annual periods beginning after June

15, 2005. Accordingly, we will adopt SFAS 123R commencing January 1, 2006 and expect to recognize approximately

$2,800,000 of expense related to the non-vested portion of previously granted stock options for the year ended December

31, 2006.

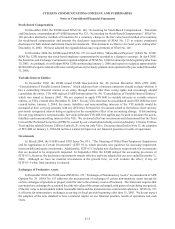

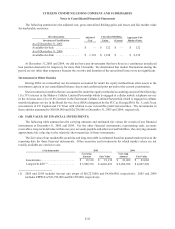

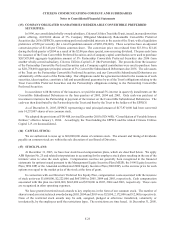

Variable Interest Entities

In December 2003, the FASB issued FASB Interpretation No. 46 (revised December 2003) (FIN 46R),

“Consolidation of Variable Interest Entities,” which addresses how a business enterprise should evaluate whether it

has a controlling financial interest in an entity through means other than voting rights and accordingly should

consolidate the entity. FIN 46R replaces FASB Interpretation No. 46, “Consolidation of Variable Interest Entities,”

which was issued in January 2003. We are required to apply FIN 46R to variable interests in variable interest

entities, or VIEs, created after December 31, 2003. For any VIEs that must be consolidated under FIN 46R that were

created before January 1, 2004, the assets, liabilities and noncontrolling interests of the VIE initially would be

measured at their carrying amounts with any difference between the net amount added to the balance sheet and any

previously recognized interest being recognized as the cumulative effect of an accounting change. If determining

the carrying amounts is not practicable, fair value at the date FIN 46R first applies may be used to measure the assets,

liabilities and noncontrolling interest of the VIE. We reviewed all of our investments and determined that the Trust

Convertible Preferred Securities (EPPICS), issued by our consolidated wholly-owned subsidiary, Citizens Utilities

Trust and the related Citizens Utilities Capital L.P., were our only VIEs. Except as described in Note 15, the adoption

of FIN 46R on January 1, 2004 did not have a material impact on our financial position or results of operations.

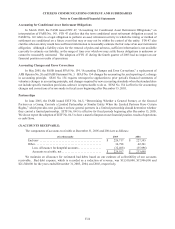

Investments

In March 2004, the FASB issued EITF Issue No. 03-1, “The Meaning of Other-Than-Temporary Impairment

and Its Application to Certain Investments” (EITF 03-1), which provides new guidance for assessing impairment

losses on debt and equity investments. Additionally, EITF 03-1 includes new disclosure requirements for investments

that are deemed to be temporarily impaired. In September 2004, the FASB delayed the accounting provisions of

EITF 03-1; however, the disclosure requirements remain effective and were adopted for our year ended December 31,

2004. Although we have no material investments at the present time, we will evaluate the effect, if any, of

EITF 03-1 when final guidance is released.

Exchanges of Productive Assets

In December 2004, the FASB issued SFAS No. 153, “Exchanges of Nonmonetary Assets,” an amendment of APB

Opinion No. 29. SFAS No. 153 addresses the measurement of exchanges of certain non-monetary assets (except for

certain exchanges of products or property held for sale in the ordinary course of business). The Statement requires that

non-monetary exchanges be accounted for at the fair value of the assets exchanged, with gains or losses being recognized,

if the fair value is determinable within reasonable limits and the transaction has commercial substance. SFAS No. 153

is effective for nonmonetary exchanges occurring in fiscal periods beginning after June 15, 2005. We do not expect

the adoption of the new standard to have a material impact on our financial position, results of operations and cash

flows.