Frontier Communications 2005 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Income Taxes

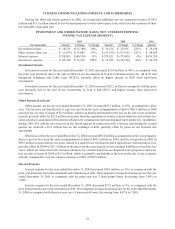

Income taxes for the year ended December 31, 2005 increased $73.9 million, as compared with the prior year

primarily due to changes in taxable income and the effective tax rate. The effective tax rate for 2005 was 29.6% as

compared with 13.5% for 2004. Our effective tax rate was below statutory rates in both years as a result of the

completion of audits with federal and state taxing authorities and changes in the structure of certain of our

subsidiaries.

Income taxes for the year ended December 31, 2004 decreased $54.4 million, or 84%, as compared with the

prior year primarily due to changes in taxable income (loss). The effective tax rate for 2004 was 13.5% as compared

with an effective tax rate of 34.3% for 2003.

CUMULATIVE EFFECT OF CHANGE IN ACCOUNTING PRINCIPLE

($ in thousands) 2003

Amount

Cumulative effect of change in accounting principle . . . . . . . . $ 65,769

During the first quarter of 2003, as a result of our adoption of SFAS No. 143, “Accounting for Asset Retirement

Obligations,” we recognized an after tax non-cash gain of approximately $65.8 million.

DISCONTINUED OPERATIONS

($ in thousands) 2005 2004 2003

Amount Amount Amount

Revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,607 $ 24,558 $ 20,764

Operating income . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,489 $ 8,188 $ 6,820

Income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 449 $ 2,957 $ 2,440

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,040 $ 5,231 $ 4,380

On March 15, 2005, we completed the sale of CCUSA for $43.6 million in cash. The pre-tax gain on the sale of

CCUSA was $14.1 million. Our after-tax gain was $1.2 million. The book income taxes recorded upon sale are

primarily attributable to a low tax basis in the assets sold.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

DISCLOSURE OF PRIMARY MARKET RISKS AND HOW THEY ARE MANAGED

We are exposed to market risk in the normal course of our business operations due to ongoing investing and

funding activities, including those associated with our pension assets. Market risk refers to the potential change in

fair value of a financial instrument as a result of fluctuations in interest rates and equity and commodity prices. We

do not hold or issue derivative instruments, derivative commodity instruments or other financial instruments for

trading purposes. As a result, we do not undertake any specific actions to cover our exposure to market risks and we

are not party to any market risk management agreements other than in the normal course of business or to hedge

long-term interest rate risk.

INTEREST RATE EXPOSURE

Our exposure to market risk for changes in interest rates relates primarily to the interest-bearing portion of our

investment portfolio and interest on our long-term debt and capital lease obligations. The long-term debt and capital

lease obligations include various instruments with various maturities and weighted average interest rates.

Our objectives in managing our interest rate risk are to limit the impact of interest rate changes on earnings and

cash flows and to lower our overall borrowing costs. To achieve these objectives, a majority of our borrowings have

fixed interest rates. Consequently, we have limited material future earnings or cash flow exposures from changes in

interest rates on our long-term debt and capital lease obligations. A hypothetical 10% adverse change in interest rates