Frontier Communications 2005 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-16

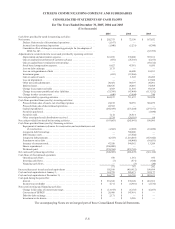

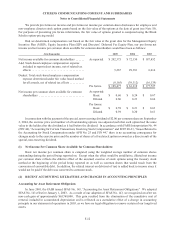

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

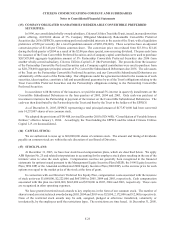

2003

On April 1, 2003, we completed the sale of approximately 11,000 telephone access lines in North Dakota for

approximately $25,700,000 in cash. The pre-tax gain on the sale was $2,274,000.

On April 4, 2003, we completed the sale of our wireless partnership interest in Wisconsin for approximately

$7,500,000 in cash. The pre-tax gain on the sale was $2,173,000.

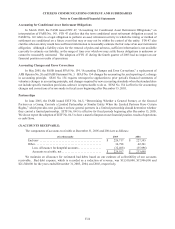

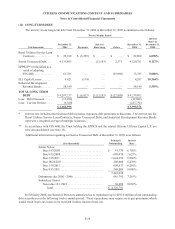

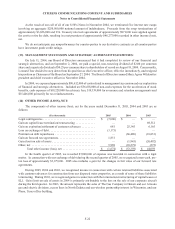

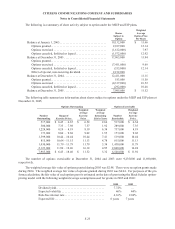

(7) OTHER INTANGIBLES:

Other intangibles at December 31, 2005 and 2004 are as follows:

($ in thousands) 2005 2004

Customer base - amortizable over 96 months . . . . . . . . . . . . . . . . . . $ 994,605 $ 994,605

Trade name - non-amortizable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 122,058 122,058

Other intangibles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,116,663 1,116,663

Accumulated amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (557,930 ) (431,552)

Total other intangibles, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 558,733 $ 685,111

Amortization expense was $126,378,000, $126,520,000 and $126,838,000 for the years ended December 31,

2005, 2004 and 2003, respectively. Amortization expense, based on our estimate of useful lives, is estimated to be

$126,380,000 per year through 2008 and $57,533,000 in 2009, at which point these assets will have been fully

amortized.

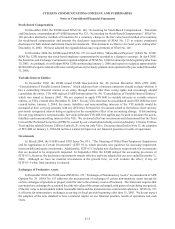

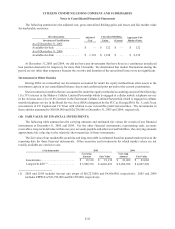

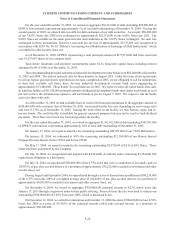

(8) DISCONTINUED OPERATIONS:

Conference Call USA

In February 2005, we entered into a definitive agreement to sell Conference-Call USA, LLC (CCUSA), our

conferencing services business. On March 15, 2005, we completed the sale for $43,565,000 in cash, subject to adjustments

under the terms of the agreement. The pre-tax gain on the sale of CCUSA was $14,061,000. Our after-tax gain was

approximately $1,167,000. The book income taxes recorded upon sale are primarily attributable to a low tax basis in the

assets sold.

In accordance with SFAS No. 144, any component of our business that we dispose of or classify as held for sale

that has operations and cash flows clearly distinguishable from operations, and for financial reporting purposes, and

that will be eliminated from the ongoing operations, should be classified as discontinued operations. Accordingly,

we have classified the results of operations of CCUSA as discontinued operations in our consolidated statements of

operations and have restated prior periods.

CCUSA had revenues of approximately $24,600,000 and operating income of approximately $8,000,000 for the

year ended December 31, 2004. At December 31, 2004, CCUSA’s net assets totaled approximately $23,400,000. The

company had no outstanding debt specifically identified with CCUSA and therefore no interest expense was allocated

to discontinued operations. In addition, we ceased to record depreciation expense effective February 16, 2005.