Frontier Communications 2005 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F-26

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

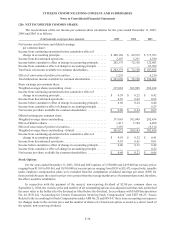

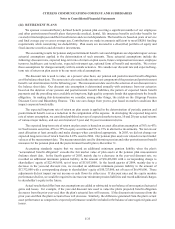

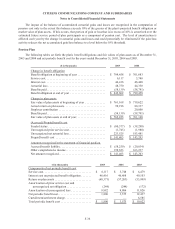

Non-Employee Directors’ Compensation Plan

Upon commencement of his or her service on the Board of Directors, each non-employee director receives a

grant of 10,000 stock options, which is awarded under our 2000 EIP. The price of these options, which are immediately

exercisable, is set at the average of the high and low market prices of our common stock on the effective date of the

director’s initial election to the board.

Annually, each non-employee director also receives a grant of 3,500 stock units under our Formula Plan, which

commenced in 1997 and continues through May 22, 2007. Prior to April 20, 2004, each non-employee director

received an award of 5,000 stock options. The exercise price of the options granted under the Formula Plan was set

at 100% of the average of the high and low market prices of our common stock on the third, fourth, fifth, and sixth

trading days of the year in which the options were granted. The options are exercisable six months after the grant

date and remain exercisable for ten years after the grant date. In addition, on September 1, 1996, each non-employee

director received a grant, under the Formula Plan, of options to purchase 2,500 shares of common stock. These

options granted under the Formula Plan became exercisable six months after the grant date and remain exercisable

for ten years after the grant date.

Effective April 2004, the Formula Plan was amended to replace the annual grant of stock options with an

annual grant of 3,500 stock units. The stock units are awarded on the first business day of each calendar year. Each

non-employee director must elect, by December 31 of the preceding year, whether the stock units awarded under the

Formula Plan will be redeemed in cash or stock upon the director’s retirement or death, whichever occurs first.

In addition, each non-employee director is also entitled to annually receive a retainer, meeting fees, and, when

applicable, fees for serving as a committee chair or as Lead Director, which are awarded under the Non-Employee

Directors’ Deferred Fee Equity Plan. For 2005, each non-employee director had to elect, by December 31 of the

preceding year, to receive $30,000 cash or 5,000 stock units as an annual retainer. Directors making a stock unit

election must also elect to convert the units to either common stock (convertible on a one-to-one basis) or cash upon

retirement or death. Prior to June 30, 2003, a director could elect to receive 20,000 stock options as an annual

retainer in lieu of cash or stock units. The exercise price of the stock options was set at the average of the high and

low market prices of our common stock on the date of grant. The options were exercisable six months after the date

of grant and had a 10-year term.

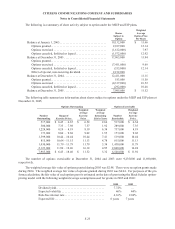

As of any date, the maximum number of shares of common stock which the Non-Employee Directors’ Deferred

Fee Equity Plan is obligated to deliver shall not be more than one percent (1%) of the total outstanding shares of our

common stock as of June 30, 2003, subject to adjustment in the event of changes in our corporate structure affecting

capital stock. There were 14 directors participating in the Directors’ Plan during all or part of 2005. In 2005, the total

options, plan units, and stock earned were 0, 64,000 and 0, respectively. In 2004, the total options, plan units, and stock

earned were 50,000, 57,226 and 0, respectively. In 2003, the total options, plan units, and stock earned were 83,125,

46,034 and 0, respectively. At December 31, 2005, 473,252 options were exercisable at a weighted average exercise price

of $9.80.

For 2005, each non-employee director received fees of $2,000 for each Board of Directors and committee

meeting attended. The chairs of the Audit, Compensation, Nominating and Corporate Governance and Retirement

Plan Committees were paid an additional annual fee of $25,000, $15,000, $7,500 and $5,000, respectively. In addition,

the Lead Director, who heads the ad hoc committee of non-employee directors, received an additional annual fee of

$17,000 (based on an annual fee that was changed from $20,000 to $15,000 mid-year). A director must elect, by

December 31 of the preceding year, to receive meeting and other fees in cash, stock units, or a combination of both. All

fees paid to the non-employee directors in 2005 were paid quarterly (except for the retainer which was paid at the

beginning of the year. If the director elects stock units, the number of units credited to the director’s account is

determined as follows: the total cash value of the fees payable to the director are divided by 85% of the average of the

high and low market prices of our common stock on the first trading day of the year the election is in effect. Units are

credited to the director’s account quarterly.