Frontier Communications 2005 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-30

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

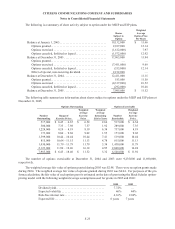

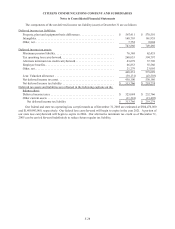

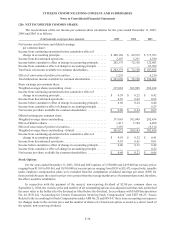

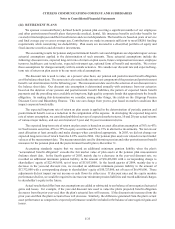

(20) NET INCOME PER COMMON SHARE:

The reconciliation of the net income per common share calculation for the years ended December 31, 2005,

2004 and 2003 is as follows:

($ in thousands, except per-share amounts) 2005 2004 2003

Net income used for basic and diluted earnings

per common share:

Income from continuing operations before cumulative effect of

change in accounting principle . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 200,168 $ 66,919 $ 117,703

Income from discontinued operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,207 5,231 4,380

Income before cumulative effect of change in accounting principle . . . . . . 202,375 72,150 122,083

Income from cumulative effect of change in accounting principle . . . . . . . — — 65,769

Total basic net income available for common shareholders . . . . . . . . . . . . . $ 202,375 $ 72,150 $ 187,852

Effect of conversion of preferred securities . . . . . . . . . . . . . . . . . . . . . . . . . 1,255 — 6,210

Total diluted net income available for common shareholders . . . . . . . . . . . $ 203,630 $ 72,150 $ 194,062

Basic earnings per common share:

Weighted-average shares outstanding - basic . . . . . . . . . . . . . . . . . . . . . . . 337,065 303,989 282,434

Income from continuing operations before cumulative effect of

change in accounting principle . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.59 $ 0.22 $ 0.42

Income from discontinued operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.01 0.02 0.02

Income before cumulative effect of change in accounting principle . . . . . . 0.60 0.24 0.44

Income from cumulative effect of change in accounting principle . . . . . . . — — 0.23

Net income per share available for common shareholders. . . . . . . . . . . . . . $ 0.60 $ 0.24 $ 0.67

Diluted earnings per common share:

Weighted-average shares outstanding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 337,065 303,989 282,434

Effect of dilutive shares . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,417 5,194 4,868

Effect of conversion of preferred securities . . . . . . . . . . . . . . . . . . . . . . . . . 3,193 — 15,134

Weighted-average shares outstanding - diluted . . . . . . . . . . . . . . . . . . . . . . 341,675 309,183 302,436

Income from continuing operations before cumulative effect of

change in accounting principle . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.59 $ 0.22 $ 0.41

Income from discontinued operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.01 0.01 0.01

Income before cumulative effect of change in accounting principle . . . . . . 0.60 0.23 0.42

Income from cumulative effect of change in accounting principle . . . . . . . — — 0.22

Net income per share available for common shareholders. . . . . . . . . . . . . . $ 0.60 $ 0.23 $ 0.64

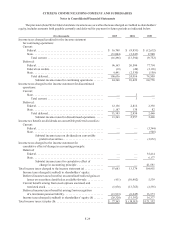

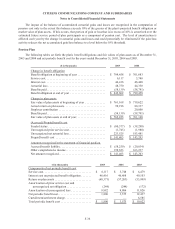

Stock Options

For the years ended December 31, 2005, 2004 and 2003 options of 1,930,000 and 2,495,000 (at exercise prices

ranging from $13.09 to $18.46), and 10,190,000 (at exercise prices ranging from $9.18 to $21.47), respectively, issuable

under employee compensation plans were excluded from the computation of diluted earnings per share (EPS) for

those periods because the exercise prices were greater than the average market price of common shares and, therefore,

the effect would be antidilutive.

In connection with the payment of the special, non-recurring dividend of $2.00 per common share on

September 2, 2004, the exercise price and number of all outstanding options was adjusted such that each option had

the same value to the holder after the dividend as it had before the dividend. In accordance with FASB Interpretation

No. 44 (FIN 44), “Accounting for Certain Transactions involving Stock Compensation” and EITF 00-23, “Issues

Related to the Accounting for Stock Compensation under APB No. 25 and FIN 44,” there is no accounting consequence

for changes made to the exercise price and the number of shares of a fixed stock option or award as a direct result of

the special, non-recurring dividend.