Frontier Communications 2005 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.29

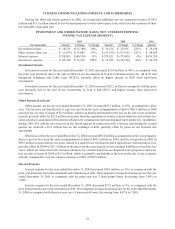

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

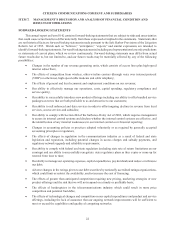

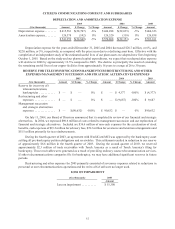

Depreciation and Amortization

The calculation of depreciation and amortization expense is based on the estimated economic useful lives of the

underlying property, plant and equipment and identifiable intangible assets. An independent study of the estimated

useful lives of our plant assets was completed in 2005. We adopted the lives proposed in that study effective October

1, 2005.

Intangibles

Our indefinite lived intangibles consist of goodwill and trade name, which resulted from the purchase of ILEC

properties. We test for impairment of these assets annually, or more frequently, as circumstances warrant. All of our

ILEC properties share similar economic characteristics and as a result, our reporting unit is the ILEC segment. In

determining fair value of goodwill during 2005 we compared the net book value of the ILEC assets to trading values

of our publicly traded common stock. Additionally, we utilized a range of prices to gauge sensitivity. Our test

determined that fair value exceeded book value of goodwill. An independent third party appraiser analyzed trade

name.

Pension and Other Postretirement Benefits

Our estimates of pension expense, other post retirement benefits including retiree medical benefits and related

liabilities are “critical accounting estimates.” We sponsor a noncontributory defined benefit pension plan covering

a significant number of our employees and other post retirement benefit plans that provide medical, dental, life

insurance benefits and other benefits for covered retired employees and their beneficiaries and covered dependents.

The accounting results for pension and post retirement benefit costs and obligations are dependent upon various

actuarial assumptions applied in the determination of such amounts. These actuarial assumptions include the

following: discount rates, expected long-term rate of return on plan assets, future compensation increases, employee

turnover, healthcare cost trend rates, expected retirement age, optional form of benefit and mortality. We review

these assumptions for changes annually with its outside actuaries. We consider our discount rate and expected long-

term rate of return on plan assets to be our most critical assumptions.

The discount rate is used to value, on a present basis, our pension and post retirement benefit obligation as of

the balance sheet date. The same rate is also used in the interest cost component of the pension and post retirement

benefit cost determination for the following year. The measurement date used in the selection of our discount rate is

the balance sheet date. Our discount rate assumption is determined annually with assistance from our actuaries

based on the duration of our pension and postretirement benefit liabilities, the pattern of expected future benefit

payments and the prevailing rates available on long-term, high quality corporate bonds that approximate the benefit

obligation. In making this determination we consider, among other things, the yields on the Citigroup Pension

Discount Curve and Bloomberg Finance. This rate can change from year-to-year based on market conditions that

impact corporate bond yields. Our discount rate declined from 6.00% at year-end 2004 to 5.625% at year-end

2005.

The expected long-term rate of return on plan assets is applied in the determination of periodic pension and

post retirement benefit cost as a reduction in the computation of the expense. In developing the expected long-term

rate of return assumption, we considered published surveys of expected market returns, 10 and 20 year actual returns

of various major indices, and our own historical 5-year and 10-year investment returns. The expected long-term rate

of return on plan assets is based on an asset allocation assumption of 30% to 45% in fixed income securities, 45% to

55% in equity securities and 5% to 15% in alternative investments. We review our asset allocation at least annually

and make changes when considered appropriate. In 2005, we did not change our expected long-term rate of return

from the 8.25% used in 2004. Our pension plan assets are valued at actual market value as of the measurement

date.

Accounting standards require that we record an additional minimum pension liability when the plan’s

“accumulated benefit obligation” exceeds the fair market value of plan assets at the pension plan measurement

(balance sheet) date. In the fourth quarter of 2004, mainly due to a decrease in the year-end discount rate, we

recorded an additional minimum pension liability in the amount of $17.4 million with a corresponding charge to

shareholders’ equity of $10.7 million, net of taxes of $6.7 million. In the fourth quarter of 2005, primarily due to