Frontier Communications 2005 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Sale of Non-Strategic Investments

In February 2006, we entered into a definitive agreement to sell all of the outstanding membership interests in

ELI to Integra Telecom Holdings, Inc. (Integra) for $247.0 million, including $243.0 million in cash plus the

assumption of approximately $4.0 million in capital lease obligations, subject to customary adjustments under the

terms of the agreement. We anticipate the recognition of a pre-tax gain on the sale of ELI of approximately $130.0

million. The transaction is expected to close in the third quarter of 2006 and is subject to regulatory and other

customary approvals and conditions, as well as the funding of Integra’s fully committed financing. We expect that

for periods subsequent to December 31, 2005, ELI will be accounted for as a discontinued operation.

On February 1, 2005, we sold shares of Prudential Financial, Inc. for approximately $1.1 million in cash, and

we recognized a pre-tax gain of approximately $0.5 million that is included in other income (loss), net.

On March 15, 2005, we completed the sale of our conferencing business for approximately $43.6 million in

cash. The pre-tax gain on the sale of CCUSA was $14.1 million.

In June 2005, we sold for cash our interests in certain key man life insurance policies on the lives of Leonard

Tow, our former Chairman and Chief Executive Officer, and his wife, a former director. The cash surrender value of

the policies purchased by Dr. Tow totaled approximately $24.2 million, and we recognized a pre-tax gain of

approximately $457,000 that is included in other income (loss), net.

During 2005, we sold shares of Global Crossing Limited for approximately $1.1 million in cash, and we

recognized a pre-tax gain for the same amount that is included in other income (loss), net.

Off-Balance Sheet Arrangements

We do not maintain any off-balance sheet arrangements, transactions, obligations or other relationship with

unconsolidated entities that would be expected to have a material current or future effect upon our financial

statements.

Future Commitments

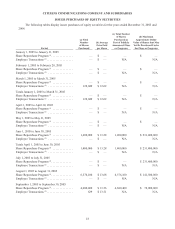

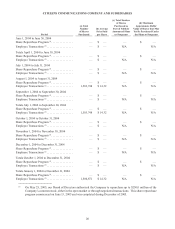

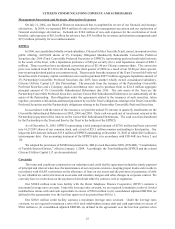

A summary of our future contractual obligations and commercial commitments as of December 31, 2005 is as

follows:

Contractual Obligations: Payment due by period

($ in thousands)

Total

Less than

1 year 1-3 years 3-5 years

More than

5 years

Long-term debt obligations,

excluding interest (see Note 11) (1) . . . . . . . . $ 4,201,730 $ 227,693 $ 738,709 $ 5,393 $ 3,229,935

ELI capital lease obligations (see Note 25) . . . . 4,287 41 236 310 3,700

Operating lease obligations (see Note 25) . . . . . 92,088 19,062 24,445 19,307 29,274

Purchase obligations (see Note 25) . . . . . . . . . . . 76,384 30,619 29,354 11,296 5,115

Other long-term liabilities (2) . . . . . . . . . . . . . . . . 33,785 — — — 33,785

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,408,274 $ 277,415 $ 792,744 $36,306 $ 3,301,809

(1) Includes interest rate swaps ($(8.7) million).

(2) Consists of our Equity Providing Preferred Income Convertible Securities (EPPICS) reflected on our balance

sheet.

At December 31, 2005, we have outstanding performance letters of credit totaling $22.4 million.