Frontier Communications 2005 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-29

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

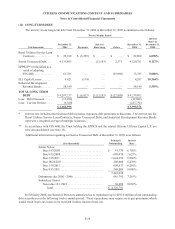

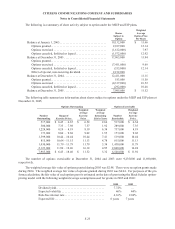

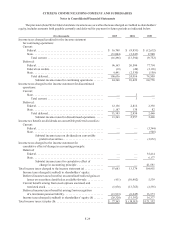

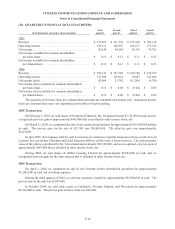

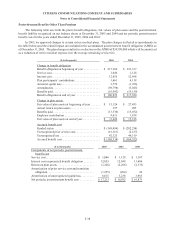

The provision (benefit) for federal and state income taxes, as well as the taxes charged or credited to shareholders’

equity, includes amounts both payable currently and deferred for payment in future periods as indicated below:

($ in thousands) 2005 2004 2003

Income taxes charged (credited) to the income statement

for continuing operations:

Current:

Federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 16,708 $ (9,951 ) $ (12,632 )

State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (33,004 ) (3,643 ) 2,900

Total current . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (16,296) (13,594 ) (9,732)

Deferred:

Federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 96,163 26,586 77,794

Federal tax credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (18 ) (40 ) (3,128)

State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,491 (2,530 ) (158)

Total deferred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100,636 24,016 74,508

Subtotal income taxes for continuing operations . . . . . . . 84,340 10,422 64,776

Income taxes charged to the income statement for discontinued

operations:

Current:

State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 3 —

Total current . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 3 —

Deferred:

Federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12,156 2,816 2,358

State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,187 138 82

Total deferred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,343 2,954 2,440

Subtotal income taxes for discontinued operations . . . . . . 13,343 2,957 2,440

Income tax benefit on dividends on convertible preferred securities:

Current:

Federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ——(3,344)

State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —— (508 )

Subtotal income taxes on dividends on convertible

preferred securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . ——(3,852 )

Income taxes charged to the income statement for

cumulative effect of change in accounting principle:

Deferred:

Federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ——35,414

State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ——6,177

Subtotal income taxes for cumulative effect of

change in accounting principle . . . . . . . . . . . . . . . . . . —— 41,591

Total income taxes charged to the income statement (a) . . . . . . . . . . . . . 97,683 13,379 104,955

Income taxes charged (credited) to shareholders’ equity:

Deferred income taxes (benefits) on unrealized/realized gains or

losses on securities classified as available-for-sale. . . . . . . . . . . . (411 ) (10,982 ) 5,539

Current benefit arising from stock options exercised and

restricted stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (5,976 ) (13,765 ) (2,535)

Deferred income taxes (benefits) arising from recognition

of a minimum pension liability . . . . . . . . . . . . . . . . . . . . . . . . . . . (13,933 ) (6,645 ) 13,373

Income taxes charged (credited) to shareholders’ equity (b) . . . . . . . (20,320) (31,392 ) 16,377

Total income taxes: (a) plus (b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 77,363 $(18,013 ) $ 121,332