Frontier Communications 2005 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-12

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

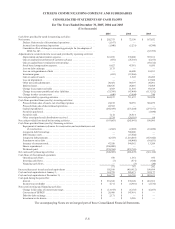

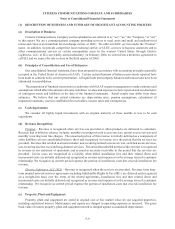

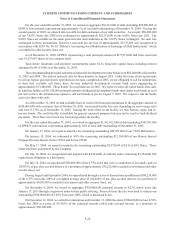

We provide pro forma net income and pro forma net income per common share disclosures for employee and

non-employee director stock option grants based on the fair value of the options at the date of grant (see Note 18).

For purposes of presenting pro forma information, the fair value of options granted is computed using the Black

Scholes option-pricing model.

Had we determined compensation cost based on the fair value at the grant date for the Management Equity

Incentive Plan (MEIP), Equity Incentive Plan (EIP) and Directors’ Deferred Fee Equity Plan, our pro forma net

income and net income per common share available for common shareholders would have been as follows:

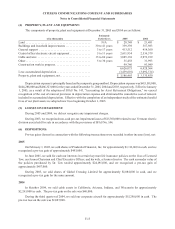

($ in thousands) 2005 2004 2003

Net income available for common shareholders . . . . . . As reported $ 202,375 $ 72,150 $ 187,852

Add: Stock-based employee compensation expense

included in reported net income, net of related tax

effects . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,267 29,381 6,014

Deduct: Total stock-based employee compensation

expense determined under fair value based method

for all awards, net of related tax effects . . . . . . . . . . (8,165) (38,312) (16,139)

Pro forma $ 199,477 $ 63,219 $ 177,727

Net income per common share available for common

shareholders . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

As reported:

Basic $ 0.60 $ 0.24 $ 0.67

Diluted 0.60 0.23 0.64

Pro forma:

Basic $ 0.59 $ 0.21 $ 0.63

Diluted 0.59 0.20 0.61

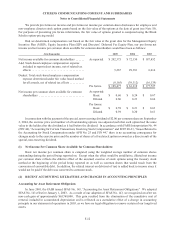

In connection with the payment of the special, non-recurring dividend of $2.00 per common share on September

2, 2004, the exercise price and number of all outstanding options was adjusted such that each option had the same

value to the holder after the dividend as it had before the dividend. In accordance with FASB Interpretation No. 44

(FIN 44), “Accounting for Certain Transactions Involving Stock Compensation” and EITF 00-23, “Issues Related to

the Accounting for Stock Compensation under APB No. 25 and FIN 44,” there is no accounting consequence for

changes made to the exercise price and the number of shares of a fixed stock option or award as a direct result of the

special, non-recurring dividend.

(l) Net Income Per Common Share Available for Common Shareholders:

Basic net income per common share is computed using the weighted average number of common shares

outstanding during the period being reported on. Except when the effect would be antidilutive, diluted net income

per common share reflects the dilutive effect of the assumed exercise of stock options using the treasury stock

method at the beginning of the period being reported on as well as common shares that would result from the

conversion of convertible debt. In addition, the related interest on debt (net of tax) is added back to income since it

would not be paid if the debt was converted to common stock.

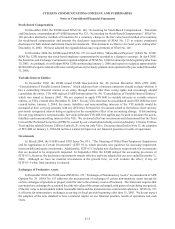

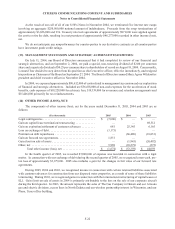

(2) RECENT ACCOUNTING LITERATURE AND CHANGES IN ACCOUNTING PRINCIPLES:

Accounting for Asset Retirement Obligations

In June 2001, the FASB issued SFAS No. 143, “Accounting for Asset Retirement Obligations.” We adopted

SFAS No. 143 effective January 1, 2003. As a result of our adoption of SFAS No. 143, we recognized an after tax

non-cash gain of approximately $65,769,000. This gain resulted from the elimination of the cumulative cost of

removal included in accumulated depreciation and is reflected as a cumulative effect of a change in accounting

principle in our statement of operations in 2003, as we have no legal obligation to remove certain of our long-lived

assets.