Delta Airlines 2004 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

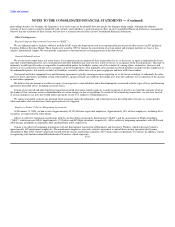

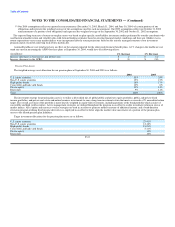

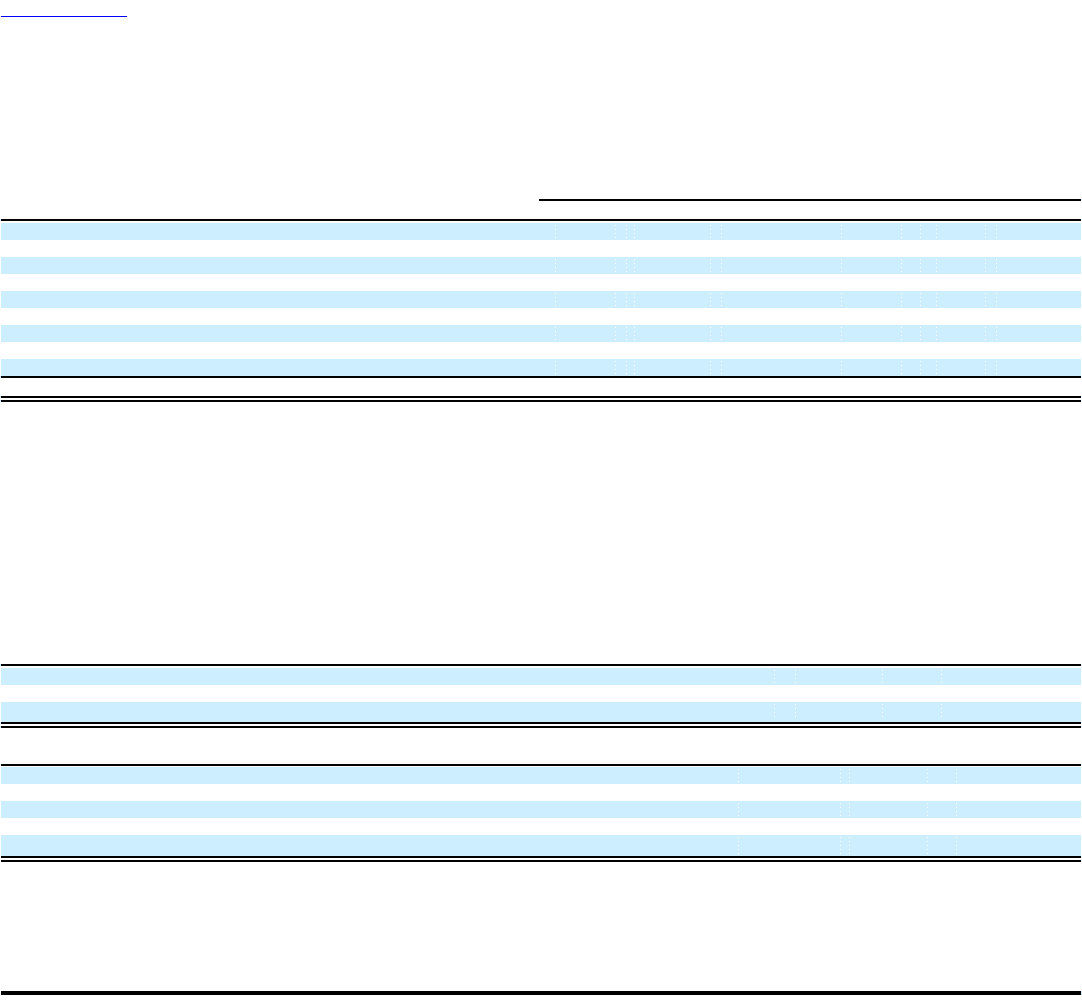

Net periodic benefit cost for the years ended December 31, 2004, 2003 and 2002, included the following components:

Other

Pension Postretirement

Benefits Benefits

(in millions) 2004 2003 2002 2004 2003 2002

Service cost $ 233 $ 238 $ 282 $ 28 $ 33 $ 30

Interest cost 757 768 825 121 161 160

Expected return on plan assets (657) (753) (984) — — —

Amortization of prior service cost 15 13 24 (79) (47) (50)

Recognized net actuarial loss (gain) 194 97 (8) 6 7 2

Amortization of net transition obligation 7 7 8 — — —

Settlement charge 257 219 1 — — —

Curtailment loss (gain) — 47 — (527) (4) —

Special termination benefits 10 — 7 142 — 44

Net periodic benefit cost $ 816 $ 636 $ 155 $ (309) $ 150 $ 186

During 2004 and 2003, we recorded non-cash settlement charges totaling $257 million and $219 million, respectively, in our Consolidated Statements of

Operations. These charges primarily relate to the Pilot Plan and result from lump sum distributions to pilots who retired. We recorded these charges in

accordance with SFAS No. 88, "Employers' Accounting for Settlements and Curtailments of Defined Benefit Pension Plans and for Termination Benefits"

("SFAS 88"). SFAS 88 requires settlement accounting if the cost of all settlements, including lump sum retirement benefits paid, in a year exceeds, or is

expected to exceed, the total of the service and interest cost components of pension expense for the same period.

Additionally, in the December 2004 quarter we recorded a $527 million curtailment gain related to the elimination of company subsidized retiree medical

benefits for eligible employees who retire after January 1, 2006.

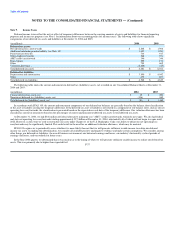

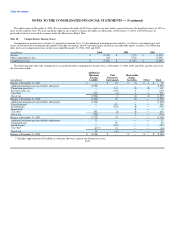

Assumptions

We used the following actuarial assumptions to determine our benefit obligations at September 30, 2004 and 2003, and our net periodic benefit cost for

the years ended December 31, 2004, 2003 and 2002, as measured at September 30:

Benefit Obligations 2004 2003

Weighted average discount rate 6.00% 6.125%

Rate of increase in future compensation levels (1.28)% 1.89%

Assumed healthcare cost trend rate(1) 9.50% 9.00%

Net Periodic Benefit Cost 2004(2) 2003(2) 2002

Weighted average discount rate — pension benefits 6.09% 6.83% 7.75%

Weighted average discount rate — other benefits 6.05% 6.91% 7.75%

Rate of increase in future compensation levels 1.89% 2.47% 4.67%

Expected long-term rate of return on plan assets 9.00% 9.00% 10.00%

Assumed healthcare cost trend rate(1) 9.00% 10.00% 6.25%

(1) We have implemented a limit on the amount we will pay for postretirement medical benefits for employees eligible for such benefits who retire after

November 1, 1993. The assumed healthcare cost trend rate is assumed to decline gradually to 5.00% by 2010 for health plan costs not subject to this

limit and to zero by 2007 for health plan costs subject to the limit (2008 for participants covered under the collectively-bargained healthcare plan), and

remain level thereafter. F-42