Delta Airlines 2004 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

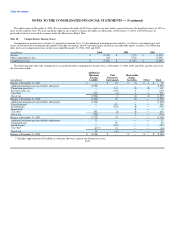

Note 17. Earnings (Loss) per Share ("EPS")

We calculate basic earnings (loss) per share by dividing the net income (loss) available to common shareowners by the weighted average number of

common shares outstanding. Diluted earnings (loss) per share includes the dilutive effects of stock options and convertible securities. To the extent stock

options and convertible securities are anti-dilutive, they are excluded from the calculation of diluted earnings (loss) per share.

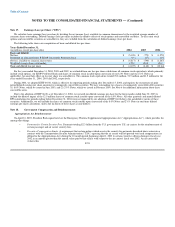

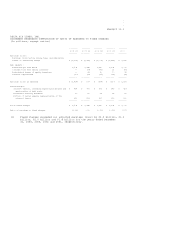

The following table shows our computation of basic and diluted loss per share:

Years Ended December 31,

(in millions, except per share data) 2004 2003 2002

Basic and diluted:

Net loss $ (5,198) $ (773) $ (1,272)

Dividends on allocated Series B ESOP Convertible Preferred Stock (19) (17) (15)

Net loss available to common shareowners $ (5,217) $ (790) $ (1,287)

Weighted average shares outstanding 127.0 123.4 123.3

Basic and diluted loss per share $ (41.07) $ (6.40) $ (10.44)

For the years ended December 31, 2004, 2003 and 2002, we excluded from our loss per share calculations all common stock equivalents, which primarily

include stock options, our ESOP Preferred Stock and shares of common stock issuable upon conversion of our 8.0% Notes and our 27/8% Notes (as

applicable), because their effect on loss per share was anti-dilutive. The common stock equivalents totaled 78.8 million, 51.9 million and 61.5 million for the

years ended December 31, 2004, 2003 and 2002, respectively.

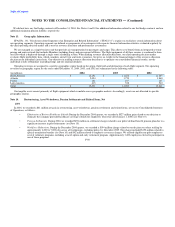

During 2004, we adopted EITF 04-08, which is effective for reporting periods ending after December 15, 2004, and requires the restatement of prior

period diluted earnings per share amounts for contingently convertible securities. We have outstanding two classes of contingently convertible debt securities:

(1) 8.0% Notes, which we issued in June 2003, and (2) 27/8% Notes, which we issued in February 2004. See Note 6 for additional information about these

convertible notes.

Due to the adoption of EITF 04-08 as of December 31, 2004, we restated our diluted earnings per share for the three months ended June 30, 2003 to

include the dilutive impact of the 12.5 million shares of common stock issuable upon conversion of the 8.0% Notes. All other quarterly and annual diluted

EPS calculations for periods ending before December 31, 2004 were not impacted by our adoption of EITF 04-08 due to the anti-dilutive nature of these

securities. Additionally, we will include the shares of common stock issuable upon conversion of the 8.0% Notes and 27/8% Notes in our future diluted

earnings per share calculations, unless the inclusion of these shares is anti-dilutive.

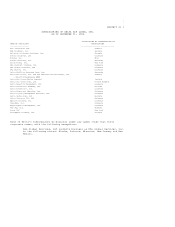

Note 18. Government Compensation and Reimbursements

Appropriations Act Reimbursements

On April 16, 2003, President Bush signed into law the Emergency Wartime Supplemental Appropriations Act ("Appropriations Act"), which provides for,

among other things:

• Payments for Certain Security Fees. Payments totaling $2.3 billion from the U.S. government to U.S. air carriers for the reimbursement of

certain passenger and air carrier security fees.

• Executive Compensation Limits. A requirement that certain airlines which receive the security fee payments described above enter into a

contract with the Transportation Security Administration ("TSA") agreeing that the air carrier will not provide total cash compensation (as

defined in the Appropriations Act) during the 12-month period beginning April 1, 2003 to certain executive officers during its fiscal year

2002 in an amount greater than the annual salary paid to that officer with respect to the air carrier's fiscal year 2002. An air carrier that

violates this F-55