Delta Airlines 2004 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

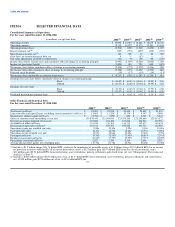

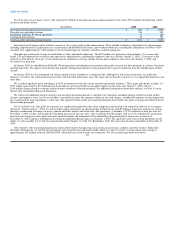

Passenger Revenue per ASM ("Passenger RASM") decreased 3% to 9.09¢. Load factor increased 1.4 points to 74.7%. For additional information about

factors impacting our passenger revenues for 2004, see the "Business Environment" section above.

North American Passenger Revenues. North American passenger revenues increased 4% to $11.1 billion for 2004 on a capacity increase of 7%. RPMs

increased 9%, while passenger mile yield fell 4%. Passenger RASM decreased 3% to 9.28¢. Load factor increased by 1.1 points to 73.7%.

International Passenger Revenues. International passenger revenues increased 18% to $2.6 billion during 2004 on a capacity increase of 15%. RPMs

increased 19%, while passenger mile yield remained unchanged. Passenger RASM increased 3% to 8.16¢, and load factor rose 2.2 points to 78.9%. All of

these increases are primarily due to the depressed levels in the prior year from the war in Iraq.

Cargo and Other Revenues. Cargo revenues increased 7% to $500 million in 2004 primarily due to a 13% increase from higher international freight

volume and yield, which was partially offset by a 5% decrease due to lower mail volume and yield. Cargo ton miles increased 6%, while cargo ton mile yield

remained relatively flat. Other revenues increased 19% to $712 million, primarily reflecting a 6% increase due to revenue from new airport handling contracts

and other miscellaneous contracts, a 5% rise due to increased administrative service charges, and a 3% increase due to higher codeshare revenue from

capacity increases. We expect revenues from administrative service charges to decrease in 2005 due to a reduction in ticket change fees we implemented in

conjunction with the expansion of SimpliFares in January 2005. Increased volume in administrative service charges may offset some of this anticipated

decrease.

Operating Expenses

Operating expenses were $18.3 billion for 2004, a 23%, or $3.4 billion, increase over 2003. As discussed below, the increase in operating expenses was

primarily due to (1) a $1.9 billion goodwill impairment charge recorded in 2004; (2) significantly higher fuel prices in 2004 than in 2003; and (3) $398 million

in reimbursements we received under the Emergency Wartime Supplemental Appropriations Act ("Appropriations Act") in 2003 which were recorded as an

offset to operating expenses in that year. Operating capacity increased 9% to 152 billion ASMs primarily due to the restoration of capacity that we reduced in

2003 due to the war in Iraq. Operating Cost per Available Seat Mile ("CASM") increased 13% to 12.07¢.

Salaries and related costs were relatively flat at $6.3 billion. This reflects a 3% decline due to a decrease in benefit expenses from our cost savings

initiatives and a 2% decline due to lower Mainline headcount. These decreases were offset by (1) a 3% increase due to higher pension and related expense;

(2) a 1% increase due to a 4.5% salary rate increase in May 2004 for our pilots under their collective bargaining agreement which was partially offset by their

rate decrease effective December 1, 2004; and (3) a 1% increase due to growth in operations.

Aircraft fuel expense increased 51%, or $986 million, to $2.9 billion, with approximately $820 million of the increase resulting from higher fuel prices

which remain at historically high levels. The average fuel price per gallon increased 42% to $1.16, and total gallons consumed increased 7%. Approximately

8% and 65% of our aircraft fuel requirements were hedged during 2004 and 2003, respectively. As discussed in Note 4 of the Notes to the Consolidated

Financial Statements, in February 2004, we settled all of our fuel hedge contracts prior to their scheduled settlement dates, resulting in a deferred gain of

$82 million that we recognized during 2004. In 2004, our fuel expense is shown net of fuel hedge gains of $105 million, which included the gain related to the

early settlement. Our fuel expense for 2003 is shown net of fuel hedge gains of $152 million.

Contracted services expense increased 13%, primarily reflecting a 4% increase from new contracts to provide airport handling and other miscellaneous

services, a 2% increase due to technology projects, a 2% increase due to the suspension of the Transportation Security Administration ("TSA") security fee

from June 1, 2003 to September 30, 2003 and subsequent reimbursements and a 2% increase resulting from higher capacity.

Expenses from our contract carrier arrangements increased 19% to $932 million, largely reflecting an 8% increase from higher fuel costs, a 7% increase

due to growth under certain contract carrier arrangements and a 3% increase from higher maintenance expense.

31