Delta Airlines 2004 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Comair's approximately 1,040 flight attendants, to modify their existing collective bargaining agreement, which becomes amendable in July 2007.

The outcome of ASA's and Comair's negotiations with the unions representing their employees cannot presently be determined.

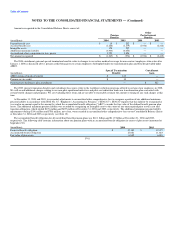

Planned Sale of Aircraft

In connection with our agreement to sell 11 B737-800 aircraft to a third party immediately after those aircraft are delivered to us by the manufacturer in

2005, we agreed to pay the third party, for a designated period with respect to each of the 11 B737-800 aircraft, an amount equal to the excess, if any, of a

specified rate over the rate at which the third party leases the aircraft to another party. The maximum undiscounted amount we could be required to pay for all

11 aircraft totals approximately $70 million. While we cannot predict with certainty whether we will be required to make a payment under this provision, we

believe that the possibility of this event is not likely due to the current and estimated future marketability of these aircraft.

Subsequent to December 31, 2004, we sold four of these aircraft to the third party, which leased those aircraft to another party at a rate that did not require

us to make any payments under the provision discussed in the preceding paragraph. As a result, we believe that the maximum undiscounted amount we could

be required to pay under that provision decreased from approximately $70 million to $45 million.

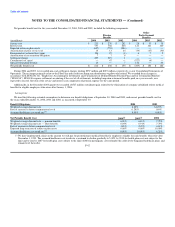

GECC Aircraft

In November 2004, as a condition to availability of the GE Commercial Finance Facility, we granted GECC the right, exercisable until November 2, 2005,

to lease to us (or, at our option subject to certain conditions, certain Delta Connection carriers) up to 12 CRJ-200 aircraft then leased to another airline.

Subsequent to December 31, 2004, GECC exercised this right with respect to eight CRJ-200 aircraft. The leases for these eight aircraft begin throughout 2005

and have terms of 138 to 168 months. We estimate that our total lease payments for these eight aircraft will be approximately $130 million over the terms

mentioned above. Obligations related to these aircraft are not included in the table of lease commitments in Note 7 since GECC exercised its right subsequent

to December 31, 2004. Additionally, the lease rates we will pay for these aircraft approximate current market rates. We expect to use these aircraft in our

operations.

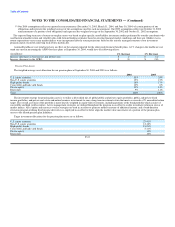

War-Risk Insurance Contingency

As a result of the terrorist attacks on September 11, 2001, aviation insurers (1) significantly reduced the maximum amount of insurance coverage available

to commercial air carriers for liability to persons (other than employees or passengers) for claims resulting from acts of terrorism, war or similar events and

(2) significantly increased the premiums for such coverage and for aviation insurance in general. Since September 24, 2001, the U.S. government has been

providing U.S. airlines with war-risk insurance to cover losses, including those resulting from terrorism, to passengers, third parties (ground damage) and the

aircraft hull. The coverage currently extends through August 31, 2005 (with a possible extension to December 31, 2005 at the discretion of the Secretary of

Transportation). The withdrawal of government support of airline war-risk insurance would require us to obtain war-risk insurance coverage commercially.

Such commercial insurance could have substantially less desirable coverage than currently provided by the U.S. government, may not be adequate to protect

our risk of loss from future acts of terrorism, may result in a material increase to our operating expenses and may result in an interruption to our operations.

Other

We have certain contracts for goods and services that require us to pay a penalty, acquire inventory specific to us or purchase contract specific equipment,

as defined by each respective contract, if we terminate the contract without cause prior to its expiration date. These obligations are contingent upon whether

we terminate the contract without cause prior to its expiration date; therefore, no obligation would exist unless such a termination were to occur.

F-36