Delta Airlines 2004 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

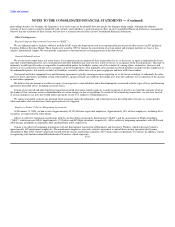

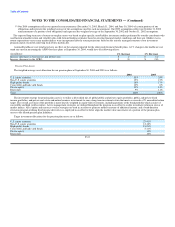

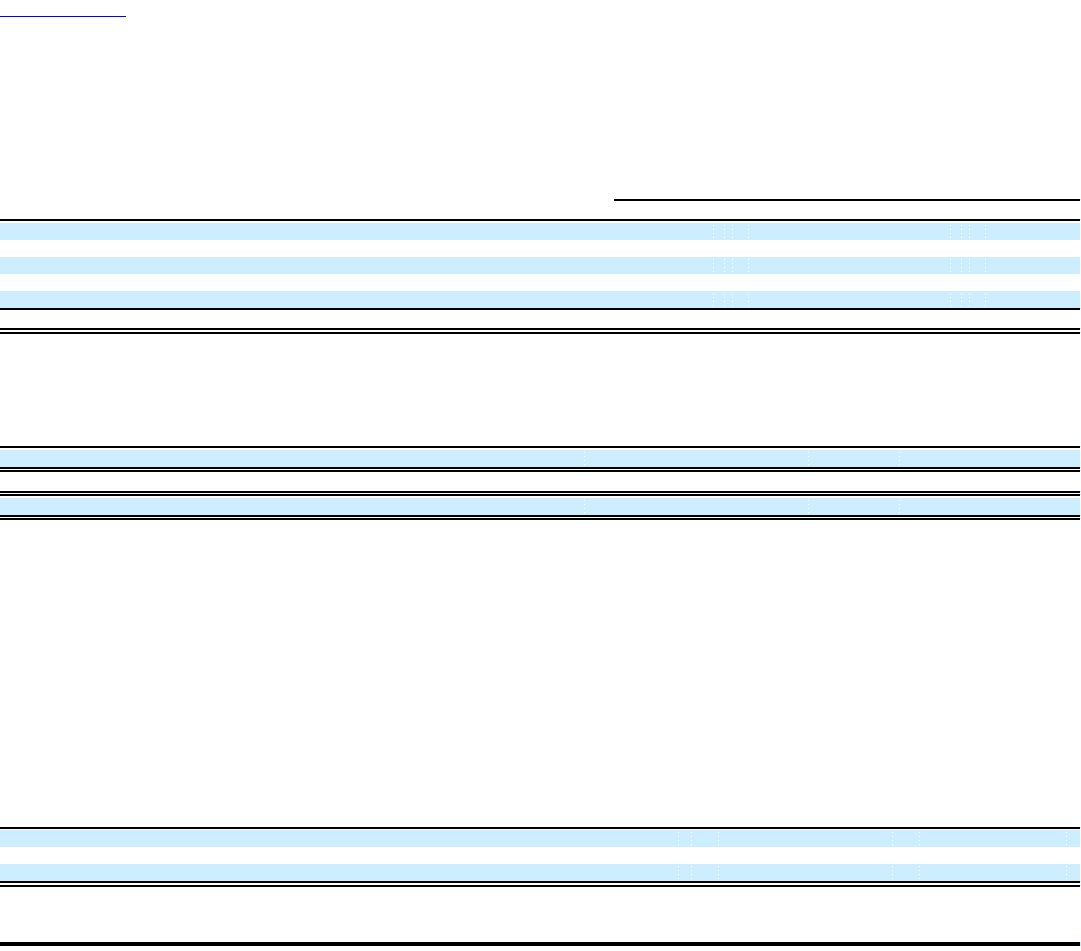

Amounts recognized in the Consolidated Balance Sheets consist of:

Other

Pension Postretirement

Benefits Benefits

(in millions) 2004 2003 2004 2003

Prepaid benefit cost $ 19 $ 202 $ — $ —

Accrued benefit cost (1,266) (1,179) (1,936) (2,412)

Intangible assets 178 227 — —

Additional minimum liability (3,933) (4,052) — —

Accumulated other comprehensive loss, pretax 3,755 3,826 — —

Net amount recognized $ (1,247) $ (976) $ (1,936) $ (2,412)

The 2004 curtailment gain and special termination benefits relate to changes to our retiree medical coverage for non-contract employees who retire after

January 1, 2006 as discussed above, pension credit being given to certain employees furloughed under our transformation plan and benefits provided under

AERO.

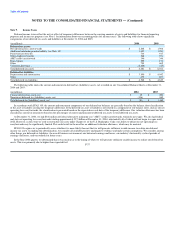

Special Termination Curtailment

(in millions) Benefits Gain

AERO enhanced medical benefits $ 142 —

Pension service credit $ 10 —

Postretirement healthcare plan amendment — $ 527

The 2003 special termination benefits and curtailment loss (gain) relate to the workforce reduction programs offered to certain of our employees in 2002.

We will record additional charges relating to our non-pilot operational initiatives and pilot cost reductions under our transformation plan associated with

certain benefit changes and programs. We are evaluating these items and are not able to reasonably estimate the amount or timing of any such charges at this

time.

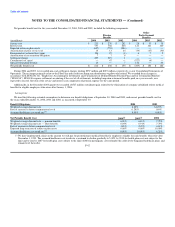

At December 31, 2004 and 2003, we recorded adjustments to accumulated other comprehensive loss to recognize a portion of our additional minimum

pension liability in accordance with SFAS No. 87, "Employers' Accounting for Pensions" ("SFAS 87"). SFAS 87 requires that this liability be recognized at

year end in an amount equal to the amount by which the accumulated benefit obligation ("ABO") exceeds the fair value of the defined benefit pension plan

assets. The additional minimum pension liability was recorded by recognizing an intangible asset to the extent of any unrecognized prior service cost and

transition obligation, which totaled $178 million and $227 million at December 31, 2004 and 2003, respectively. The additional minimum pension liability

adjustments totaling ($14) million and $786 million, net of tax, were recorded in accumulated other comprehensive loss on our Consolidated Balance Sheets

at December 31, 2004 and 2003, respectively (see Note 12).

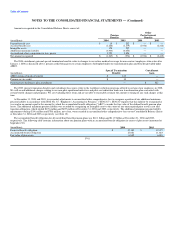

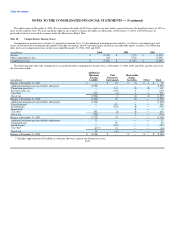

The accumulated benefit obligation for all our defined benefit pension plans was $12.1 billion and $11.9 billion at December 31, 2004 and 2003,

respectively. The following table contains information about our pension plans with an accumulated benefit obligation in excess of plan assets (measured at

September 30):

(in millions) 2004 2003

Projected benefit obligation $ 12,140 $ 12,477

Accumulated benefit obligation 12,081 11,863

Fair value of plan assets 6,842 6,818

F-41