Delta Airlines 2004 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

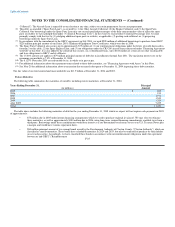

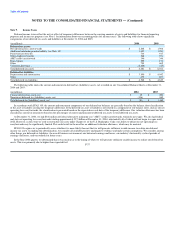

The following table summarizes, as of December 31, 2004, our minimum rental commitments under capital leases and noncancelable operating leases

with initial terms in excess of one year:

Years Ending December 31, Capital Operating

(in millions) Leases Leases

2005 $ 158 $ 1,091

2006 162 1,017

2007 134 915

2008 112 980

2009 146 836

After 2009 410 4,823

Total minimum lease payments 1,122 $ 9,662

Less: lease payments that represent interest 674

Present value of future minimum capital lease payments 448

Less: current obligations under capital leases 58

Long-term capital lease obligations $ 390

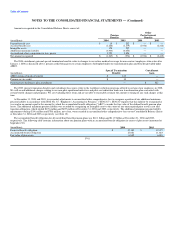

We expect to receive approximately $120 million under noncancelable sublease agreements. This expected sublease income is not reflected as a reduction

in the total minimum rental commitments under operating leases in the table above.

At December 31, 2004, we operated 297 aircraft under operating leases and 48 aircraft under capital leases. These leases have remaining terms ranging

from three months to 13 years. During the December 2004 quarter, we renegotiated 99 aircraft lease agreements (95 operating leases and four capital leases)

as part of our transformation plan (see Note 1). As a result of changes in certain lease terms, 33 of the operating leases were reclassified as capital leases when

their new terms were evaluated in accordance with SFAS No. 13 "Accounting for Leases" ("SFAS 13"). These reclassifications increased our capital lease

obligations by approximately $375 million and our flight and ground equipment under capital leases by approximately $240 million at December 31, 2004.

As part of our aircraft lease and debt renegotiations, we entered into agreements with aircraft lessors and lenders under which we expect to receive average

annual cash savings of approximately $57 million between 2005 and 2009, which will also result in some cost reductions. We issued a total of

4,354,724 shares of common stock in these transactions. Substantially all of these shares were issued under the aircraft lease renegotiations. The fair value of

the shares issued to lessors approximated $30 million and, in accordance with SFAS 13, was considered a component of minimum lease payments.

Certain municipalities have issued special facilities revenue bonds to build or improve airport and maintenance facilities leased to us. The facility lease

agreements require us to make rental payments sufficient to pay principal and interest on the bonds. The above table includes $1.7 billion of operating lease

rental commitments for these payments.

See Note 8 for additional lease commitments occurring subsequent to December 31, 2004. See Note 6 for additional information about the Reimbursement

Agreement which covers certain of our lease obligations in the table above. F-32