Delta Airlines 2004 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

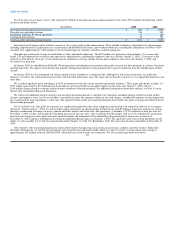

Non-Pilot Operational Improvements. The targeted $1.6 billion of non-pilot operational improvements by the end of 2006 includes the following, which

are discussed further below:

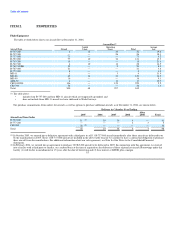

(in millions) 2005 2006

Incremental profit improvement initiatives $ 600 $ 1,000

Non-pilot pay and benefit savings 350 350

Dehubbing of Dallas/ Ft. Worth operations 75 100

Continuous hub redesign 50 150

Total non-pilot operational improvements $ 1,075 $ 1,600

Incremental profit improvement initiatives consist of cost savings and revenue enhancements. These include technology and productivity enhancements,

including improvements in airport processes, maintenance and distribution efficiency; and overhead reductions, including the elimination of 6,000 to 7,000

non-pilot jobs. Approximately 3,400 employees elected to participate in voluntary workforce reduction programs.

Non-pilot pay and benefit savings are attributable to salary and benefit reductions. The $350 million of estimated savings includes: (1) an across-the-

board, 10% pay reduction for executives and supervisory, administrative, and frontline employees that was effective January 1, 2005; (2) increases to the

shared cost of healthcare coverage; (3) the elimination of a healthcare coverage subsidy for non-pilot employees who retire after January 1, 2006; and

(4) reduced vacation time.

In January 2005, we dehubbed our Dallas/Ft. Worth operations and redeployed aircraft from that market to grow our hub operations in Atlanta, Cincinnati

and Salt Lake City. We expect to benefit from this initiative through incremental revenue primarily due to greater utilization from the redeployment of these

aircraft.

In January 2005, we also redesigned our Atlanta operation from a banked to a continuous hub. Although we will incur incremental costs under this

initiative, we believe the related incremental revenue will more than offset these costs. We expect the net benefit to increase as we expand this initiative to our

other hubs.

We recorded significant gains and charges in 2004 in connection with some of our non-pilot operational initiatives. These gains and charges include (1) a

$527 million gain related to the elimination of the healthcare coverage subsidy for non-pilot employees who retire after January 1, 2006, and (2) a

$194 million charge related to voluntary and involuntary workforce reduction programs. For additional information about these subjects, see Note 14 in the

Notes to the Consolidated Financial Statements.

We will record additional charges relating to our non-pilot operational initiatives and pilot cost reductions, including charges related to certain facility

closures and employee items, but we are not able to reasonably estimate the amount or timing of any such charges, including the amounts of such charges that

may result in future cash expenditures, at this time. The targeted benefits under our transformation plan do not reflect any gains or charges described in this or

the preceding paragraph.

Pilot Cost Reductions. Our pilot cost structure was significantly higher than that of our competitors and needed to be reduced in order for us to compete

effectively. On November 11, 2004, we and our pilots union entered into an agreement that will provide us with $1 billion in long-term, annual cost savings

through a combination of changes in wages, pension and other benefits and work rules. The agreement (1) includes a 32.5% reduction to base pay rates on

December 1, 2004; (2) does not include any scheduled increases in base pay rates; and (3) includes benefit changes such as a 16% reduction in vacation pay,

increased cost sharing for active pilot and retiree medical benefits, the amendment of the defined benefit pension plan to stop service accrual as of

December 31, 2004, and the establishment of a defined contribution pension plan as of January 1, 2005. The agreement also states certain limitations on our

ability to seek to modify it if we file for reorganization under Chapter 11 of the U.S. Bankruptcy Code. The agreement becomes amendable on December 31,

2009.

Other Benefits. Our transformation plan also targets other benefits through concessions from aircraft lessors, creditors and other vendors. During the

December 2004 quarter, we entered into agreements with aircraft lessors and lenders under which we expect to receive average annual cash savings of

approximately $57 million between 2005 and 2009, which will also result in some cost reductions. We also reached agreements with about

28