Delta Airlines 2004 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Collateral"). The Aircraft Loan is repayable at our election at any time, subject to certain prepayment fees on any prepayment.

(6) This debt, as amended ("Spare Parts Loan"), is secured by (1) the Other Aircraft Collateral; (2) the Engine Collateral; and (3) the Spare Parts

Collateral. Our borrowings under the Spare Parts Loan may not exceed specified percentages of the then current market value of either the spare

parts or rotables we have pledged thereunder ("Collateral Percentage Tests"). In the event we exceed either Collateral Percentage Test, we must

promptly comply with that test by (1) pledging additional spare parts or rotables, as applicable; (2) posting cash collateral; or (3) prepaying

borrowings under the Spare Parts Loan.

(7) In accordance with the amendments to the GECC agreements in July 2004, we used $228 million of additional borrowings to purchase from GECC

$228 million principal amount of our Series 2001-1 Enhanced Equipment Trust Certificates, which were due in 2006.

(8) The Spare Parts Collateral also secures up to approximately $75 million of (1) our reimbursement obligations under the letters of credit discussed in

footnote 3 to this table; (2) the Spare Engines Loan; and (3) our obligations under the CRJ-200 aircraft leases discussed under "Financing Agreement

with GE" in this Note. It is also added to the collateral that secures, on a subordinated basis, up to $160 million of certain of our other existing debt

and lease obligations to GECC and its affiliates.

(9) The 15.46% interest rate applies to $79 million principal amount of debt due in installments through June 2011. The maximum interest rate on the

remaining secured debt is 7.0% at December 31, 2004.

(10) The 8.125% Notes due 2039 are redeemable by us, in whole or in part at par.

(11) For additional information about the repayment terms related to these debt maturities, see "Financing Agreement with Amex" in this Note.

(12) See Note 20 for additional information about a transaction that occurred subsequent to December 31, 2004 impacting these debt maturities.

The fair value of our total secured and unsecured debt was $11.9 billion at December 31, 2004 and 2003.

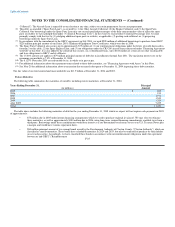

Future Maturities

The following table summarizes the maturities of our debt, including current maturities, at December 31, 2004:

Years Ending December 31, Principal

(in millions) Amount

2005 $ 835

2006 913

2007 1,374

2008 1,549

2009 1,324

After 2009 7,455

Total $ 13,450

The table above includes the following maturities of debt for the year ending December 31, 2005 which we expect will not require cash payments in 2005

of approximately:

• $75 million due in 2005 under interim financing arrangements which we used to purchase regional jet aircraft. We may elect to refinance

these maturities, as well as approximately $180 million due in 2006, using long-term, secured financing commitments available to us from a

third party. Borrowings under these commitments would bear interest at a rate determined by reference to ten-year U.S. Treasury Notes plus

a margin, and would have various repayment dates.

• $80 million principal amount of tax-exempt bonds issued by the Development Authority of Clayton County ("Clayton Authority") which are

classified as current maturities. These bonds have scheduled maturities in 2029 and 2035, but may be tendered for purchase by their holders

on seven days notice. Accordingly, we have classified these bonds in accordance with our reimbursement obligations under the agreement

between us and GECC ("Reimbursement F-25