Delta Airlines 2004 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

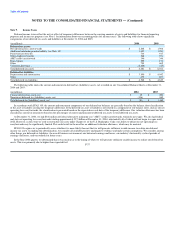

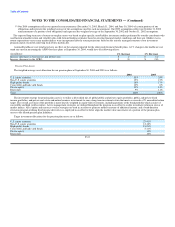

Obligations and funded status (measured at September 30):

Other

Pension Postretirement

Benefits Benefits

(in millions) 2004 2003 2004 2003

Benefit obligation at beginning of year $ 12,477 $ 11,682 $ 2,260 $ 2,370

Service cost 233 238 28 33

Interest cost 757 768 121 161

Actuarial (gain) loss (35) 1,014 71 131

Benefits paid, including lump sums and annuities (1,292) (1,092) (178) (178)

Participant contributions — — 20 16

Special termination benefits — 7 — 44

Curtailment loss (gain) — 25 — (4)

Plan amendments — (165) (487) (313)

Benefit obligation at end of year $ 12,140 $ 12,477 $ 1,835 $ 2,260

Fair value of plan assets at beginning of period $ 6,818 $ 6,775

Actual gain on plan assets 821 991

Employer contributions 495 144

Benefits paid, including lump sums and annuities (1,292) (1,092)

Fair value of plan assets at end of period $ 6,842 $ 6,818

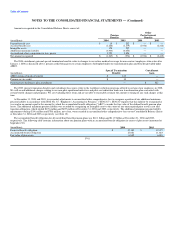

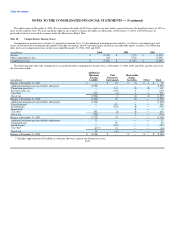

Other

Pension Postretirement

Benefits Benefits

(in millions) 2004 2003 2004 2003

Funded status $ (5,298) $ (5,659) $ (1,835) $ (2,260)

Unrecognized net actuarial loss 3,989 4,728 489 412

Unrecognized transition obligation 22 29 — —

Unrecognized prior service cost (benefit) 107 122 (1,013) (605)

Contributions (net) made between the measurement date and year end 69 16 38 41

Special termination benefits recognized between the measurement date and year end (10) — (142) —

Settlement/Curtailment (charge) gain recognized between the measurement date and year end (126) (212) 527 —

Net amount recognized on the Consolidated Balance Sheets $ (1,247) $ (976) $ (1,936) $ (2,412)

F-40