Delta Airlines 2004 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

We did not have any fuel hedge contracts at December 31, 2004. See Notes 4 and 10 for additional information related to our fuel hedge contracts and our

additional minimum pension liability, respectively.

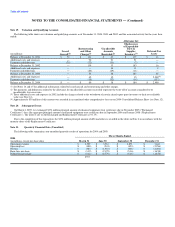

Note 13. Geographic Information

SFAS No. 131, "Disclosures about Segments of an Enterprise and Related Information" ("SFAS 131"), requires us to disclose certain information about

our operating segments. Operating segments are defined as components of an enterprise with separate financial information which is evaluated regularly by

the chief operating decision-maker and is used in resource allocation and performance assessments.

We are managed as a single business unit that provides air transportation for passengers and cargo. This allows us to benefit from an integrated revenue

pricing and route network that includes Mainline (including Song) and our regional affiliates. The flight equipment of all three carriers is combined to form

one fleet which is deployed through a single route scheduling system. When making resource allocation decisions, our chief operating decision maker

evaluates flight profitability data, which considers aircraft type and route economics, but gives no weight to the financial impact of the resource allocation

decision on an individual carrier basis. Our objective in making resource allocation decisions is to optimize our consolidated financial results, not the

individual results of Mainline (including Song) and our regional affiliates.

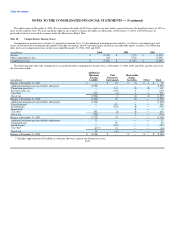

Operating revenues are assigned to a specific geographic region based on the origin, flight path and destination of each flight segment. Our operating

revenues by geographic region for the years ended December 31, 2004, 2003, and 2002 are summarized in the following table:

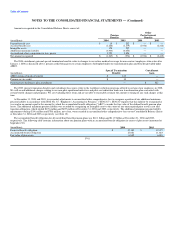

(in millions) 2004 2003 2002

North America $ 12,192 $ 11,672 $ 11,339

Atlantic 2,054 1,770 1,860

Pacific 141 107 127

Latin America 615 538 540

Total $ 15,002 $ 14,087 $ 13,866

Our tangible assets consist primarily of flight equipment which is mobile across geographic markets. Accordingly, assets are not allocated to specific

geographic regions.

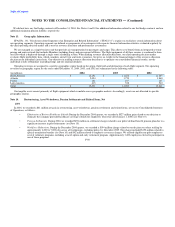

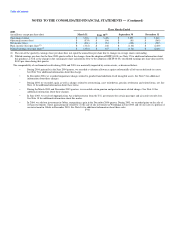

Note 14. Restructuring, Asset Writedowns, Pension Settlements and Related Items, Net

2004

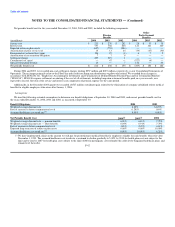

In 2004, we recorded a $41 million net gain in restructuring, asset writedowns, pension settlements and related items, net on our Consolidated Statement

of Operations, as follows:

• Elimination of Retiree Healthcare Subsidy.During the December 2004 quarter, we recorded a $527 million gain related to our decision to

eliminate the company provided healthcare coverage subsidy for employees who retire after January 1, 2006 (see Note 10).

• Pension Settlements. During 2004, we recorded $251 million in settlement charges related to our pilots' defined benefit pension plan due to a

significant increase in pilot retirements (see Note 10).

• Workforce Reductions. During the December 2004 quarter, we recorded a $194 million charge related to our decision to reduce staffing by

approximately 6,000 to 7,000 jobs across all workgroups, excluding pilots, by December 2005. This charge included $152 million related to

special termination benefits (see Note 10) and $42 million related to employee severance charges. We offered eligible non-pilot employees

several voluntary programs, including a travel option and early retirement program. Approximately 3,400 employees elected to participate in

one of these programs. F-50