Delta Airlines 2004 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

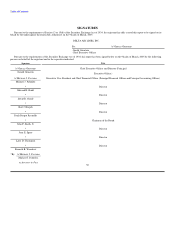

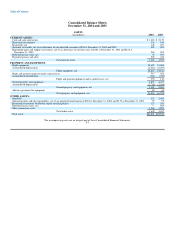

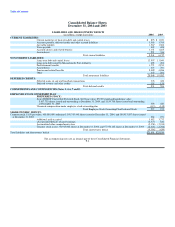

Consolidated Balance Sheets

December 31, 2004 and 2003

LIABILITIES AND SHAREOWNERS' DEFICIT

(in millions, except share data) 2004 2003

CURRENT LIABILITIES:

Current maturities of long-term debt and capital leases $ 893 $ 1,021

Accounts payable, deferred credits and other accrued liabilities 1,560 1,709

Air traffic liability 1,567 1,308

Taxes payable 499 498

Accrued salaries and related benefits 1,151 1,285

Accrued rent 271 336

Total current liabilities 5,941 6,157

NONCURRENT LIABILITIES:

Long-term debt and capital leases 12,507 11,040

Long-term debt issued by Massachusetts Port Authority 498 498

Postretirement benefits 1,771 2,253

Accrued rent 633 701

Pension and related benefits 5,099 4,886

Other 340 204

Total noncurrent liabilities 20,848 19,582

DEFERRED CREDITS:

Deferred gains on sale and leaseback transactions 376 426

Deferred revenue and other credits 155 158

Total deferred credits 531 584

COMMITMENTS AND CONTINGENCIES (Notes 3, 4, 6, 7 and 8)

EMPLOYEE STOCK OWNERSHIP PLAN

PREFERRED STOCK:

Series B ESOP Convertible Preferred Stock, $1.00 par value, $72.00 stated and liquidation value;

5,417,735 shares issued and outstanding at December 31, 2004, and 5,839,708 shares issued and outstanding

at December 31, 2003 390 420

Unearned compensation under employee stock ownership plan (113) (145)

Total Employee Stock Ownership Plan Preferred Stock 277 275

SHAREOWNERS' DEFICIT:

Common stock, $1.50 par value; 450,000,000 authorized; 190,745,445 shares issued at December 31, 2004, and 180,915,087 shares issued

at December 31, 2003 286 271

Additional paid-in capital 3,052 3,272

(Accumulated deficit) retained earnings (4,373) 844

Accumulated other comprehensive loss (2,358) (2,338)

Treasury stock at cost, 50,915,002 shares at December 31, 2004, and 57,370,142 shares at December 31, 2003 (2,403) (2,708)

Total shareowners' deficit (5,796) (659)

Total liabilities and shareowners' deficit $21,801 $25,939

The accompanying notes are an integral part of these Consolidated Financial Statements.

F-4