Delta Airlines 2004 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

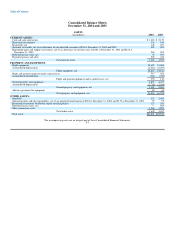

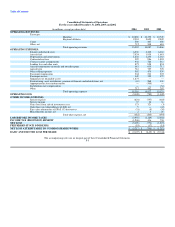

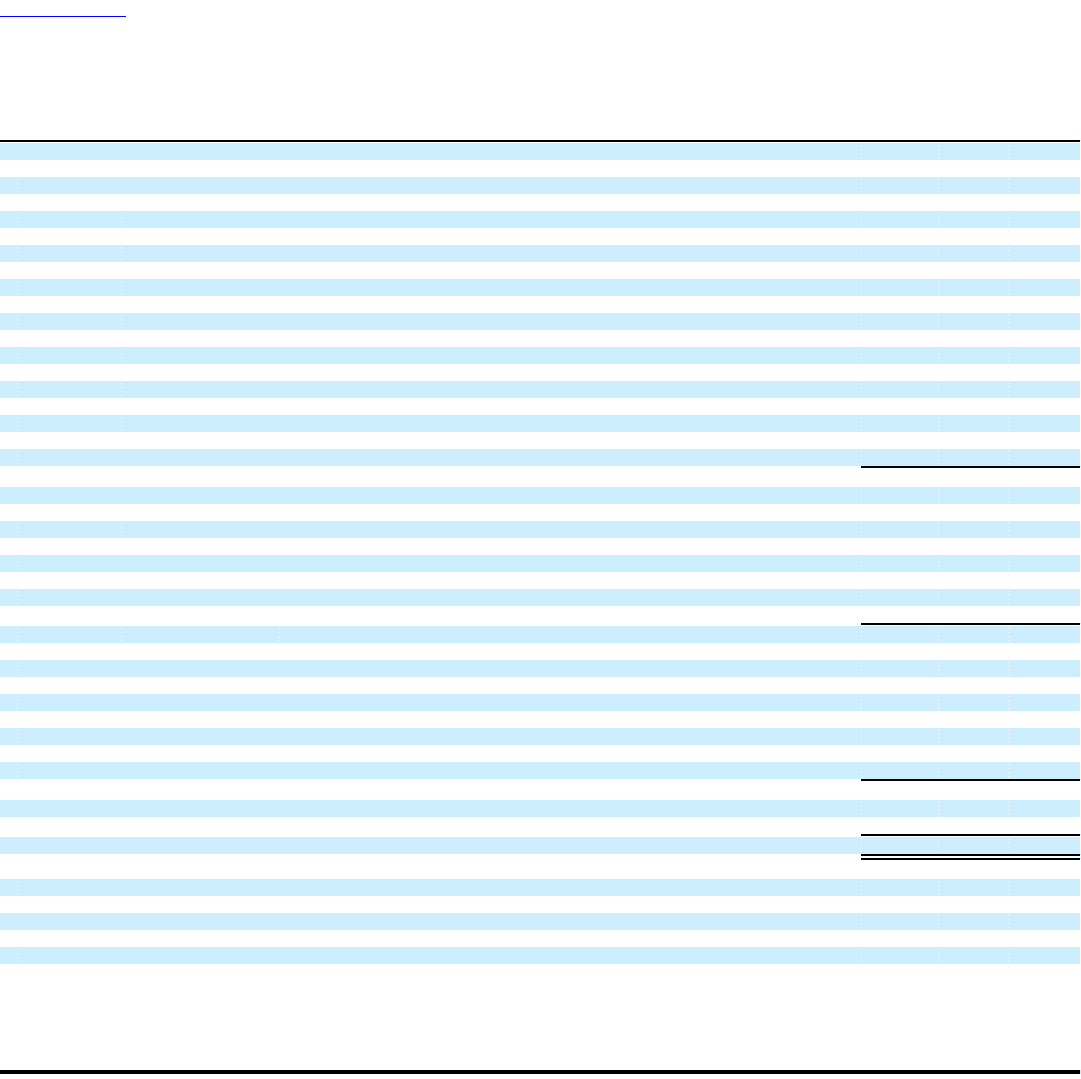

Consolidated Statements of Cash Flows

For the years ended December 31, 2004, 2003 and 2002

(in millions) 2004 2003 2002

Cash Flows From Operating Activities:

Net loss $ (5,198) $ (773) $ (1,272)

Adjustments to reconcile net loss to net cash (used in) provided by operating activities:

Asset and other writedowns 1,915 47 287

Depreciation and amortization 1,244 1,230 1,181

Deferred income taxes 1,206 (416) (411)

Fair value adjustments of SFAS 133 derivatives 31 9 39

Pension, postretirement and postemployment expense (less than) in excess of payments (121) 532 177

(Gain) loss on extinguishment of debt, net (9) — 42

Dividends in excess of (less than) income from equity method investments — 30 (3)

(Gain) loss from sale of investments, net (123) (321) 3

Changes in certain current assets and liabilities:

Decrease (increase) in short-term investments, net 204 (311) (60)

(Increase) decrease in receivables (27) 317 (243)

Increase in current restricted cash (141) (73) (134)

Increase in prepaid expenses and other current assets (151) (90) (35)

Increase in air traffic liability 259 38 46

(Decrease) increase in other payables, deferred credits and accrued liabilities (233) (276) 600

Other, net 21 199 8

Net cash (used in) provided by operating activities (1,123) 142 225

Cash Flows From Investing Activities:

Property and equipment additions:

Flight equipment, including advance payments (373) (382) (922)

Ground property and equipment, including technology (387) (362) (364)

Decrease in restricted investments related to the Boston airport terminal project 159 131 58

Proceeds from sales of flight equipment 234 15 100

Proceeds from sales of investments 146 325 24

Other, net 1 13 (5)

Net cash used in investing activities (220) (260) (1,109)

Cash Flows From Financing Activities:

Payments on long-term debt and capital lease obligations (1,452) (802) (1,113)

Issuance of long-term obligations 2,123 1,774 2,554

Payments on notes payable — — (765)

Make-whole payments on extinguishment of ESOP Notes — (15) (42)

Payment on termination of accounts receivable securitization — (250) —

Cash dividends — (19) (39)

Other, net (35) (140) (12)

Net cash provided by financing activities 636 548 583

Net (Decrease) Increase In Cash and Cash Equivalents (707) 430 (301)

Cash and cash equivalents at beginning of year 2,170 1,740 2,041

Cash and cash equivalents at end of year $ 1,463 $ 2,170 $ 1,740

Supplemental disclosure of cash paid (refunded) for:

Interest, net of amounts capitalized $ 768 $ 715 $ 569

Income taxes $ — $ (402) $ (649)

Non-cash transactions:

Aircraft delivered under seller-financing $ 314 $ 718 $ 705

Dividends payable on ESOP preferred stock $ 22 $ 13 $ —

Aircraft capital leases from sale and leaseback transactions $ — $ — $ 52

The accompanying notes are an integral part of these Consolidated Financial Statements.

F-6