Delta Airlines 2004 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

Business Environment

Financial Results

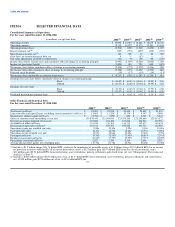

Our financial performance continued to deteriorate during 2004, the fourth consecutive year we reported substantial losses. Our consolidated net loss of

$5.2 billion in 2004 reflects a net charge of $2.9 billion, which is discussed elsewhere in this Form 10-K (see Notes 5, 9, 14 and 16 of the Notes to the

Consolidated Financial Statements), a significant decline in passenger mile yield, historically high aircraft fuel prices and other cost pressures. Our

unrestricted cash and cash equivalents and short-term investments were $1.8 billion at December 31, 2004, down from $2.7 billion at December 31, 2003.

These results underscore the urgent need to make fundamental changes in the way we do business.

Our financial performance for 2004 was materially adversely affected by a decrease in passenger mile yield. While Revenue Passenger Miles ("RPMs"),

or traffic, rose 11% during 2004 compared to the prior year, passenger revenue increased only 6%, reflecting a 4% decrease in the passenger mile yield on a

year-over-year basis. We believe the decrease in passenger mile yield reflects permanent changes in the airline industry revenue environment which have

occurred primarily due to the following factors:

• the continuing growth of low-cost carriers with which we compete in most of our domestic markets;

• high industry capacity, resulting in significant fare discounting to stimulate traffic; and

• increased price sensitivity by our customers, enhanced by the availability of airline fare information on the Internet.

Aircraft fuel prices also had a significant negative impact on our financial results in 2004. These prices reached historically high levels, as our average fuel

price per gallon increased 42% to $1.16 (net of hedging gains) for 2004 compared to the prior year. Aircraft fuel expense rose 51%, or $986 million, in 2004

compared to 2003, with approximately $820 million of the increase resulting from higher fuel prices.

In light of our significant losses and the decline in our cash and cash equivalents and short-term investments, we are making permanent structural changes

that are intended to appropriately align our cost structure with the revenue we can generate in this business environment and to enable us to compete with low-

cost carriers.

Our Transformation Plan

In 2002, we began our profit improvement program, which had a goal of reducing our unit costs and increasing our revenues. We made significant

progress under this program, but increases in aircraft fuel prices and pension and related expense, and declining domestic passenger mile yields, have offset a

large portion of these benefits. Accordingly, we will need substantial further reductions in our cost structure to achieve viability.

At the end of 2003, we began a strategic reassessment of our business. The goal of this project was to develop and implement a comprehensive and

competitive business strategy that addresses the airline industry environment and positions us to achieve long-term success. As part of this project, we

evaluated the appropriate 26