Delta Airlines 2004 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Flyi that would constitute an event of default under the leases or the likelihood of the financing parties seeking to exercise certain remedies against us if such

an event of default were to occur.

Flyi has stated that as part of its restructuring effort, it has secured commitments from certain of the financing parties that, upon our assumption of the

leases, such parties will effectively release Flyi from its future obligations to such financing parties under the leases. We are in discussions with the financing

parties to restructure these leases so that events relating to Flyi would not constitute an event of default after we assume the leases.

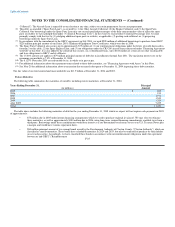

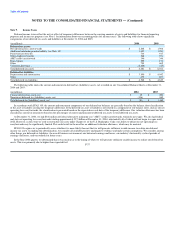

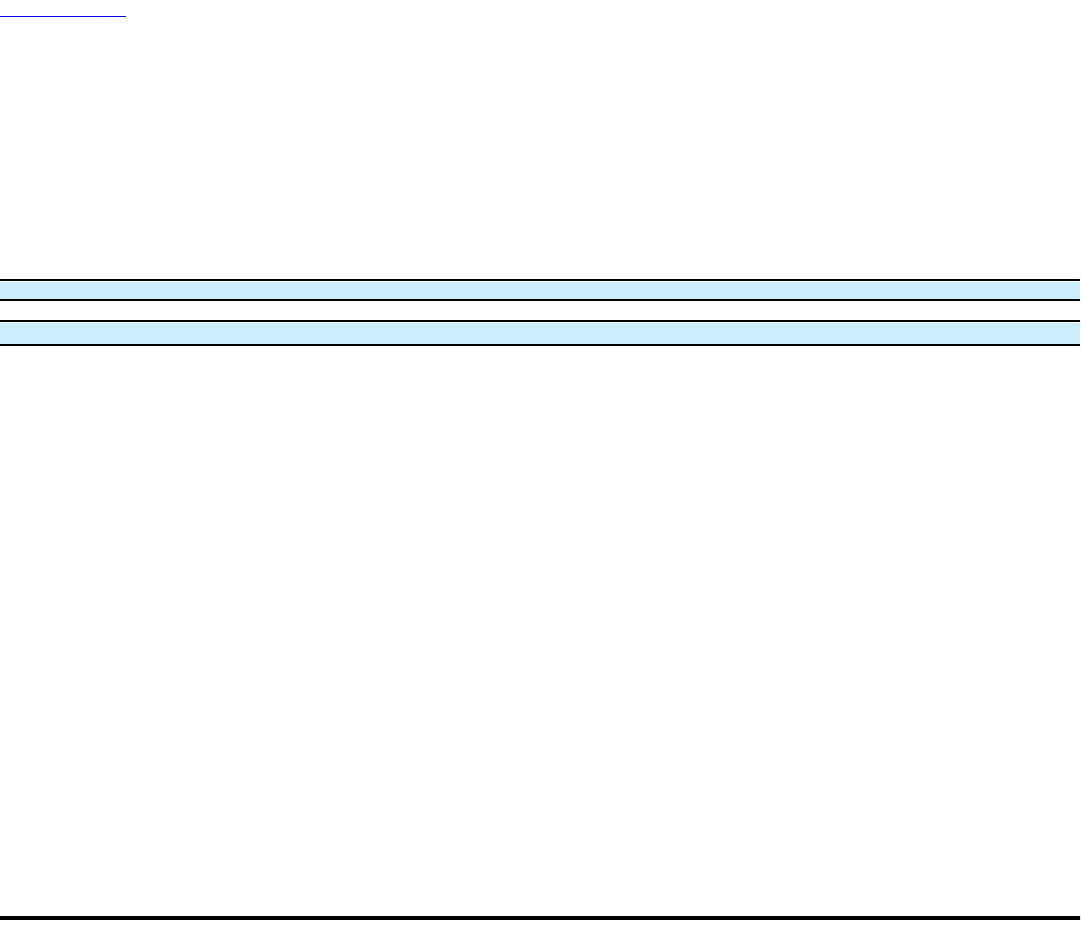

The following unaudited table shows the available seat miles ("ASMs"), revenue passenger miles ("RPMs") and number of aircraft operated for us by Flyi,

SkyWest and Chautauqua under the contract carrier agreements, for the years ended December 31, 2004, 2003 and 2002:

(in millions, except aircraft) 2004 2003 2002

ASMs 5,535 5,121 3,513

RPMs 3,991 3,627 2,392

Number of aircraft operated, end of period(1) 128 123 100

(1) The 128 aircraft operated for us at December 31, 2004 include 30 aircraft previously operated by Flyi, 59 aircraft operated by SkyWest and 39 aircraft

operated by Chautauqua. Our contract carrier agreements with SkyWest and Chautauqua do not include any scheduled changes in these numbers

during the remaining term of those agreements.

In January 2005, we entered into a contract carrier agreement with Republic Airline under which that carrier will operate 16 ERJ-170 regional jet aircraft

for us on substantially the same terms as Chautauqua. These aircraft will be placed into service between July 2005 and August 2006. Our agreement with

Republic Airline expires in 2018.

We may terminate the SkyWest agreement without cause at any time by giving the airline certain advance notice. If we terminate the SkyWest agreement

without cause, SkyWest has the right to assign to us leased regional jet aircraft which it operates for us, provided we are able to continue the leases on the

same terms SkyWest had prior to the assignment.

We may terminate the Chautauqua and Republic Airline agreements without cause effective at any time after November 2009 and December 2012,

respectively, by providing certain advance notice. If we terminate either the Chautauqua or Republic Airline agreements without cause, Chautauqua or

Republic Airline, respectively, has the right to (1) assign to us leased aircraft that the airline operates for us, provided we are able to continue the leases on the

same terms the airline had prior to the assignment and (2) require us to purchase or sublease any of the aircraft that the airline owns and operates for us at the

time of the termination. If we are required to purchase aircraft owned by Chautauqua or Republic Airline, the purchase price would be equal to the amount

necessary to (1) reimburse Chautauqua or Republic Airline for the equity it provided to purchase the aircraft and (2) repay in full any debt outstanding at such

time that is not being assumed in connection with such purchase. If we are required to sublease aircraft owned by Chautauqua or Republic Airline, the

sublease would have (1) a rate equal to the debt payments of Chautauqua or Republic Airline for the debt financing of the aircraft calculated as if 90% of the

aircraft was debt financed by Chautauqua or Republic Airline and (2) specified other terms and conditions.

We estimate that the total fair value, at December 31, 2004, of the aircraft that SkyWest or Chautauqua could assign to us or require that we purchase if

we terminate without cause our contract carrier agreements with those airlines is approximately $600 million and $500 million, respectively. The actual

amount that we may be required to pay in these circumstances may be materially different from these estimates.

Legal Contingencies

We are involved in legal proceedings relating to antitrust matters, employment practices, environmental issues and other matters concerning our business.

We are also a defendant in numerous lawsuits arising out of the terrorist attacks of September 11, 2001. We cannot reasonably estimate the potential loss for

certain legal F-34