Delta Airlines 2004 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

including current maturities and short-term obligations, totaled $12.6 billion at December 31, 2003. We issued $1.9 billion of secured long-term debt during

2003.

2002

Cash and cash equivalents and short-term investments totaled $2.0 billion at December 31, 2002. Net cash provided by operations totaled $225 million

during 2002, including receipt of (1) a $472 million tax refund due to a new tax law and (2) $112 million in compensation under the Stabilization Act. Capital

expenditures, including aircraft acquisitions made under seller-financing arrangements, were $2.0 billion during 2002; this included the acquisition of four

B737-800, three B767-400, one B777-200, 34 CRJ-200 and 15 CRJ-700 aircraft. Debt and capital lease obligations, including current maturities and short-

term obligations, totaled $10.9 billion at December 31, 2002. We issued $2.6 billion of secured long-term debt during 2002.

Financial Position

December 31, 2004 Compared to December 31, 2003

This section discusses certain changes in our Consolidated Balance Sheets which are not otherwise discussed in this Form 10-K.

Prepaid expenses and other current assets increased by 10%, or $49 million, primarily reflecting an increase in prepaid aircraft fuel from higher fuel costs

and increased prepayment requirements. Flight and ground equipment under capital leases, net of accumulated amortization, increased $243 million primarily

due to the renegotiation of certain operating leases that are now classified as capital leases in accordance with SFAS 13, "Accounting for Leases," due to the

amendment of certain lease terms (see Note 7 of the Notes to the Consolidated Financial Statements). Restricted investments for our Boston airport terminal

project decreased 56%, or $159 million, due primarily to the reimbursement of project expenditures during 2004.

Accounts payable, deferred credits and other accrued liabilities decreased 9%, or $149 million, primarily reflecting a decrease in trade accounts payable

from increased prepayment requirements in 2004. Air traffic liability increased 20% from 2003 primarily due to (1) stronger advance sales from increased

capacity and (2) growth in codeshare operations. Accrued salaries and related benefits decreased 10% due primarily to (1) a lower vacation accrual at the end

of 2004 due to changes in our salary rates as part of our transformation plan and (2) salary rate decreases that occurred in the December 2004 quarter

primarily related to our new pilot collective bargaining agreement that was effective December 1, 2004.

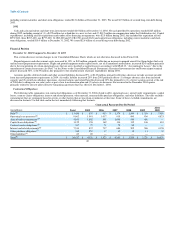

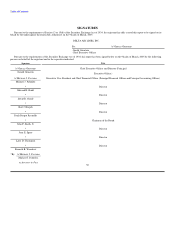

Contractual Obligations

The following table summarizes our contractual obligations as of December 31, 2004 related to debt; operating leases; aircraft order commitments; capital

leases; contract carrier obligations; interest and related payments; other material, noncancelable purchase obligations; and other liabilities. The table excludes

commitments that are contingent based on events or other factors that are uncertain or unknown at this time. Some of these excluded commitments are

discussed in footnote 9 to this table and in the text immediately following that footnote.

Contractual Payments Due By Period

After

(in millions) Total 2005 2006 2007 2008 2009 2009

Debt(1) $ 13,450 $ 835 $ 913 $ 1,374 $ 1,549 $ 1,324 $ 7,455

Operating lease payments(2) 9,662 1,091 1,017 915 980 836 4,823

Aircraft order commitments(3) 4,161 1,002 598 1,645 510 406 —

Capital lease obligations(4) 1,122 158 162 134 112 146 410

Contract carrier obligations(5) 317 79 79 79 80 — —

Interest and related payments(6) 7,514 837 737 684 592 506 4,158

Other purchase obligations(7) 342 257 17 12 12 11 33

Other liabilities(8) 69 69 — — — — —

Total(9) $ 36,637 $ 4,328 $ 3,523 $ 4,843 $ 3,835 $ 3,229 $ 16,879

40