Delta Airlines 2004 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Note 1. Summary of Significant Accounting Policies

Basis of Presentation

Delta Air Lines, Inc. (a Delaware corporation) is a major air carrier that provides air transportation for passengers and cargo throughout the U.S. and

around the world. Our Consolidated Financial Statements include the accounts of Delta Air Lines, Inc. and our wholly owned subsidiaries, including Atlantic

Southeast Airlines, Inc. ("ASA") and Comair, Inc. ("Comair"), collectively referred to as Delta. We have eliminated all material intercompany transactions in

our Consolidated Financial Statements.

We do not consolidate the financial statements of any company in which we have an ownership interest of 50% or less unless we control that company.

During 2004, 2003 and 2002, we did not control any company in which we had an ownership interest of 50% or less.

These Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the United States of America

("GAAP") on a going concern basis.

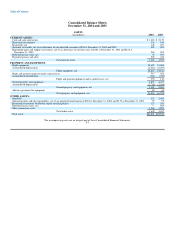

Effective December 31, 2004, we reclassified our investments in auction rate securities from cash and cash equivalents to short-term investments on our

Consolidated Balance Sheets for all periods presented. The cash flows related to these investments are presented as operating activities in our Consolidated

Statements of Cash Flows for all periods presented. For additional information about our short-term investments, see "Short-Term Investments" in this Note.

We have reclassified certain other prior period amounts in our Consolidated Financial Statements to be consistent with the current period presentation.

The effect of these reclassifications is not material.

Business Environment

Financial Results

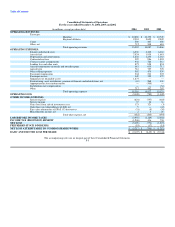

Our financial performance continued to deteriorate during 2004, the fourth consecutive year we reported substantial losses. Our consolidated net loss of

$5.2 billion in 2004 reflects a net charge of $2.9 billion (which is discussed in Notes 5, 9, 14 and 16), a significant decline in passenger mile yield, historically

high aircraft fuel prices and other cost pressures. Our unrestricted cash and cash equivalents and short-term investments were $1.8 billion at December 31,

2004, down from $2.7 billion at December 31, 2003. These results underscore the urgent need to make fundamental changes in the way we do business.

In light of our significant losses and the decline in our cash and cash equivalents and short-term investments, we are making permanent structural changes

which are intended to appropriately align our cost structure with the revenue we can generate in this business environment and to enable us to compete with

low-cost carriers.

Our Transformation Plan

In 2002, we began our profit improvement program, which had a goal of reducing our unit costs and increasing our revenues. We made significant

progress under this program, but increases in aircraft fuel prices and pension and related expense, and declining domestic passenger mile yields, have offset a

large portion of these benefits. Accordingly, we will need substantial further reductions in our cost structure to achieve viability.

At the end of 2003, we began a strategic reassessment of our business. The goal of this project was to develop and implement a comprehensive and

competitive business strategy that addresses the airline industry environment and positions us to achieve long-term success. As part of this project, we

evaluated the appropriate cost reduction targets and the actions we should take to seek to achieve these targets.

In September 2004, we outlined key elements of our transformation plan, which are intended to deliver approximately $5 billion in annual benefits by the

end of 2006 (as compared to 2002) while also improving the service we provide to our customers. Elements of the transformation plan include (1) non-pilot

operational improvements, (2) pilot cost reductions and (3) other benefits. By the end of 2004, we achieved approximately

F-8