Delta Airlines 2004 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

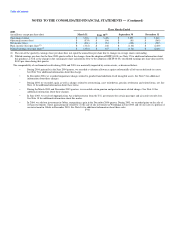

aircraft due to the difficult business environment facing the airline industry after September 11, 2001. During the June 2001 quarter, we

decided to remove from service the B737-300 aircraft and recorded a reserve for future lease payments less estimated sublease income. Due

to our decision to return these aircraft to service, we reversed the remaining $56 million reserve related to these B737-300 aircraft.

During the December 2002 quarter, we entered into an agreement with Boeing to defer 31 mainline aircraft previously scheduled for

delivery in 2003 and 2004. As a result of these deferrals, we had no Mainline aircraft deliveries in 2003 and 2004. We incurred a $30 million

charge related to these deferrals.

During the December 2002 quarter, we decided to accelerate the retirement of 37 owned EMB-120 aircraft to achieve costs savings and

operating efficiencies. We removed these aircraft from service during 2003. The accelerated retirement of these aircraft as well as a

reduction in their estimated future cash flows and fair values resulted in an impairment charge.

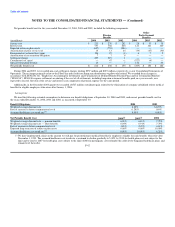

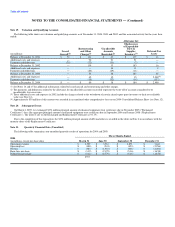

During 2002, we recorded the following impairment charges for our owned B727, MD-11 and EMB-120 aircraft:

Used in Operations(1) Held for Sale

No. of No. of Spare

(dollars in millions) Writedown(2) Aircraft Writedown Aircraft Subtotal Parts(3) Total

B727 $ 24 23 $ 37 36 $ 61 $ — $ 61

MD-11 141 8 — — 141 18 159

EMB-120 27 37 — — 27 4 31

Total $ 192 $ 37 $ 229 $ 22 $ 251

(1) Reflects the classification of these aircraft at the time of the 2002 impairment analysis, which may differ from the classification at

December 31, 2004.

(2) The fair value of aircraft used in operations was determined using third party appraisals.

(3) Charges related to the writedown of the related spare parts inventory to their net realizable value.

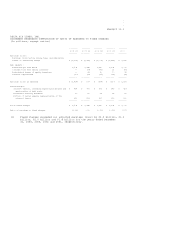

• Workforce Reductions. We recorded a $127 million charge related to our decision in October 2002 to reduce staffing by up to approximately

8,000 jobs across all workgroups, excluding pilots. We offered eligible non-pilot employees several programs, including voluntary

severance, leaves of absence and early retirement. Approximately 3,900 employees elected to participate in one of these programs.

Involuntary reductions were expected to affect approximately 4,000 employees (see Note 15).

The total charge includes (1) $51 million for costs associated with the voluntary programs that were recorded as special termination benefits

under our pension and postretirement medical benefit obligations (see Note 10) and (2) $76 million for severance and related costs.

• Surplus Pilots and Grounded Aircraft. We recorded $93 million in expenses for the temporary carrying cost of surplus pilots and grounded

aircraft related to our capacity reductions which became effective on November 1, 2001. This cost also included related requalification

training and relocation costs for certain pilots.

• Other.We recorded (1) a $23 million gain related to the adjustment of certain prior year restructuring reserves based on revised estimates of

remaining costs; (2) a $14 million charge associated with our decision to close certain leased facilities; and (3) a $3 million charge related to

other items (see Note 15). F-52