Delta Airlines 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

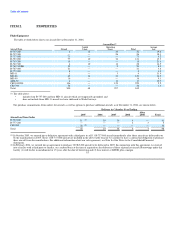

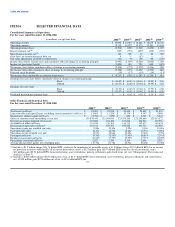

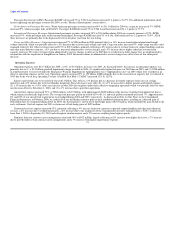

Appropriations Act compensation; and a $304 million gain ($191 million net of tax, or $1.55 diluted EPS) for certain other income and expense items (see

"Management's Discussion and Analysis" in Item 7).

(3) Includes a $439 million charge ($277 million net of tax, or $2.25 diluted EPS) for restructuring, asset writedowns, and related items, net; a $34 million

gain ($22 million net of tax, or $0.17 diluted EPS) for Stabilization Act compensation; and a $94 million charge ($59 million net of tax, or $0.47 diluted

EPS) for certain other income and expense items (see "Management's Discussion and Analysis" in Item 7).

(4) Includes a $1.1 billion charge ($695 million net of tax, or $5.63 diluted EPS) for restructuring, asset writedowns, and related items, net; a $634 million

gain ($392 million net of tax, or $3.18 diluted EPS) for Stabilization Act compensation; and a $186 million gain ($114 million net of tax, or $0.92 diluted

EPS) for certain other income and expense items.

(5) Includes a $108 million charge ($66 million net of tax, or $0.50 diluted EPS) for restructuring, asset writedowns, and related items, net; a $151 million

gain ($93 million net of tax, or $0.70 diluted EPS) for other income and expense items; and a $164 million cumulative effect, non-cash charge

($100 million net of tax, or $0.77 diluted EPS) resulting from our adoption of SFAS 133 on July 1, 2000.

(6) Includes interest income.

(7) Includes gains (losses) from the sale of investments. 25