Delta Airlines 2004 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

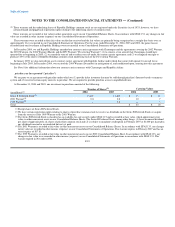

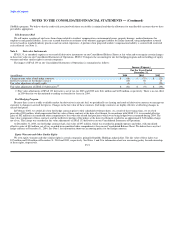

Note 5. Goodwill and Other Intangible Assets

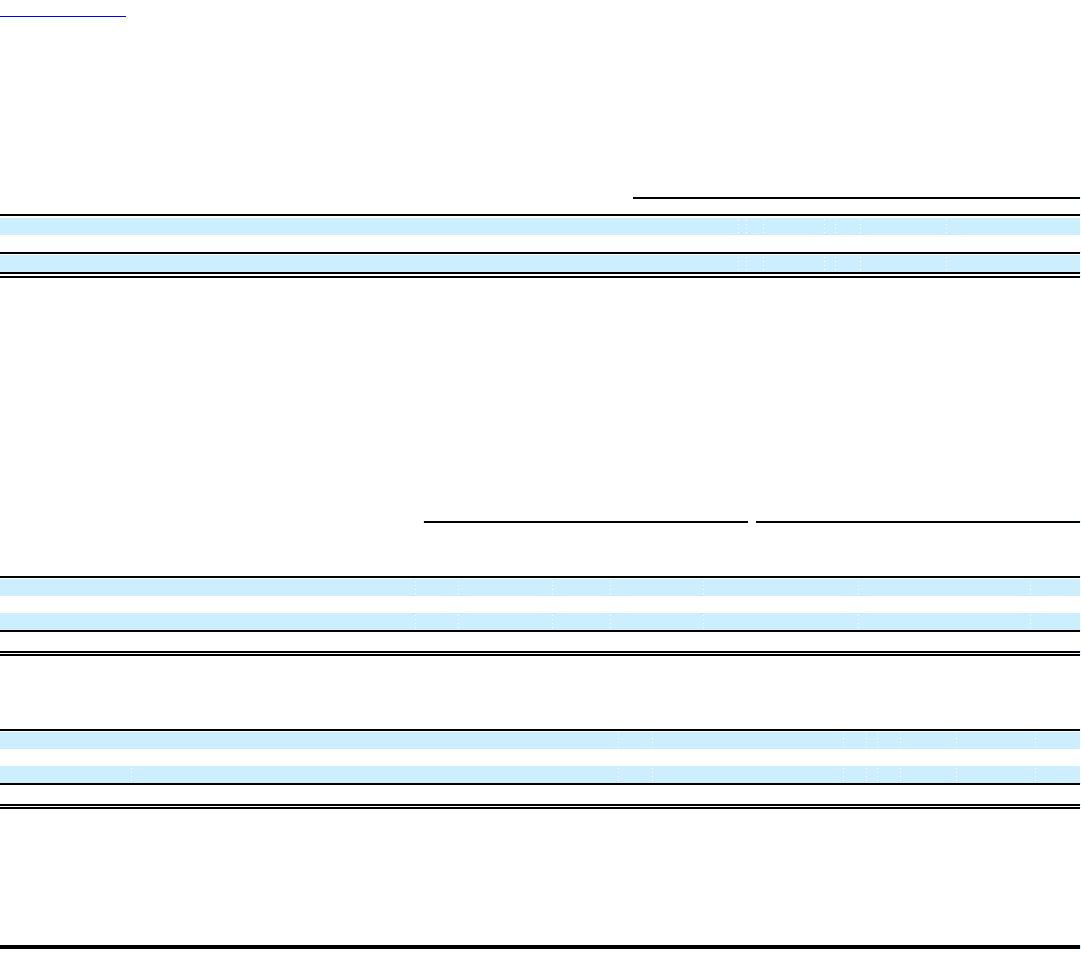

The following table includes the components of goodwill at December 31, 2004, 2003 and 2002, and the activity during 2004:

Reporting Unit

(in millions) Mainline ASA Comair Total

Balance at December 31, 2003, 2002 and 2001 $ 227 $ 498 $ 1,367 $ 2,092

Impairment charge — (498) (1,367) (1,865)

Balance at December 31, 2004 $ 227 $ — $ — $ 227

We performed our annual goodwill impairment test as of December 31, 2004. As a result of this test, we recorded a charge totaling $1.9 billion in

impairment of intangible assets on our 2004 Consolidated Statement of Operations.

During the December 2004 quarter, we re-evaluated the estimated fair values of our reporting units in light of the implementation of initiatives as a result

of our strategic reassessment and the completion of our new long-range cash flow plans. These initiatives and plans reflect, among other things, (1) the

strategic role of ASA and Comair in our business; (2) the projected impact of Simplifares on the revenues of each of our reporting units; and (3) an

expectation of the continuation of historically high fuel prices. These factors had a substantial negative impact on the impairment test results for ASA and

Comair. Our goodwill impairment test for Mainline as of December 31, 2004 resulted in no impairment because (1) our $5 billion in targeted benefits under

our transformation plan provides significant benefits to Mainline; (2) we achieved substantial cost reductions, which are included in the $5 billion in targeted

benefits, under our new Mainline pilot contract which was ratified in November 2004; and (3) Mainline has a low carrying value. Our previous impairment

tests of goodwill for all reporting units resulted in no impairment.

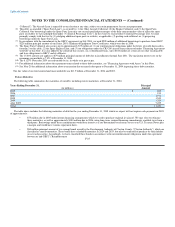

The following table presents information about our intangible assets, other than goodwill, at December 31:

2004 2003

Gross Gross

Carrying Accumulated Carrying Accumulated

(in millions) Amount Amortization Amount Amortization

Definite-lived intangible assets:

Leasehold and operating rights $ 125 $ (99) $ 125 $ (92)

Other 3 (2) 3 (2)

Total $ 128 $ (101) $ 128 $ (94)

Net Net

Carrying Carrying

(in millions) Amount Amount

Indefinite-lived intangible assets:

International routes $ 51 $ 60

Other 1 1

Total $ 52 $ 61

We recorded an impairment charge totaling approximately $9 million for certain of our international routes at December 31, 2004 as a result of a decision

not to utilize these routes for the foreseeable future. This charge is recorded in impairment of intangible assets on our 2004 Consolidated Statement of

Operations. Our previous impairment tests of indefinite-lived intangible assets resulted in no impairment.

See Note 1 for additional information about our accounting policy for goodwill and other intangible assets.

F-22