Delta Airlines 2004 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

(2) These warrants and the underlying shares of Republic Holdings common stock are not registered under the Securities Act of 1933; however, we have

certain demand and piggyback registration rights relating to the underlying shares of common stock.

These warrants are recorded at fair value in other noncurrent assets on our Consolidated Balance Sheets. In accordance with SFAS 133, any changes in fair

value are recorded in other income (expense) on our Consolidated Statement of Operations.

These warrants were recorded at their fair values on the date received and the fair values are primarily being recognized on a straight-line basis over an

approximately five year period in our Consolidated Statement of Operations. For the years ended December 31, 2004, 2003 and 2002, the gains (losses)

recorded from our investment in Republic Holdings were not material to our Consolidated Statements of Operations.

In December 2004, we and Republic Holdings amended our contract carrier agreement with Chautauqua and the agreements covering the 2002 Warrant,

the 2003 Warrants, the 2004 Warrant (March) and the IPO Warrant ("Pre-existing Warrants") (1) to remove seven aircraft that Chautauqua would have

operated for us beginning in 2005; (2) to extend the term of and to reduce our cost under the contract carrier agreement; and (3) to relinquish our right to

purchase 45% of the shares of Republic Holdings common stock underlying each of the Pre-existing Warrants.

In January 2005, we also entered into a new contract carrier agreement with Republic Airline under which that carrier will operate 16 aircraft for us

beginning in July 2005. In December 2004, we received the 2004 Warrant (December) in anticipation of, and conditioned upon, entering into this agreement.

See Note 8 for additional information about our contract carrier contracts with Chautauqua and Republic Airline.

priceline.com Incorporated ("priceline")

We are party to an agreement with priceline under which we (1) provide ticket inventory that may be sold through priceline's Internet-based e-commerce

system and (2) received certain equity interests in priceline. We are required to provide priceline access to unpublished fares.

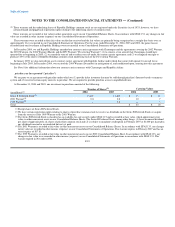

At December 31, 2004 and 2003, our investment in priceline consisted of the following:

Number of Shares(2) Carrying Values

(in millions)(1) 2004 2003 2004 2003

Series B Preferred Stock(3) 13,469 13,469 $ 13 $ 13

2001 Warrant(4) 0.8 0.8 10 7

1999 Warrant(5) — 0.8 — 3

Total $ 23 $ 23

(1) Except shares of Series B Preferred Stock.

(2) We have certain registration rights relating to shares of priceline common stock we receive as dividends on the Series B Preferred Stock, or acquire

from the exercise of the 1999 Warrant or the 2001 Warrant.

(3) The Series B Preferred Stock is classified as an available-for-sale security under SFAS 115 and is recorded at face value, which approximates fair

value, in other noncurrent assets on our Consolidated Balance Sheets. The Series B Preferred Stock, among other things, (1) bears an annual dividend

per share of approximately six shares of priceline common stock and (2) is subject to mandatory redemption in February 2007 at $1,000 per share plus

any dividends accrued or accumulated but not yet paid.

(4) The 2001 Warrant is recorded at fair value in other noncurrent assets on our Consolidated Balance Sheets. In accordance with SFAS 133, any changes

in fair value are recorded in other income (expense) on our Consolidated Statements of Operations. This warrant expires in February 2007 and has an

exercise price of $17.81.

(5) The 1999 Warrant is recorded at fair value in other noncurrent assets on our 2003 Consolidated Balance Sheet. In accordance with SFAS 133, any

changes in fair value were recorded in other income (expense) on our Consolidated Statements of Operations in accordance with SFAS 133. This

warrant expired in November 2004. F-19