Delta Airlines 2004 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

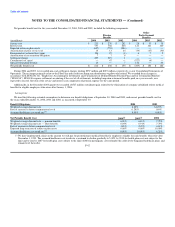

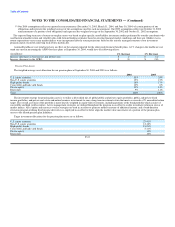

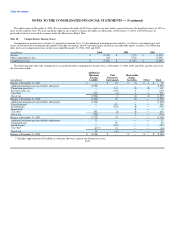

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

interest. Participants in the plan on July 1, 2003 may be eligible for additional annual pay credits of 2% or 2.75%, depending on their age and service as of

that date. Non-contract employees hired on or after July 1, 2003 are covered by the cash balance benefit only. Effective July 1, 2010, all covered employees

earn the cash balance benefit only.

Our defined benefit pension plan for pilots ("Pilot Plan") generally provides benefits based on years of service and final average salary. Effective

December 31, 2004, the Pilot Plan was amended to freeze service accruals. Future employee earnings will continue to be used in the calculation of pilots'

pension benefits. This amendment is not reflected in the tables below because the new collective bargaining agreement between Delta and ALPA which

amended the Pilot Plan was ratified after the September 30, 2004 measurement date.

We also sponsor healthcare plans that provide benefits to substantially all Delta retirees and their eligible dependents. Benefits are funded from our current

assets. Plan benefits are subject to copayments, deductibles and other limits as described in the plans. Non-contract employees hired on or after January 1,

2003 are not eligible for company provided post retirement healthcare coverage, although they may purchase such coverage at full cost. In addition, the

healthcare plan covering non-contract employees was amended effective September 30, 2004 to eliminate company provided post-age 65 retiree healthcare

coverage for non-contract employees retiring after January 1, 2006, regardless of their date of hire. We will provide post-age 65 retiree healthcare coverage

for non-contract employees at full cost to employees who retire after this date. Additionally, pilots hired after November 11, 2004 will not be eligible for

company provided post-age 65 healthcare coverage, although they may purchase such coverage at full cost.

During 2004, we amended our pilot benefit plans in connection with the new collective bargaining agreement we entered into with ALPA as discussed

above. Also in 2004, we offered an early retirement window, the Alternative Early Retirement Option ("AERO"), to certain non-contract employees, and we

announced other components of our transformation plan (see Note 1). As a result of these events, we remeasured a large portion of our benefit obligations on

November 30, 2004. See below for details of the costs related to the special termination benefits offered in connection with AERO and the transformation

plan.

The Medicare Act (see Note 1) introduces new prescription drug benefits to retirees. In accordance with SFAS No. 106, "Employers' Accounting for

Postretirement Benefits Other Than Pensions," we remeasured our accumulated postretirement benefits obligation ("APBO") as of December 31, 2003 to

reflect the effects of the new prescription drug benefit. The remeasurement resulted in a $356 million reduction in our APBO. This reduction is primarily due

to (1) lower expected per capita claims cost from Medicare's assumption of a larger portion of prescription drug costs and (2) lower anticipated participation

rates in our plans that provide postretirement benefits. F-39