Delta Airlines 2004 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

securities, we expect that our cash and cash equivalents and short-term investments will be substantially lower at December 31, 2005 than at the end of 2004.

Our financing agreements with GE Commercial Finance and Amex include covenants that impose substantial restrictions on our financial and business

operations, including covenants that require us (1) to maintain specified levels of cash and cash equivalents and (2) to achieve certain levels of EBITDAR

(earnings before interest, taxes, depreciation, amortization and aircraft rent, as defined). Although under our business plan we expect to be in compliance with

these covenants in 2005, we do not expect to exceed either of the required levels by a significant margin. Accordingly, if any of the assumptions underlying

our business plan proves to be incorrect, we might not be in compliance with these covenants, which could result in the outstanding borrowings under these

agreements becoming immediately due and payable (unless the lenders waive these covenant violations). If this were to occur, we would need to seek to

restructure under Chapter 11 of the U.S. Bankruptcy Code. For additional information about these financing agreements, see Note 6 of the Notes to the

Consolidated Financial Statements.

Many of the material assumptions underlying our business plan are not within our control. These assumptions include that (1) we achieve in 2005 all the

benefits of our transformation plan targeted to be achieved in that year and (2) the average annual jet fuel price per gallon in 2005 is approximately $1.22

(with each 1¢ increase in the average annual jet fuel price per gallon increasing our liquidity needs by approximately $25 million per year, unless we are

successful in offsetting some or all of this increase through fare increases or additional cost reduction initiatives). Our business plan also includes significant

assumptions about passenger mile yield (which we expect to be lower in 2005 as compared to 2004), interest rates, our ability to generate incremental

revenues, our pension funding obligations and credit card processor holdbacks (our current Visa/Mastercard processing contract expires in August 2005). See

"Risk Factors Related to Delta" concerning risks associated with sensitivities in our assumptions.

If the assumptions underlying our business plan prove to be incorrect in any material adverse respect and we are unable to sell assets or access the capital

markets, or if our level of cash and cash equivalents and short-term investments otherwise declines to an unacceptably low level, we would need to seek to

restructure under Chapter 11 of the U.S. Bankruptcy Code.

Basis of Presentation of Consolidated Financial Statements

The matters discussed above under "Business Environment" raise substantial doubt about our ability to continue as a going concern. Our Consolidated

Financial Statements have been prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP") on a going

concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. Accordingly, our Consolidated

Financial Statements do not include any adjustments relating to the recoverability of assets and classification of liabilities that might be necessary should we

be unable to continue as a going concern.

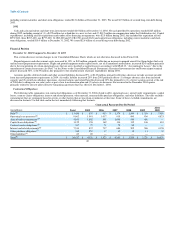

Results of Operations — 2004 Compared to 2003

Net Loss and Loss per Share

We recorded a consolidated net loss of $5.2 billion ($41.07 diluted loss per share) in 2004, compared to a consolidated net loss of $773 million ($6.40

diluted loss per share) in 2003.

Operating Revenues

Operating revenues totaled $15.0 billion in 2004, a 6% increase from 2003. Passenger revenue increased 6% on a 9% increase in capacity. The increase in

passenger revenue reflects an 11% rise in RPMs and a 4% decline in passenger mile yield. The increase in capacity was primarily driven by the restoration of

flights that we reduced in 2003 due to the war in Iraq. The decline in the passenger mile yield reflects our lack of pricing power due to the continuing growth

of low-cost carriers with which we compete in most of our domestic markets, high industry capacity and increased price sensitivity by our customers,

enhanced by the availability of airline fare information on the Internet. 30