Delta Airlines 2004 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

We regularly monitor competitive developments in the airline industry and evaluate our strategic alternatives. These strategic alternatives include, among

other things, internal growth, codesharing arrangements, marketing alliances, joint ventures, and mergers and acquisitions. Our evaluations involve internal

analysis and, where appropriate, discussions with third parties.

At the end of 2003, we began a strategic reassessment of our business. The goal of this project was to develop and implement a comprehensive and

competitive business strategy that addresses the airline industry environment and positions us to achieve long-term sustained success. As part of this project,

we evaluated the appropriate cost reduction targets and the actions we should take to seek to achieve these targets. On September 8, 2004, we outlined key

elements of our transformation plan, which are intended to achieve the cost savings and other benefits that we believe are necessary to effect an out-of-court

restructuring. The initiatives that we announced are part of our overall strategic reassessment. See "Management's Discussion and Analysis of Financial

Condition and Results of Operation — Business Environment — Our Transformation Plan" in Item 7 for additional information about our transformation

plan.

Airport Access

Operations at three major U.S. airports and certain foreign airports served by us are regulated by governmental entities through "slot" allocations. Each

slot represents the authorization to land at, or take off from, the particular airport during a specified time period.

In the United States, the FAA currently regulates slot allocations at JFK and LaGuardia in New York and National in Washington, D.C. Our operations at

those three airports generally require slot allocations. Under legislation enacted by Congress, slot rules will be phased out at JFK and LaGuardia by 2007.

We currently have sufficient slot authorizations to operate our existing flights, and have generally been able to obtain slots to expand our operations and to

change our schedules. There is no assurance, however, that we will be able to obtain slots for these purposes in the future because, among other reasons, slot

allocations are subject to changes in governmental policies.

Possible Legislation or DOT Regulation

A number of Congressional bills and proposed DOT regulations have been considered in recent years to address airline competition issues. Some of these

proposals would require large airlines with major operations at certain airports to divest or make available to other airlines slots, gates, facilities and other

assets at those airports. Other measures would limit the service or pricing responses of major carriers that appear to target new entrant airlines. In addition,

concerns about airport congestion issues have caused the DOT and FAA to consider various proposals for access to certain airports, including "congestion-

based" landing fees and programs that would withdraw slots from existing carriers and reallocate those slots (either by lottery or auction) to the highest bidder

or to carriers with little or no current presence at such airports. These proposals, if enacted, could negatively impact our existing services and our ability to

respond to competitive actions by other airlines.

Fuel

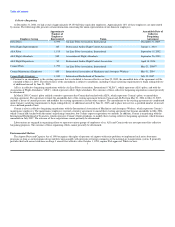

Our results of operations are significantly impacted by changes in the price and availability of aircraft fuel. The following table shows our aircraft fuel

consumption and costs for 2002-2004.

Gallons Average Percentage of

Consumed Cost (1) Price Per Total Operating

Year (Millions) (Millions) Gallon (1) Expenses

2004 2,527 $ 2,924 115.70¢ 16 %

2003 2,370 1,938 81.78 13

2002 2,514 1,683 66.94 11

(1) Net of fuel hedge gains under our fuel hedging program.

Aircraft fuel expense increased 51% in 2004 compared to 2003. Total gallons consumed increased 7% in 2004 mainly due to the restoration of capacity

that we reduced in 2003 due to the war in Iraq. The average fuel price per gallon in 2004 rose 42% to $1.16 as compared to an average price of 81.78¢ in

2003. Our fuel cost is 5