Delta Airlines 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

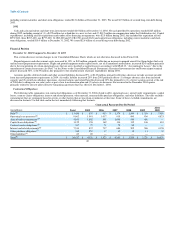

Salaries and related costs totaled $6.3 billion in 2003, a 3% increase from 2002. This 3% increase primarily reflects (1) a 5% increase from higher pension

and related expense of approximately $290 million; (2) a 2% increase due to salary rate increases primarily for pilots in the June 2003 and June 2002 quarters

under their collective bargaining agreement, and for mechanics in the June 2002 quarter; and (3) a 2% increase due to growth in our wholly owned

subsidiaries' regional jet operations. These increases were partially offset by a 6% decrease due to our 2002 workforce reduction programs. The increase in

pension expense mainly reflects the impact of declining interest rates, a decrease in the fair value of pension plan assets and scheduled pilot salary increases,

partially offset by approximately $120 million in expense reductions from the transition of our non-pilot defined benefit pension plan to a cash balance plan.

For additional information related to this transition, see Note 10 of the Notes to the Consolidated Financial Statements.

Aircraft fuel expense totaled $1.9 billion during 2003, a 15% increase from 2002. This increase is primarily due to higher fuel prices, partially offset by

capacity reductions. The average fuel price per gallon rose 22% to 81.78¢, while total gallons consumed decreased 6%. Our fuel cost is shown net of fuel

hedge gains of $152 million for 2003 and $136 million for 2002. Approximately 65% and 56% of our aircraft fuel requirements were hedged during 2003 and

2002, respectively. For additional information about our fuel hedge contracts, see Note 4 of the Notes to the Consolidated Financial Statements.

Depreciation and amortization expense rose 6% in 2003, primarily due to the acquisition of regional jet aircraft and an increase in software amortization

associated with completed technology projects.

Contracted services expense declined 12% primarily due to reduced traffic and capacity, the suspension of the air carrier security fees under the

Appropriations Act between June 1, 2003 and September 30, 2003, and a decrease in contracted services across certain workgroups. For additional

information about the Appropriations Act, see Note 18 of the Notes to the Consolidated Financial Statements.

Expenses from our contract carrier arrangements increased 40% to $784 million primarily due to growth under our agreement with Chautauqua.

Landing fees and other rents rose 3%, primarily due to higher landing fees adopted by airports seeking to recover lost revenue due to decreased traffic, and

increased facility rates. Aircraft maintenance materials and outside repairs expense fell 11%, primarily from reduced maintenance volume and materials

consumption as a result of process improvement initiatives, lower capacity and our fleet simplification program. Aircraft rent expense increased 3% mainly

due to our decision in the December 2002 quarter to return our B737-300 leased aircraft to service during 2003. For additional information related to this

decision, see Note 14 of the Notes to Consolidated Financial Statements.

Other selling expenses fell 11%. This decline primarily reflects a 9% decrease related to lower booking fees from decreased traffic and a 3% decline from

higher sales of mileage credits under our SkyMiles program because a portion of this revenue is recorded as an offset to other selling expenses. These

decreases were partially offset by an increase in advertising expenses due to the launch of Song, our low-fare service. Passenger commission expense declined

34%, primarily reflecting a 22% decrease from the change in our commission rate structure in 2002, which resulted in the elimination of travel agent base

commissions for tickets sold in the U.S. and Canada. The decrease in passenger commissions also reflects the cancellation or renegotiation of certain travel

agent contracts and a lower volume of base and incentive commissions. Passenger service expense decreased 13%, primarily reflecting a 10% decline from

decreased traffic and capacity, and a 7% decrease due to certain meal service-related cost savings initiatives.

Restructuring, asset writedowns, pension settlements and related items, net totaled $268 million in 2003 compared to $439 million in 2002. Our 2003

charge consists of (1) $212 million related to settlements under the Pilot Plan; (2) $43 million related to a net curtailment loss for the cost of pension and

postretirement obligations for participants under our 2002 workforce reduction programs; and (3) $41 million associated with the planned sale of 11 B737-800

aircraft. This charge was partially offset by a $28 million reduction to operating expenses from revised estimates of remaining costs associated with our

restructuring activities. Our 2002 charge consists of (1) $251 million in asset writedowns; (2) $127 million related to our 2002 workforce reduction programs;

(3) $93 million for the temporary carrying cost of surplus pilots and grounded aircraft; (4) $30 million due to the deferred delivery of certain Boeing aircraft;

(5) $14 million for the closure of certain leased facilities; and (6) $3 million related to other items. This charge was partially offset by (1) the reversal of a

$56 million reserve 34