Delta Airlines 2004 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

these matters cannot be predicted with certainty and could have a material adverse effect on our Consolidated Financial Statements, management believes that

the resolution of these actions will not have a material adverse effect on our Consolidated Financial Statements.

For a discussion of certain environmental matters, see "Business — Environmental Matters" in Item 1.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters were submitted to a vote of security holders of the company during the fourth quarter of the fiscal year covered by this report.

PART II

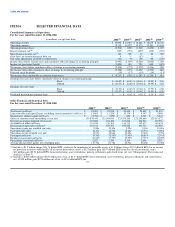

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

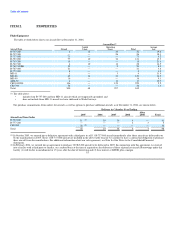

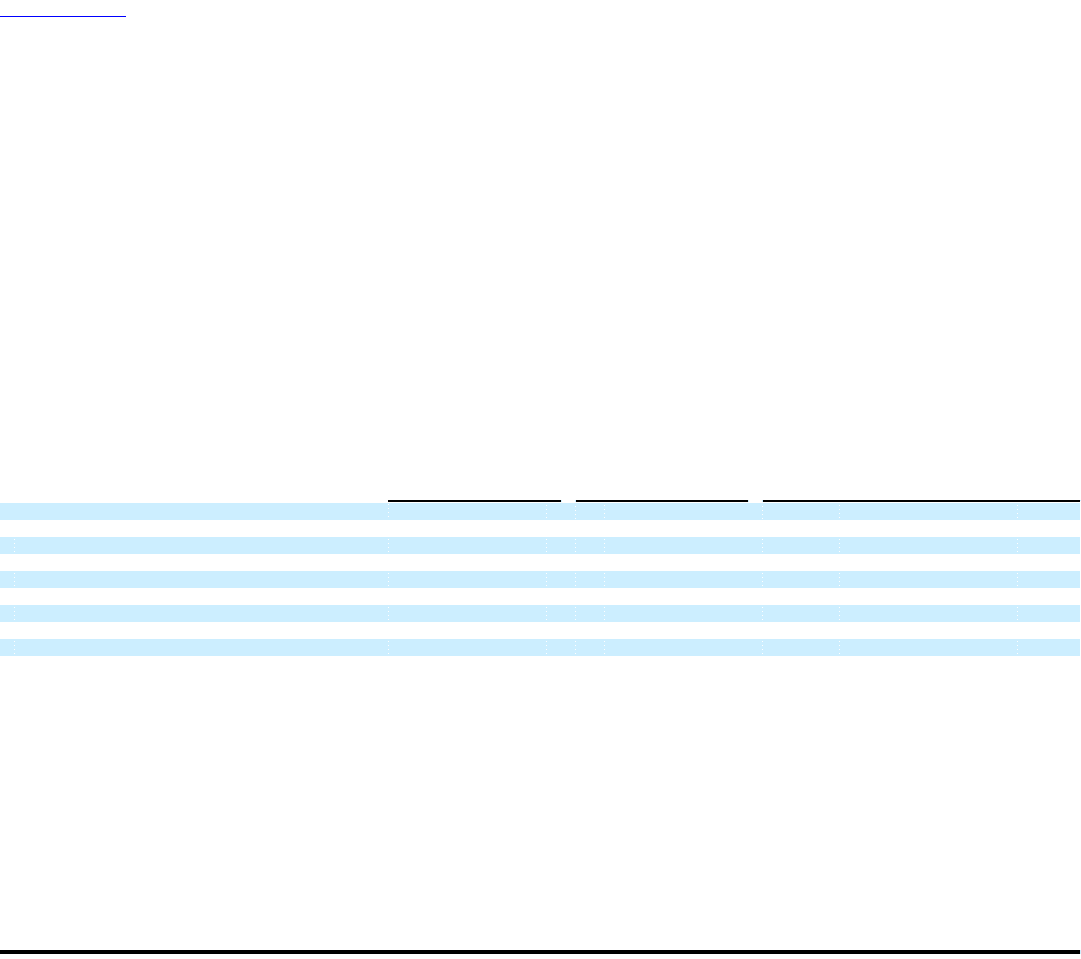

Our common stock is listed on the New York Stock Exchange under the symbol "DAL." The following table sets forth, for the periods indicated, the

highest and lowest sale prices for our common stock, as reported on the New York Stock Exchange, as well as cash dividends paid per common share.

Cash Dividends

per Common

High Low Share

Fiscal 2003

First Quarter $ 14.00 $ 6.56 $ 0.025

Second Quarter 16.05 8.76 0.025

Third Quarter 15.47 10.26 —

Fourth Quarter 15.28 10.45 —

Fiscal 2004

First Quarter $ 13.20 $ 7.00 —

Second Quarter 8.59 4.53 —

Third Quarter 7.25 2.78 —

Fourth Quarter 8.17 2.75 —

As of December 31, 2004, there were approximately 22,148 holders of record of our common stock. On February 28, 2005, the last reported sale price of

our common stock on the New York Stock Exchange was $4.64.

On July 24, 2003, our Board of Directors announced that we would immediately discontinue the payment of quarterly common stock cash dividends due

to the financial challenges facing us. On November 12, 2003, our Board of Directors announced that we would suspend indefinitely the payment of semi-

annual dividend payments on our Series B ESOP Convertible Preferred Stock ("ESOP Preferred Stock") due to applicable restrictions under Delaware

General Corporation Law ("Delaware Law"). To comply with Delaware Law, our Board of Directors also changed the form of payment we will use to redeem

shares of ESOP Preferred Stock when redemptions are required under our Savings Plan. As of December 1, 2003, we began using shares of our common

stock rather than cash to redeem ESOP Preferred Stock when redemptions are required under the Savings Plan.

Our dividend policy is reviewed from time to time by the Board of Directors. The payment of dividends is restricted by our financing agreements with GE

Commercial Finance and Amex. Future common stock dividend decisions will take into account our then current business results, cash requirements and

financial condition. 23