Delta Airlines 2004 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

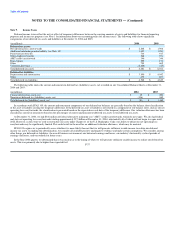

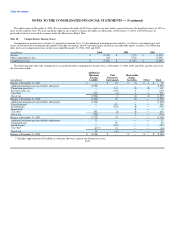

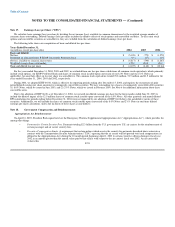

The following table includes additional information about these plans as of December 31, 2004:

Shares

Total Shares Non-Qualified Reserved

Authorized for Stock Options for Future

Plan Issuance Granted Grant

2004 broad-based employee stock option plans (1) 62,340,000 62,216,100 124,500

1996 broad-based employee stock option plans (2) 49,400,000 49,400,000 —

Delta 2000 Performance Compensation Plan(3) 16,000,000 13,495,361 6,600,784

Non-Employee Directors' Stock Option Plan (4) 250,000 119,245 143,615

Non-Employee Directors' Stock Plan(5) 500,000 — 400,319

(1) During the December 2004 quarter, we adopted these pilot and non-pilot plans due to the substantial contributions made by employees to our out-

of-court restructuring efforts. We did not seek shareowner approval to adopt these plans because the Audit Committee of our Board of Directors

determined that the delay necessary in obtaining such approval would seriously jeopardize our financial viability. The New York Stock Exchange

accepted our reliance on this exception to its shareowner approval policy. The plans provide that shares reserved for awards that are forfeited are

available for future stock option grants.

(2) In 1996, shareowners approved broad-based pilot and non-pilot stock option plans. Under these two plans, we granted eligible employees non-

qualified stock options to purchase a total of 49.4 million shares of common stock in three approximately equal installments on October 30, 1996,

1997 and 1998.

(3) On October 25, 2000, shareowners approved this plan, which authorizes the grant of stock options and a limited number of other stock awards.

The plan amends and restates a prior plan which was also approved by shareowners. No awards have been, or will be, granted under the prior

plan on or after October 25, 2000. At December 31, 2004, there were 2.2 million shares of common stock reserved for awards (primarily non-

qualified stock options) that were outstanding under the prior plan. The current plan provides that shares reserved for awards under the current or

prior plans that are forfeited, settled in cash rather than stock or withheld, plus shares tendered to us in connection with such awards, may be

added back to the shares available for future grants under the current plan. At December 31, 2004, 17.9 million shares had been added back

pursuant to that provision, including 11.0 million shares canceled under the stock option exchange program discussed below.

(4) On October 22, 1998, the Board of Directors approved this plan under which each non-employee director may receive an annual grant of non-

qualified stock options. This plan provides that shares reserved for awards that are forfeited may be added back to the shares available for future

stock option grants.

(5) In 1995, shareowners approved this plan, which provides that a portion of each non-employee director's compensation for serving as a director

will be paid in shares of common stock. It also permits non-employee directors to elect to receive all or a portion of their cash compensation for

service as a director in shares of common stock at current market prices.

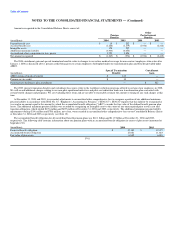

On May 28, 2003, we commenced, with shareowner approval, a stock option exchange program ("Exchange Program") for eligible employees in our 1996

broad-based stock option plans and the Delta 2000 Performance Compensation Plan. Approximately 45,000 eligible employees could elect to exchange their

outstanding stock options with an exercise price of $25 per share or more for a designated fewer number of replacement options with an exercise price equal

to the fair market value of the common stock on the grant date of the replacement options. In accordance with the terms of the Exchange Program, we

canceled approximately 32 million outstanding stock options on June 25, 2003 and issued, in exchange for the canceled options, approximately 12 million

replacement options on December 26, 2003. The exercise price of the replacement options is $11.60, the closing price of our common stock on the grant date.

Members of our Board of Directors, including our Chief Executive Officer, were not eligible to participate in the Exchange Program.

F-46