Delta Airlines 2004 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

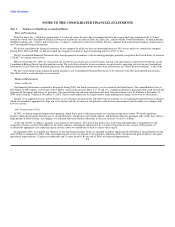

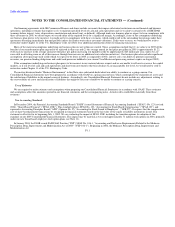

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Equity Warrants and Other Similar Rights

We record our equity warrants and other similar rights in certain companies at fair value at the date of acquisition in other noncurrent assets on our

Consolidated Balance Sheets. In accordance with SFAS 133, we regularly adjust our Consolidated Balance Sheets to reflect the changes in the fair values of

the equity warrants and other similar rights, and recognize the related gains or losses as fair value adjustments of SFAS 133 derivatives in other income

(expense) on our Consolidated Statements of Operations.

Revenue Recognition

Passenger Revenues

We record sales of passenger tickets as air traffic liability on our Consolidated Balance Sheets. Passenger revenues are recognized when we provide the

transportation, reducing the related air traffic liability. We periodically evaluate the estimated air traffic liability and record any resulting adjustments in our

Consolidated Statements of Operations in the period in which the evaluations are completed.

We sell mileage credits in the SkyMiles® frequent flyer program to participating partners such as credit card companies, hotels and car rental agencies. A

portion of the revenue from the sale of mileage credits is deferred until the credits are redeemed for travel. We amortize the deferred revenue on a straight-line

basis over a 30-month period. The majority of the revenue from the sale of mileage credits, including the amortization of deferred revenue, is recorded in

passenger revenue on our Consolidated Statements of Operations; the remaining portion is recorded as an offset to other selling expenses.

Cargo Revenues

Cargo revenues are recognized in our Consolidated Statements of Operations when we provide the transportation.

Other, net

Other, net revenue includes revenue from codeshare agreements with certain other airlines. Under these agreements, we sell seats on these airlines' flights

and they sell seats on our flights, with each airline separately marketing its respective seats. The revenue from our sale of codeshare seats on other airlines,

and the direct costs incurred in marketing those seats, are recorded in other, net in operating revenues on our Consolidated Statements of Operations. Our

revenue from other airlines' sale of codeshare seats on our flights is recorded in passenger revenue on our Consolidated Statements of Operations.

Long-Lived Assets

We record our property and equipment at cost and depreciate or amortize these assets on a straight-line basis to their estimated residual values over their

respective estimated useful lives. Residual values for flight equipment range from 5%-40% of cost. We also capitalize certain internal and external costs

incurred to develop internal-use software; these assets are included in ground property and equipment, net on our Consolidated Balance Sheets. The estimated

useful lives for major asset classifications are as follows:

Estimated

Asset Classification Useful Life

Owned flight equipment 15-25 years

Flight and ground equipment under capital lease Lease Term

Ground property and equipment 3-10 years

In accordance with SFAS 144, we record impairment losses on long-lived assets used in operations when events and circumstances indicate the assets may

be impaired and the undiscounted cash flows estimated to be generated by those assets are less than their carrying amounts. For long-lived assets held for sale,

we record F-14