Delta Airlines 2004 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. .

.

.

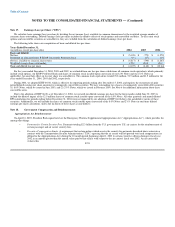

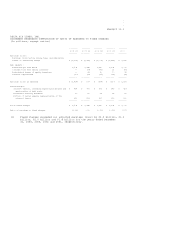

EXHIBIT 12.1

DELTA AIR LINES, INC.

STATEMENT REGARDING COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES

(In millions, except ratios)

-------- -------- -------- -------- --------

2004 (1) 2003 (1) 2002 (1) 2001 (1) 2000

-------- -------- -------- -------- --------

Earnings (loss):

Earnings (loss) before income taxes and cumulative

effect of accounting change $ (3,992) $ (1,189) $ (2,002) $ (1,864) $ 1,549

Add (deduct):

Fixed charges from below 1,504 1,448 1,340 1,204 1,079

(Income)/loss from equity investees -- (14) (41) 12 (59)

Distributed income of equity investees -- 44 40 70 32

Interest capitalized (10) (12) (15) (32) (45)

-------- -------- -------- -------- --------

Earnings (loss) as adjusted $ (2,498) $ 277 $ (678) $ (610) $ 2,556

Fixed charges:

Interest expense, including capitalized amounts and $ 834 $ 769 $ 679 $ 543 $ 427

amortization of debt costs

Preference security dividend 19 25 24 22 22

Portion of rental expense representative of the

interest factor 651 654 637 639 630

-------- -------- -------- -------- --------

Total fixed charges $ 1,504 $ 1,448 $ 1,340 $ 1,204 $ 1,079

Ratio of earnings to fixed charges (1.66) 0.19 (0.51) (0.51) 2.37

(1) Fixed charges exceeded our adjusted earnings (loss) by $4.0 billion, $1.2

billion, $2.0 billion and $1.8 billion for the years ended December

31, 2004, 2003, 2002 and 2001, respectively.