Delta Airlines 2004 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

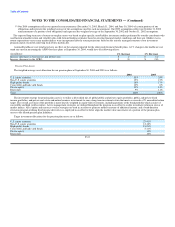

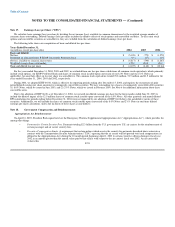

• Asset Impairment Charge. During the September 2004 quarter, we recorded a $41 million non-cash aircraft impairment charge related to our

agreement to sell eight owned MD-11 aircraft. In October 2004, we sold these aircraft and related inventory to a third party for $227 million.

2003

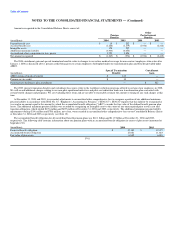

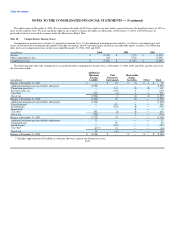

In 2003, we recorded $268 million in net charges ($169 million net of tax) in restructuring, asset writedowns, pension settlements and related items, net on

our Consolidated Statement of Operations, as follows:

• Pension Settlement. During the December 2003 quarter, we recorded a $212 million non-cash charge related to our pilots' defined benefit

pension plan due to a significant increase in pilot retirements (see Note 10).

• Pension and Postretirement Curtailment. During the March 2003 quarter, we recorded a $43 million net charge for costs associated with the

2002 workforce reduction program. This charge relates to a net curtailment loss under certain of our pension and postretirement medical

benefit plans (see Note 10). See below for additional information about our 2002 workforce reduction programs.

• Planned Sale of Aircraft. During the December 2003 quarter, we recorded a $41 million charge as a result of a definitive agreement to sell

11 B737-800 aircraft to a third party immediately after those aircraft are delivered to us by the manufacturer in 2005 (see Note 8).

• Other.During 2003, we recorded a $28 million reduction to operating expenses based primarily on revised estimates of remaining costs

associated with prior year restructuring reserves (see Note 15).

2002

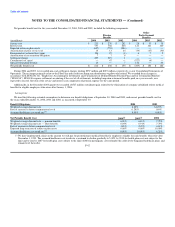

In 2002, we recorded $439 million in net charges ($277 million net of tax) in restructuring, asset writedowns, pension settlements and related items, net on

our Consolidated Statement of Operations, as follows:

• Fleet Changes. We recorded $225 million in net asset impairments and other charges due to significant changes we made to our fleet plan in

2002 (1) to reduce costs through fleet simplification and capacity reductions and (2) to decrease capital expenditures through aircraft

deferrals. These actions are discussed below.

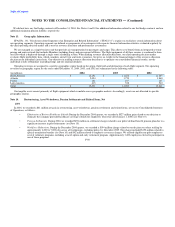

During the September 2002 quarter, we recorded an impairment charge, shown in the table below, related to 59 owned B727 aircraft. This

included the impairment of (1) 23 B727 aircraft used in operations due to a further reduction in their estimated future cash flows and fair

values since our impairment review in 2001 and (2) 36 B727 aircraft held for sale due to a further decline in their fair values less the cost to

sell since our impairment review in 2001. The aircraft held for sale were sold as part of our fleet simplification plan during 2003; the net

book value of these aircraft was included in other noncurrent assets on our Consolidated Balance Sheet at December 31, 2002, and was not

material.

During the September 2002 quarter, we decided to temporarily remove from service our MD-11 aircraft, beginning in early 2003. As a result

of this decision, we recorded an impairment charge, shown in the table below, related to our eight owned MD-11 aircraft to reflect the

further reduction in estimated future cash flows and fair values of these aircraft since our impairment review in 2001. The MD-11 aircraft

were replaced on international routes by B767-300ER aircraft that had been used in our domestic system. We used smaller Mainline aircraft

to replace the B767-300ER aircraft on domestic routes, thereby reducing our domestic capacity.

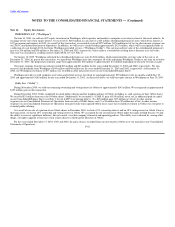

During the December 2002 quarter, we decided to return to service, beginning in 2003, nine leased B737-300 aircraft which we had removed

from operations. This decision was based on (1) capacity and operating cost considerations and (2) our inability to sublease the B737-300

F-51