Delta Airlines 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Table of contents

-

Page 1

DELTA AIR LINES INC /DE/ (DAL) 10-K Annual report pursuant to section 13 and 15(d) Filed on 03/10/2005 Filed Period 12/31/2004 -

Page 2

... or organization) Post Office Box 20706 Atlanta, Georgia (Address of principal executive offices) Registrant's telephone number, including area code: (404) 715-2600 Securities registered pursuant to Section 12(b) of the Act: Title of each class Common Stock, par value $1.50 per share Preferred Stock... -

Page 3

... Airline Operations Regulatory Matters Fares and Rates Route Authority Competition Airport Access Possible Legislation or DOT Regulation Fuel Employee Matters Environmental Matters Frequent Flyer Program Civil Reserve Air Fleet Program Executive Officers Risk Factors Relating to Delta Risk... -

Page 4

... 9A. CONTROLS AND PROCEDURES Disclosure Controls and Procedures Changes in Internal Control Management's Annual Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm ITEM 9B. OTHER INFORMATION PART III ITEM 10. DIRECTORS AND EXECUTIVE OFFICERS OF... -

Page 5

... executive offices are located at Hartsfield-Jackson Atlanta International Airport in Atlanta, Georgia (the "Atlanta Airport"). Our telephone number is (404) 715-2600, and our Internet address is www.delta.com. See "- Risk Factors Relating to Delta" and "- Risk Factors Relating to the Airline... -

Page 6

... under our code in July 2005. For additional information regarding our agreements with SkyWest and Chautauqua, see Note 8 of the Notes to the Consolidated Financial Statements. Our contract with Eagle, which is limited to certain flights operated to and from the Los Angeles International Airport, as... -

Page 7

...Terminal) and both Boston - Logan International Airport ("Logan") and Washington, D.C. - Ronald Reagan National Airport ("National"). Song On April 15, 2003, we introduced a new low-fare operation, Song, that primarily offers flights between cities in the Northeastern United States, Los Angeles, Las... -

Page 8

...-cost carriers and other airlines depends, in part, on our ability to achieve operating costs per available seat mile ("unit costs") that are competitive with those carriers. International marketing alliances formed by domestic and foreign carriers, including the Star Alliance (among United Airlines... -

Page 9

... no current presence at such airports. These proposals, if enacted, could negatively impact our existing services and our ability to respond to competitive actions by other airlines. Fuel Our results of operations are significantly impacted by changes in the price and availability of aircraft fuel... -

Page 10

... contracts to attempt to reduce our exposure to changes in fuel prices. Information regarding our fuel hedging program is set forth under "Management's Discussion and Analysis of Financial Condition and Results of Operations - Market Risks Associated with Financial Instruments - Aircraft Fuel Price... -

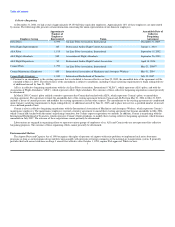

Page 11

... domestic employees. Approximate Number of Employees Represented Union 6,590 Air Line Pilots Association, International 185 1,515 885 50 1,790 485 Professional Airline Flight Control Association Air Line Pilots Association, International Association of Flight Attendants Professional Airline Flight... -

Page 12

... mileage for travel awards by flying on Delta, Delta Connection carriers and participating airlines. Mileage credit may also be earned by using certain services offered by program partners such as credit card companies, hotels, car rental agencies, telecommunication services and internet services... -

Page 13

... of revenue passengers. Civil Reserve Air Fleet Program We participate in the Civil Reserve Air Fleet ("CRAF") program, which permits the U.S. military to use the aircraft and crew resources of participating U.S. airlines during airlift emergencies, national emergencies or times of war. We have... -

Page 14

...); Vice President - Customer Service (1999-2000); Vice President - Reservation Sales (1998-1999); Vice President - Reservation Sales & Distribution Planning (1996-1998) Paul G. Matsen Senior Vice President and Chief Marketing Officer since June 2004; Senior Vice President - International & Alliances... -

Page 15

... the average annual jet fuel price per gallon increasing our liquidity needs by approximately $25 million per year, unless we are successful in offsetting some or all of this increase through fare increases or additional cost reduction initiatives). The forward curve for crude oil currently implies... -

Page 16

... financial and business operations and include financial tests that we must meet in order to continue to borrow under such facilities. The terms of our financing agreements with GE Commercial Finance and Amex restrict our ability to, among other things, incur additional indebtedness, pay dividends... -

Page 17

...revenues and increase our pension funding obligations significantly. Approximately 1,800 of our 6,400 pilots are currently at or over age 50 and thus are eligible to retire. Our business is dependent on the price and availability of aircraft fuel. Continued periods of historically high fuel costs or... -

Page 18

... major cities and to other Delta hubs. A significant interruption or disruption in service at the Atlanta Airport or at one of our other hubs could have a serious impact on our business, financial condition and operating results. We are increasingly dependent on technology in our operations, and... -

Page 19

... Contents affiliates' unionized employees may adversely affect our ability to conduct our business. Relations between air carriers and labor unions in the United States are governed by the Railway Labor Act, which provides that a collective bargaining agreement between an airline and a labor union... -

Page 20

...Although global economic conditions have improved from their depressed levels after September 11, 2001, the airline industry has continued to experience a reduction in high-yield business travel and increased price sensitivity in customers' purchasing behavior. In addition, aircraft fuel prices have... -

Page 21

Table of Contents Other laws, regulations, taxes and airport rates and charges have also been imposed from time to time that significantly increase the cost of airline operations or reduce revenues. For example, the Aviation and Transportation Security Act, which became law in November 2001, ... -

Page 22

...of Contents ITEM 2. Flight Equipment PROPERTIES The table set forth below shows our aircraft fleet at December 31, 2004. Capital Lease Current Fleet(1) Operating Lease Average Age Aircraft Type Owned Total B-737-200 B-737-300 B-737-800 B-757-200 B-767-200 B-767-300 B-767-300ER B-767-400 B-777... -

Page 23

... Atlanta maintenance base, our other major aircraft maintenance facilities are located at Cincinnati/Northern Kentucky International Airport, Tampa International Airport and Salt Lake City International Airport. We lease marketing, ticket and reservations offices in certain locations; these leases... -

Page 24

... and expansion of Terminal A at Logan. The completion of this project will enable us to consolidate all of our domestic operations at that airport into one location. Construction began in the June 2002 quarter and is scheduled to be completed in March 2005. Project costs are being funded with $498... -

Page 25

... who purchased from us or our agent a full fare, unrestricted ticket for travel on any of certain designated city pairs originating or terminating at our Cincinnati hub during the same period. The District Court has not scheduled the trial of these lawsuits. Hall, et al. v. United Airlines, et... -

Page 26

...event of our insurers' insolvency or otherwise. Delta Family-Care Savings Plan Litigation On September 3, 2004, a former Delta employee filed a lawsuit on behalf of himself and all other participants in the Savings Plan against Delta and certain past and present members of Delta's Board of Directors... -

Page 27

...the Savings Plan. Our dividend policy is reviewed from time to time by the Board of Directors. The payment of dividends is restricted by our financing agreements with GE Commercial Finance and Amex. Future common stock dividend decisions will take into account our then current business results, cash... -

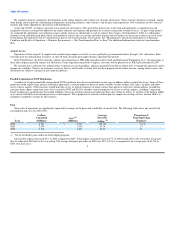

Page 28

... share Basic Diluted Dividends declared per common share Other Financial and Statistical Data For the years ended December 31, 2004-2000 2000(5) 2001(4) 2002(3) 2003(2) 2004(1) Total assets (millions) $ 21,801 $ 25,939 $ 24,303 $ 23,605 $ 21,931 Long-term debt and capital leases (excluding current... -

Page 29

Table of Contents Appropriations Act compensation; and a $304 million gain ($191 million net of tax, or $1.55 diluted EPS) for certain other income and expense items (see "Management's Discussion and Analysis" in Item 7). (3) Includes a $439 million charge ($277 million net of tax, or $2.25 diluted... -

Page 30

... low-cost carriers with which we compete in most of our domestic markets; high industry capacity, resulting in significant fare discounting to stimulate traffic; and increased price sensitivity by our customers, enhanced by the availability of airline fare information on the Internet. Aircraft fuel... -

Page 31

... nonstop service from New York-JFK to Los Angeles, San Francisco, Seattle, San Juan and Aruba. Reducing fleet complexity by retiring up to four aircraft types in approximately four years and increasing overall fleet utilization and efficiency. Eliminating 6,000 to 7,000 non-pilot jobs by December... -

Page 32

... coverage subsidy for non-pilot employees who retire after January 1, 2006; and (4) reduced vacation time. In January 2005, we dehubbed our Dallas/Ft. Worth operations and redeployed aircraft from that market to grow our hub operations in Atlanta, Cincinnati and Salt Lake City. We expect to benefit... -

Page 33

... will be cash payments (for additional information about this amount, see Note 6 of the Notes to the Consolidated Financial Statements); and (4) $450 million of estimated funding for our defined benefit pension and defined contribution plans. Absent the enactment of new federal legislation which... -

Page 34

... mile yield reflects our lack of pricing power due to the continuing growth of low-cost carriers with which we compete in most of our domestic markets, high industry capacity and increased price sensitivity by our customers, enhanced by the availability of airline fare information on the Internet... -

Page 35

... expense; (2) a 1% increase due to a 4.5% salary rate increase in May 2004 for our pilots under their collective bargaining agreement which was partially offset by their rate decrease effective December 1, 2004; and (3) a 1% increase due to growth in operations. Aircraft fuel expense increased 51... -

Page 36

...-pilot employees who retire after January 1, 2006; (2) settlement charges totaling $257 million primarily related to our defined benefit pension plan for pilots ("Pilot Plan"); (3) a $194 million charge related to voluntary and involuntary workforce reduction programs; and (4) a $40 million aircraft... -

Page 37

...of the Delta Family-Care Savings Plan's Series C Guaranteed Serial ESOP Notes ("ESOP Notes"), offset by a $15 million gain related to a debt exchange. For additional information about these transactions, see Note 6 of the Notes to the Consolidated Financial Statements. Income Tax Provision (Benefit... -

Page 38

...of our non-pilot defined benefit pension plan to a cash balance plan. For additional information related to this transition, see Note 10 of the Notes to the Consolidated Financial Statements. Aircraft fuel expense totaled $1.9 billion during 2003, a 15% increase from 2002. This increase is primarily... -

Page 39

... Statement of Operations. For additional information about the Stabilization Act, see Note 18 of the Notes to the Consolidated Financial Statements. Other operating expenses fell 16%, primarily reflecting a 9% decrease due to lower insurance rates under U.S. government-provided insurance policies... -

Page 40

... to a valuation allowance against our net deferred income tax assets, all of which are non-cash items. A $455 million funding of our qualified defined benefit pension plans. A $141 million increase in total restricted cash, primarily to support certain projected insurance obligations related to... -

Page 41

...our net deferred tax assets. For additional information about the goodwill impairment and valuation allowance, see Notes 5 and 9, respectively, of the Notes to the Consolidated Financial Statements. ESOP Preferred Stock Delaware Law provides that a company may pay dividends on its stock only (1) out... -

Page 42

... for the Delta Family-Care Savings Plan, a broad-based employee benefit plan ("Savings Plan"). • Changed the form of payment we use to redeem shares of ESOP Preferred Stock when redemptions are required under the Savings Plan. For the indefinite future, we will pay the redemption price of the... -

Page 43

...war-risk insurance currently provided by the U.S. government, see Note 8 of the Notes to the Consolidated Financial Statements. For additional information on our liquidity, see the Business Environment section of Management's Discussion and Analysis in this Form 10-K. Prior Years 2003 Cash and cash... -

Page 44

...to our new pilot collective bargaining agreement that was effective December 1, 2004. Contractual Obligations The following table summarizes our contractual obligations as of December 31, 2004 related to debt; operating leases; aircraft order commitments; capital leases; contract carrier obligations... -

Page 45

...will pay wages required under collective bargaining agreements; fund pension plans (as discussed below); purchase capacity under contract carrier arrangements (as discussed below); and pay credit card processing fees and fees for other goods and services, including those related to fuel, maintenance... -

Page 46

... on our liquidity. Contract Carriers. We have long-term contract carrier agreements with three regional air carriers, SkyWest, Chautauqua and Republic Airline. Under these agreements, SkyWest and Chautauqua operate certain of their aircraft using our flight code, and we schedule those aircraft, sell... -

Page 47

... the next 14 years. Additionally, the lease rates we will pay for these aircraft approximate current market rates. We expect to use these aircraft in our operations. Redemptions of ESOP Preferred Stock. As discussed above, we changed the form of payment we will use to redeem shares of ESOP Preferred... -

Page 48

... 2004 and change our estimated pension expense in 2005 by approximately $40 million. Our rate of increase in future compensation levels is based primarily on labor contracts currently in effect with our employees under collective bargaining agreements and expected future pay rate increases for other... -

Page 49

...annual jet fuel price would increase our aircraft fuel expense by approximately $325 million in 2005. For additional information regarding our aircraft fuel price risk management program, see Note 3 of the Notes to the Consolidated Financial Statements. Interest Rate Risk Our exposure to market risk... -

Page 50

...additional information on our long-term debt agreements, see Note 6 of the Notes to the Consolidated Financial Statements. Glossary of Defined Terms ASM - Available Seat Mile. A measure of capacity. ASMs equal the total number of seats available for transporting passengers during a reporting period... -

Page 51

... our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure. Changes In Internal Control During the three months ended December 31, 2004, we made no change in our internal control over financial reporting... -

Page 52

... Report of Independent Registered Public Accounting Firm To the Board of Directors and Shareowners of Delta Air Lines, Inc.: Atlanta, Georgia We have audited management's assessment, included in the accompanying Management's Annual Report on Internal Control over Financial Reporting, that Delta... -

Page 53

...under the headings "Director Compensation," "Corporate Governance Matters - Compensation Committee Interlocks and Insider Participation" and "Executive Compensation" in our Proxy Statement and is incorporated by reference. ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND... -

Page 54

...as Attorney-in-Fact Chief Executive Officer and Director (Principal Executive Officer) Executive Vice President and Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer) Director Director Director Director Chairman of the Board Director Director Director 50 -

Page 55

... Report on Form 10-Q for the quarter ended September 30, 1998).* Delta's By-Laws (Filed as Exhibit 3 to Delta's Current Report on Form 8-K as filed on January 27, 2005).* Rights Agreement dated as of October 24, 1996, between Delta and First Chicago Trust Company of New York, as Rights Agent... -

Page 56

... Award Program (Filed as Exhibit 10 to Delta's Current Report on Form 8-K as filed on January 27, 2005).* Delta's Non-Employee Directors' Stock Plan (Filed as Exhibit 4.5 to Delta's Registration Statement on Form S-8 (Registration No. 33-65391)).* Delta's Non-Employee Directors' Stock Option Plan... -

Page 57

...fixed charges for each fiscal year in the five-year period ended December 31, 2004. Subsidiaries of the Registrant. Consent of Deloitte & Touche LLP Powers of Attorney Rule 13a-14(a)/15d-14(a) Certification of Chief Executive Officer. Rule 13a-14(a)/15d-14(a) Certification of Chief Financial Officer... -

Page 58

Table of Contents INDEX TO CONSOLIDATED FINANCIAL STATEMENTS Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets - December 31, 2004 and 2003 Consolidated Statements of Operations for the years ended December 31, 2004, 2003 and 2002 Consolidated Statements of Cash ... -

Page 59

... of Contents REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareowners of Delta Air Lines, Inc. Atlanta, Georgia We have audited the accompanying consolidated balance sheets of Delta Air Lines, Inc. and subsidiaries (the "Company") as of December 31, 2004... -

Page 60

... Balance Sheets December 31, 2004 and 2003 ASSETS (in millions) CURRENT ASSETS: Cash and cash equivalents Short-term investments Restricted cash Accounts receivable, net of an allowance for uncollectible accounts of $38 at December 31, 2004 and 2003 Expendable parts and supplies inventories... -

Page 61

...72.00 stated and liquidation value; 5,417,735 shares issued and outstanding at December 31, 2004, and 5,839,708 shares issued and outstanding at December 31, 2003 390 420 Unearned compensation under employee stock ownership plan (113) (145) Total Employee Stock Ownership Plan Preferred Stock 277 275... -

Page 62

... (in millions, except per share data) OPERATING REVENUES: Passenger: Mainline Regional affiliates Cargo Other, net Total operating revenues OPERATING EXPENSES: Salaries and related costs Aircraft fuel Depreciation and amortization Contracted services Contract carrier arrangements Landing fees and... -

Page 63

...of amounts capitalized Income taxes Non-cash transactions: Aircraft delivered under seller-financing Dividends payable on ESOP preferred stock Aircraft capital leases from sale and leaseback transactions The accompanying notes are an integral part of these Consolidated Financial Statements. F-6 2004... -

Page 64

...,778 shares of common stock related to Delta's transformation plan ($6.98 per share) (see Notes 1, 6 and 7) Other Balance at December 31, 2004 $ - 68 1 (1) $ (2,403) $(5,796) (1) Average price per share The accompanying notes are an integral part of these Consolidated Financial Statements. F-7 -

Page 65

... Plan In 2002, we began our profit improvement program, which had a goal of reducing our unit costs and increasing our revenues. We made significant progress under this program, but increases in aircraft fuel prices and pension and related expense, and declining domestic passenger mile yields... -

Page 66

... shared cost of healthcare coverage, the elimination of a healthcare coverage subsidy for non-pilot employees who retire after January 1, 2006 and reduced vacation time; (3) dehubbing of our Dallas/ Ft. Worth operations and redeploying aircraft from that market to grow our hub operations in Atlanta... -

Page 67

...be cash payments (see Note 6); and (4) $450 million of estimated funding for our defined benefit pension and defined contribution plans. Absent the enactment of new federal legislation which reduces our pension funding obligations during the next several years, our annual pension funding obligations... -

Page 68

... in the average annual jet fuel price per gallon increasing our liquidity needs by approximately $25 million per year, unless we are successful in offsetting some or all of this increase through fare increases or additional cost reduction initiatives). Our business plan also includes significant... -

Page 69

... about Pensions and Other Postretirement Benefits, an amendment of FASB Statements No. 87, 88, and 106" ("SFAS 132R") (see Note 10 for disclosures required under SFAS 132R). EITF Issue 01-08, "Determining Whether an Arrangement Contains a Lease". SFAS No. 143, "Accounting for Asset Retirement... -

Page 70

Table of Contents NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Under our cash management system, we utilize controlled disbursement accounts that are funded daily. Checks we issue which have not been presented for payment are recorded in accounts payable, deferred credits and other ... -

Page 71

... are completed. We sell mileage credits in the SkyMiles® frequent flyer program to participating partners such as credit card companies, hotels and car rental agencies. A portion of the revenue from the sale of mileage credits is deferred until the credits are redeemed for travel. We amortize the... -

Page 72

... impairments for aircraft used in operations, we group assets at the fleet type level (the lowest level for which there are identifiable cash flows) and then estimate future cash flows based on projections of passenger yield, fuel costs, labor costs and other relevant factors in the markets in which... -

Page 73

... value in current assets on our Consolidated Balance Sheets and recognize changes in the fair value of these securities in other income (expense) on our Consolidated Statements of Operations (see Note 16). Frequent Flyer Program We record an estimated liability for the incremental cost associated... -

Page 74

...used in estimating fair values and the resulting weighted average fair value of a stock option granted in the periods presented: Assumption Risk-free interest rate Average expected life of stock options (in years) Expected volatility of common stock Expected annual dividends on common stock Weighted... -

Page 75

... determined using available market information and valuation methodologies, primarily discounted cash flow analyses and the Black-Scholes model. Note 2. Marketable and Other Equity Securities Republic Airways Holdings, Inc. and Affiliates ("Republic Holdings") We have contract carrier agreements... -

Page 76

... is classified as an available-for-sale security under SFAS 115 and is recorded at face value, which approximates fair value, in other noncurrent assets on our Consolidated Balance Sheets. The Series B Preferred Stock, among other things, (1) bears an annual dividend per share of approximately six... -

Page 77

... our accounting policy for investments in equity securities and derivative financial instruments. Note 3. Risk Management Aircraft Fuel Price Risk Our results of operations can be significantly impacted by changes in the price of aircraft fuel. To manage this risk, we periodically purchase options... -

Page 78

... is no tax effect Fuel Hedging Program Because there is not a readily available market for derivatives in aircraft fuel, we periodically use heating and crude oil derivative contracts to manage our exposure to changes in aircraft fuel prices. Changes in the fair value of these contracts (fuel hedge... -

Page 79

... in targeted benefits, under our new Mainline pilot contract which was ratified in November 2004; and (3) Mainline has a low carrying value. Our previous impairment tests of goodwill for all reporting units resulted in no impairment. The following table presents information about our intangible... -

Page 80

...FINANCIAL STATEMENTS - (Continued) Note 6. Debt The following table summarizes our debt at December 31, 2004 and 2003: (dollars in millions) Secured... G due in installments from 2005 to January 25, 2008(2) General Electric Capital Corporation ("GECC") (3)(7)(8) 6.54% Notes due in installments from ... -

Page 81

... cash and cash equivalents and short-term investments also served as collateral for our secured debt. Our variable interest rate long-term debt is shown using interest rates which represent LIBOR or Commercial Paper plus a specified margin, as provided for in the related agreements. The rates shown... -

Page 82

...CRJ-200 aircraft leases discussed under "Financing Agreement with GE" in this Note. It is also added to the collateral that secures, on a subordinated basis, up to $160 million of certain of our other existing debt and lease obligations to GECC and its affiliates. The 15.46% interest rate applies to... -

Page 83

... Lake City International Airport and Tampa International Airport. We pay debt service on these bonds pursuant to long-term lease agreements (see Note 7). • The Bonds (1) have scheduled maturities between 2029 and 2035; (2) currently bear interest at a variable rate that is determined weekly; and... -

Page 84

... FINANCIAL STATEMENTS - (Continued) LIBOR plus a margin. The principal amount of any outstanding reimbursement obligation will be repaid quarterly through May 20, 2008. GECC has the right to cause a mandatory tender for purchase of all Bonds and terminate the letters of credit if an event... -

Page 85

... FINANCIAL STATEMENTS - (Continued) $1,000 principal amount of 27/8% Notes, subject to adjustment in certain circumstances, which is equivalent to a conversion price of approximately $13.59 per share of common stock, if: • during any calendar quarter after March 31, 2004, the last reported sale... -

Page 86

... financial institutions for which General Electric Capital Corporation acts as agent ("Agent"). As discussed below, the GE Commercial Finance Facility consists of a $330 million senior secured term loan ("Term Loan") and a $300 million senior secured revolving credit facility ("Revolver"). The total... -

Page 87

...or, at our option subject to certain conditions, certain Delta Connection carriers) up to 12 CRJ-200 aircraft then leased to another airline. See Note 8 for additional information about this right and the related leases. Financing Agreement with Amex During the December 2004 quarter, we entered into... -

Page 88

... in the airline industry, our aircraft lease and financing agreements require that we maintain certain levels of insurance coverage, including war-risk insurance. Failure to maintain these coverages may result in an interruption to our operations. See Note 8 for additional information about our... -

Page 89

... special facilities revenue bonds to build or improve airport and maintenance facilities leased to us. The facility lease agreements require us to make rental payments sufficient to pay principal and interest on the bonds. The above table includes $1.7 billion of operating lease rental commitments... -

Page 90

... market rates for those services. Our contract carrier agreement with SkyWest expires in 2010 and our agreement with Chautauqua expires in 2016. In April 2004, we notified Flyi of our election to terminate its contract carrier agreement due to Flyi's decision to operate a new low-fare airline using... -

Page 91

...of default after we assume the leases. The following unaudited table shows the available seat miles ("ASMs"), revenue passenger miles ("RPMs") and number of aircraft operated for us by Flyi, SkyWest and Chautauqua under the contract carrier agreements, for the years ended December 31, 2004, 2003 and... -

Page 92

... a total of approximately 69,150 full-time equivalent employees. Approximately 18% of these employees, including all of our pilots, are represented by labor unions. ASA is in collective bargaining negotiations with the Air Line Pilots Association, International ("ALPA") and the Association of Flight... -

Page 93

... approximate current market rates. We expect to use these aircraft in our operations. War-Risk Insurance Contingency As a result of the terrorist attacks on September 11, 2001, aviation insurers (1) significantly reduced the maximum amount of insurance coverage available to commercial air carriers... -

Page 94

...Income Taxes Deferred income taxes reflect the net tax effect of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and income tax purposes (see Note 1 for information about our accounting policy for income taxes). The following table shows... -

Page 95

...We reserve the right to modify or terminate these plans as to all participants and beneficiaries at any time, except as restricted by the Internal Revenue Code, the Employee Retirement Income Security Act ("ERISA") and our collective bargaining agreements. Our qualified defined benefit pension plans... -

Page 96

...full cost. During 2004, we amended our pilot benefit plans in connection with the new collective bargaining agreement we entered into with ALPA as discussed above. Also in 2004, we offered an early retirement window, the Alternative Early Retirement Option ("AERO"), to certain non-contract employees... -

Page 97

... and funded status (measured at September 30): Pension Benefits (in millions) Benefit obligation at beginning of year Service cost Interest cost Actuarial (gain) loss Benefits paid, including lump sums and annuities Participant contributions Special termination benefits Curtailment loss (gain) Plan... -

Page 98

... curtailment gain and special termination benefits relate to changes to our retiree medical coverage for non-contract employees who retire after January 1, 2006 as discussed above, pension credit being given to certain employees furloughed under our transformation plan and benefits provided under... -

Page 99

... Rate of increase in future compensation levels Assumed healthcare cost trend rate(1) Net Periodic Benefit Cost Weighted average discount rate - pension benefits Weighted average discount rate - other benefits Rate of increase in future compensation levels Expected long-term rate of return on plan... -

Page 100

... portfolio which consist of convertible and high yield securities. Active management strategies are utilized throughout the program in an effort to realize investment returns in excess of market indices. Also, option and currency overlay strategies are used in an effort to generate modest amounts... -

Page 101

... be credited with investment gains/losses and the actuarial equivalent of the accumulated account balance at retirement will continue to offset the participants defined benefit pension benefit. Delta Family-Care Savings Plan ("Savings Plan") Our Savings Plan includes an employee stock ownership plan... -

Page 102

... compensation as shares of ESOP Preferred Stock are allocated to participants' accounts. Dividends on unallocated shares of ESOP Preferred Stock are used for debt service on the Savings Plan's ESOP Notes and are not considered dividends for financial reporting purposes. Dividends on allocated shares... -

Page 103

... the stock option exchange program discussed below. (4) On October 22, 1998, the Board of Directors approved this plan under which each non-employee director may receive an annual grant of nonqualified stock options. This plan provides that shares reserved for awards that are forfeited may be added... -

Page 104

... our Board of Directors discontinued the payment of quarterly cash dividends on our common stock due to the financial challenges facing Delta. We had previously paid a quarterly dividend of $0.025 per common share. Effective December 2003, our Board of Directors suspended indefinitely the payment of... -

Page 105

... company has sufficient "surplus". As discussed above, at December 31, 2003, we had a negative "surplus". Effective December 2003, our Board of Directors changed the form of payment we use to redeem shares of the ESOP Preferred Stock when redemptions are required under our Delta Family-Care Savings... -

Page 106

... 2,250,000 shares of preferred stock were reserved for issuance under the Shareowner Rights Plan. Note 12. Comprehensive Income (Loss) Comprehensive income (loss) includes (1) reported net income (loss); (2) the additional minimum pension liability; (3) effective unrealized gains and losses on fuel... -

Page 107

... and cargo. This allows us to benefit from an integrated revenue pricing and route network that includes Mainline (including Song) and our regional affiliates. The flight equipment of all three carriers is combined to form one fleet which is deployed through a single route scheduling system. When... -

Page 108

... Consolidated Statement of Operations, as follows: • • Pension Settlement. During the December 2003 quarter, we recorded a $212 million non-cash charge related to our pilots' defined benefit pension plan due to a significant increase in pilot retirements (see Note 10). Pension and Postretirement... -

Page 109

... TO THE CONSOLIDATED FINANCIAL STATEMENTS - (Continued) aircraft due to the difficult business environment facing the airline industry after September 11, 2001. During the June 2001 quarter, we decided to remove from service the B737-300 aircraft and recorded a reserve for future lease payments less... -

Page 110

... fleet plan during the December 2002 quarter, we (1) reversed the remaining $56 million balance of this reserve and (2) returned these aircraft to service in 2003. The facilities and other reserve represents costs related primarily to (1) future lease payments for facility closures and (2) contract... -

Page 111

... public offering and the founding airlines of Orbitz, including us, sold a portion of their Orbitz shares. We received $33 million from our sale of Orbitz shares. Additionally, we recorded (1) a SAB 51 gain of $18 million, net of tax, in additional paid-in capital on our Consolidated Balance Sheet... -

Page 112

... net income (loss) available to common shareowners by the weighted average number of common shares outstanding. Diluted earnings (loss) per share includes the dilutive effects of stock options and convertible securities. To the extent stock options and convertible securities are anti-dilutive, they... -

Page 113

... THE CONSOLIDATED FINANCIAL STATEMENTS - (Continued) agreement is required to repay its security fee payments described above. We are subject to this requirement and have entered into the required contract with the TSA. • • Compensation for Strengthening Flight Deck Doors. Payments totaling $100... -

Page 114

...32 (32) $ 38 Deferred Tax Assets $ 16 - - 16 9 - 25 2,508(4) (133) $ 2,400 (1) See Notes 14 and 15 for additional information related to leased aircraft and restructuring and other charges. (2) The payments and deductions related to the allowance for uncollectible accounts receivable represent the... -

Page 115

...03 per share during that quarter. The comparability of our financial results during 2004 and 2003 was materially impacted by certain events, as discussed below During 2004, primarily in the June 2004 quarter, we recorded a valuation allowance against substantially all of our net deferred tax assets... -

Page 116

-

Page 117

...EXHIBIT 12.1 DELTA AIR LINES, INC. STATEMENT REGARDING COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES (In millions, except ratios) -------2004 (1) -------Earnings (loss): Earnings (loss) before income taxes and cumulative effect of accounting change Add (deduct): Fixed charges from below (... -

Page 118

-

Page 119

... New York Georgia NAME OF SUBSIDIARY Aero Assurance Ltd. ASA Holdings, Inc. Atlantic Southeast Airlines, Inc. Comair Holdings, LLC Comair, Inc. Comair Services, Inc. Crown Rooms, Inc. DAL Aircraft Trading, Inc. DAL Global Services, LLC DAL Moscow, Inc. Delta AirElite Business Jets, Inc. Delta... -

Page 120

..., Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, New York, North Carolina, North Dakota, Ohio, Oregon, Pennsylvania, Tennessee, Texas, West Virginia and Wisconsin. Delta Technology, LLC conducts business as Delta Air Lines Technology, Inc. in the following states: Alaska, Arizona... -

Page 121

-

Page 122

... Accounting Standards No. 142) and (2) our report dated March 9, 2005 relating to management's report on the effectiveness of internal control over financial reporting, appearing in this Annual Report on Form 10-K of Delta Air Lines, Inc. for the year ended December 31, 2004. Atlanta, Georgia... -

Page 123

-

Page 124

... Annual Report on Form 10-K of Delta Air Lines, Inc. for the fiscal year ended December 31, 2004, and any amendment or supplement thereto; and to file such Annual Report on Form 10-K with the Securities and Exchange Commission, the New York Stock Exchange, and any other appropriate agency pursuant... -

Page 125

... Annual Report on Form 10-K of Delta Air Lines, Inc. for the fiscal year ended December 31, 2004, and any amendment or supplement thereto; and to file such Annual Report on Form 10-K with the Securities and Exchange Commission, the New York Stock Exchange, and any other appropriate agency pursuant... -

Page 126

... Annual Report on Form 10-K of Delta Air Lines, Inc. for the fiscal year ended December 31, 2004, and any amendment or supplement thereto; and to file such Annual Report on Form 10-K with the Securities and Exchange Commission, the New York Stock Exchange, and any other appropriate agency pursuant... -

Page 127

... Annual Report on Form 10-K of Delta Air Lines, Inc. for the fiscal year ended December 31, 2004, and any amendment or supplement thereto; and to file such Annual Report on Form 10-K with the Securities and Exchange Commission, the New York Stock Exchange, and any other appropriate agency pursuant... -

Page 128

... Annual Report on Form 10-K of Delta Air Lines, Inc. for the fiscal year ended December 31, 2004, and any amendment or supplement thereto; and to file such Annual Report on Form 10-K with the Securities and Exchange Commission, the New York Stock Exchange, and any other appropriate agency pursuant... -

Page 129

... Annual Report on Form 10-K of Delta Air Lines, Inc. for the fiscal year ended December 31, 2004, and any amendment or supplement thereto; and to file such Annual Report on Form 10-K with the Securities and Exchange Commission, the New York Stock Exchange, and any other appropriate agency pursuant... -

Page 130

... Annual Report on Form 10-K of Delta Air Lines, Inc. for the fiscal year ended December 31, 2004, and any amendment or supplement thereto; and to file such Annual Report on Form 10-K with the Securities and Exchange Commission, the New York Stock Exchange, and any other appropriate agency pursuant... -

Page 131

... Annual Report on Form 10-K of Delta Air Lines, Inc. for the fiscal year ended December 31, 2004, and any amendment or supplement thereto; and to file such Annual Report on Form 10-K with the Securities and Exchange Commission, the New York Stock Exchange, and any other appropriate agency pursuant... -

Page 132

-

Page 133

... in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect Delta's ability to record, process, summarize and report financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have... -

Page 134

-

Page 135

... information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in Delta's internal control over financial reporting. Date: March 9, 2005 /s / Michael J. Palumbo Michael J. Palumbo Executive Vice President and Chief Financial Officer -

Page 136

-

Page 137

... the Securities and Exchange Commission of the Quarterly Report on Form 10-K of Delta Air Lines, Inc. ("Delta") for the fiscal year ended December 31, 2004 (the "Report"). Each of the undersigned, the Chief Executive Officer and the Executive Vice President and Chief Financial Officer, respectively...