DIRECTV 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

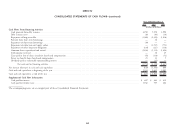

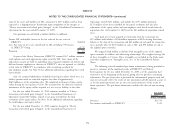

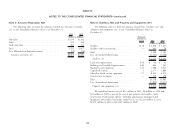

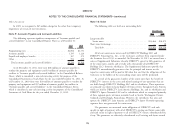

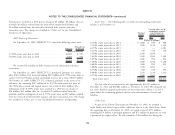

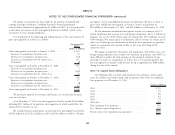

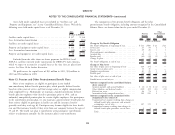

The following table sets forth property and equipment leased to our Note 7: Goodwill and Intangible Assets

subscribers as of December 31: The following table sets forth the changes in the carrying amounts of

‘‘Goodwill’’ in the Consolidated Balance Sheets by segment for the years ended

2011 2010

December 31, 2011 and 2010:

(Dollars in Millions)

Subscriber leased set-top equipment ................. $8,105 $ 6,971 Sports

Less: Accumulated depreciation of subscriber leased DIRECTV Networks,

DIRECTV Latin Eliminations

equipment ................................ (4,618) (4,096) U.S. America and Other Total

Subscriber leased set-top equipment, net .............. $3,487 $ 2,875 (Dollars in Millions)

Balance as of January 1, 2010 ...... $3,167 $656 $341 $4,164

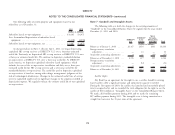

As discussed above in Note 3, effective July 1, 2011, we began depreciating Foreign currency translation

capitalized HD set-top receivers at DIRECTV U.S. over a four-year estimated adjustment ................. — 21 — 21

useful life. Previously, we depreciated HD set-top receivers at DIRECTV U.S. over Acquisition accounting adjustments . . . 9 — (46) (37)

a three-year estimated useful life. We continue to depreciate standard-definition Balance as of December 31, 2010 . . . 3,176 677 295 4,148

set-top receivers at DIRECTV U.S. over a three-year useful life. At DIRECTV Foreign currency translation

Latin America, we depreciate capitalized subscriber leased equipment, which adjustment ................. — (52) — (52)

includes the cost of the set-top receiver, installation and dish, over a three-year Acquisition accounting adjustments . . . 1 — — 1

estimated useful life for HD set-top receivers and a seven-year useful life for Balance as of December 31, 2011 . . . $3,177 $625 $295 $4,097

standard-definition set-top receivers. The useful life used to depreciate capitalized

set-top receivers is based on, among other things, management’s judgment of the

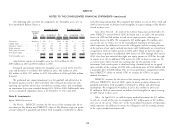

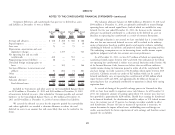

Satellite Rights

risk of technological obsolescence. Changes in the estimated useful lives of set-top

receivers capitalized could result in significant changes to the amounts recorded as Sky Brazil has an agreement for the right to use a satellite should its existing

depreciation expense. We regularly evaluate the estimate useful life of our capitalized leased satellite suffer a significant failure and replacement capacity is needed.

set-top receivers. During the first quarter of 2010, the satellite was launched and successfully placed

into its assigned orbit, and we recorded the total obligation for the right to use the

satellite of $116 million in ‘‘Intangible Assets’’ in the Consolidated Balance Sheets.

We made a $29 million payment during 2010 and we made the remaining

$87 million payment during 2011. The intangible asset is being amortized on a

straight line basis over the 15-year term of the agreement.

73