DIRECTV 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

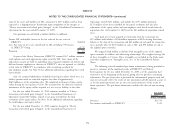

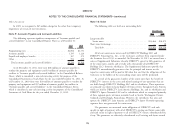

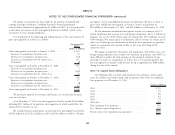

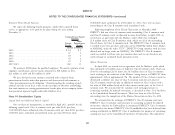

Temporary differences and carryforwards that gave rise to deferred tax assets The valuation allowance balances of $466 million at December 31, 2011 and

and liabilities at December 31 were as follows: $504 million at December 31, 2010, are primarily attributable to unused foreign

operating losses and unused capital losses, both of which are available for carry

2011 2010 forward. For the year ended December 31, 2011, the decrease in the valuation

Deferred Deferred Deferred Deferred allowance was primarily attributable to a reduction in the deferred tax asset on

Tax Ta x Tax Tax

Assets Liabilities Assets Liabilities Brazilian net operating loss carryfowards as a result of currency fluctuations.

(Dollars in Millions) Although realization is not assured, we have concluded that it is more likely

Accruals and advances ............. $ 418 $ 268 $ 366 $ 168 than not that our unreserved deferred tax assets will be realized in the ordinary

Prepaid expenses ................ — 34 — 39 course of operations based on available positive and negative evidence, including

State taxes .................... 73 — 75 — scheduling of deferred tax liabilities and projected income from operating activities.

Depreciation, amortization and asset The underlying assumptions we use in forecasting future taxable income require

impairment charges ............. — 1,155 — 723 significant judgment and take into account our recent performance.

Net operating loss and tax credit

carryforwards ................. 610 — 533 — As of December 31, 2011, we have $27 million of federal net operating loss

Programming contract liabilities ...... 48 — 59 — carryforward which expires between 2027 and 2028. The utilization of the federal

Unrealized foreign exchange gains or net operating loss carryforward is subject to an annual limitation under Section 382

losses ...................... — 105 — 146 of the Internal Revenue Code, however we believe that we will have sufficient

Tax basis differences in investments and taxable income during the limitation period to utilize all of the carryforward. We

affiliates .................... 91 804 74 861 also have foreign tax credit carryovers of $126 million which expire between 2019

Other ....................... 6 5 11 8 and 2021, California research tax credits of $25 million which can be carried

forward indefinitely, state net operating loss carryforwards of $30 million which

Subtotal ...................... 1,246 2,371 1,118 1,945 expire between 2029 and 2030, and approximately $2 billion of foreign net

Valuation allowance .............. (466) — (504) — operating losses that are primarily attributable to operations in Brazil with varying

Total deferred taxes ............. $ 780 $2,371 $ 614 $1,945 expiration dates.

As a result of closing of the parallel exchange process in Venezuela in May

Included in ‘‘Investments and other assets’’ in the Consolidated Balance Sheets

2010, we have been unable to repatriate excess cash balances. As of December 31,

are $210 million at December 31, 2011 and $320 million at December 31, 2010

2011, the cumulative amount of earnings upon which U.S. income taxes have not

of noncurrent deferred tax assets. Also included in ‘‘Accounts payable and accrued

been provided is approximately $298 million. Should these earnings be distributed

liabilities’’ in the Consolidated Balance Sheets are $92 million at December 31,

in the form of dividends, the distributions would be subject to U.S. federal income

2011 and $34 million at December 31, 2010 of current deferred tax liabilities.

tax at the statutory rate of 35 percent, less foreign tax credits available to offset

We assessed the deferred tax assets for the respective periods for recoverability such distributions. Because the time or manner of repatriation is uncertain, we

and, where applicable, we recorded a valuation allowance to reduce the total cannot determine the impact of local taxes, withholding taxes and foreign tax

deferred tax assets to an amount that will, more likely than not, be realized in the credits associated with the future repatriation of such earnings and therefore cannot

future. quantify the tax liability.

81