DIRECTV 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

year ended December 31, 2009 in ‘‘Liberty transaction and related gains (charges)’’ Covenants and Restrictions. The revolving credit facility requires DIRECTV

in the Consolidated Statements of Operations related to the partial settlement of U.S. to maintain at the end of each fiscal quarter a specified ratio of indebtedness

the collar and the adjustment of the remaining collar derivative financial to adjusted net income. The revolving credit facility also includes covenants that

instruments to their fair value as of December 31, 2009 to a liability of restrict DIRECTV U.S.’ ability to, among other things, (i) incur additional

$400 million. During the first quarter of 2010, we paid $1,537 million to repay subsidiary indebtedness, (ii) incur liens, (iii) enter into certain transactions with

the remaining principal balance and accrued interest on the credit facility, and to affiliates, (iv) merge or consolidate with another entity, (v) sell, assign, lease or

settle the equity collars. As a result, we recorded a gain of $67 million in ‘‘Liberty otherwise dispose of all or substantially all of its assets, and (vi) change its lines of

transaction and related gains (charges)’’ in the Consolidated Statements of business. Additionally, the senior notes contain restrictive covenants that are similar.

Operations in the first quarter of 2010 related to the Collar Loan. Should DIRECTV U.S. fail to comply with these covenants, all or a portion of its

borrowings under the senior notes could become immediately payable and its

Revolving Credit Facility revolving credit facility could be terminated. As of December 31, 2011,

management believes DIRECTV U.S. in compliance with all such covenants. The

In February 2011, DIRECTV U.S.’ $500 million, six-year senior secured senior notes and revolving credit facility also provide that the borrowings may be

credit facility was terminated and replaced with a five-year, $2 billion revolving required to be prepaid if certain change-in-control events occur.

credit facility. We pay a commitment fee of 0.30% per year for the unused

commitment under the revolving credit facility, and borrowings will bear interest at Restricted Cash. Restricted cash of $30 million as of December 31, 2011 and

an annual rate of (i) the London interbank offer rate (LIBOR) (or for Euro $70 million as of December 31, 2010 was included as part of ‘‘Prepaid expenses

advances the EURIBOR rate) plus 1.50% or at our option (ii) the higher of the and other’’ in our Consolidated Balance Sheets. These amounts secure our letter of

prime rate plus 0.50% or the Fed Funds Rate plus 1.00%. The commitment fee credit obligations and collateralize an international loan. Restrictions on the cash

and the annual interest rate may be increased or decreased under certain conditions, will be removed as the letters of credit expire and the loan is repaid.

which include changes in DIRECTV U.S.’ long-term, unsecured debt ratings. The

revolving credit facility has been fully and unconditionally guaranteed, jointly and Note 11: Income Taxes

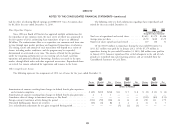

severally, by substantially all of DIRECTV U.S.’ domestic subsidiaries on a senior We base our income tax expense or benefit on reported ‘‘Income before

unsecured basis. In January 2012, we borrowed $400 million under the revolving income taxes.’’ Deferred income tax assets and liabilities reflect the impact of

credit facility. temporary differences between the amounts of assets and liabilities recognized for

Our senior notes payable mature as follows: $1,000 million in 2014, financial reporting purposes and such amounts recognized for tax purposes, as

$1,200 million in 2015, $3,750 million in 2016 and $7,550 million thereafter. The measured by applying currently enacted tax laws.

amount of interest accrued related to our outstanding debt was $201 million at

December 31, 2011 and $138 million at December 31, 2010.

79