DIRECTV 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

Change in Accounting Estimate testing of indefinite-lived intangibles. We do not expect the adoption of the revised

standard to have an effect on our consolidated results of operations and financial

Depreciable Lives of Leased Set-Top Receivers. We currently lease most set-top position, when adopted, as required, on January 1, 2012.

receivers provided to new and existing subscribers and therefore capitalize the cost

of those set-top receivers. We depreciate capitalized set-top receivers over the Note 4: Acquisitions

estimated useful life of the equipment. As a result of the completion of an extensive

evaluation of the estimated useful life of the set-top receivers, including Globo Transaction

consideration of historical write-offs, improved efficiencies in our refurbishment In connection with our acquisition of Sky Brazil in 2006, Globo was granted

program, improved set-top receiver failure rates over time and management’s the right, until January 2014, to require us to purchase all or a portion (but not

judgment of the risk of technological obsolescence, we determined that the less than half) of its 25.9% interest in Sky Brazil. In June 2010, Globo notified us

estimated useful life of HD set-top receivers used in our DIRECTV U.S. business that it was exercising its right to exchange 178.8 million shares representing

has increased to four years, from three years as previously estimated. We will approximately 19% of the ownership interests in Sky Brazil. In accordance with our

continue to depreciate standard definition set-top receivers at DIRECTV U.S. over agreement, Globo will have the right to exchange all (but not less than all) of its

a three-year estimated useful life. We are accounting for this change in the useful remaining equity interest in Sky Brazil until January 2014.

life of the HD set-top receivers at DIRECTV U.S. as a change in an accounting

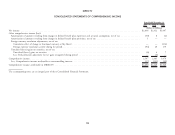

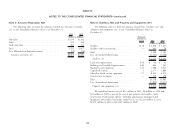

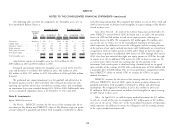

estimate beginning July 1, 2011. This change had the effect of reducing As a result of Globo’s notice, the fair value of the approximate 19% interest

depreciation and amortization expense and increasing both net income attributable was determined to be $605 million by an independent investment bank according

to DIRECTV and earnings per share in our consolidated results of operations for to a process specified by Globo and us in the related agreement. During the fourth

the year ended December 31, 2011 as follows: quarter of 2010, we paid the purchase price in cash, which was recorded as a

reduction to ‘‘Redeemable noncontrolling interest’’ in the Consolidated Balance

(Dollars in Millions, Sheets, for their approximate 19% interest in Sky Brazil. In addition, we recorded

Except Per Share Amounts) $79 million of net deferred tax assets related to the acquisition of this interest as an

Depreciation and amortization expense ............. $(141) offset to ‘‘Additional paid in capital’’ in the Consolidated Balance Sheets. We and

Net income attributable to DIRECTV ............. 86 our subsidiaries now own 93% of Sky Brazil and Globo owns the remaining 7%.

Basic earnings attributable to DIRECTV Class A

stockholders per common share ................ $0.12 Liberty Transaction

Diluted earnings attributable to DIRECTV Class A

On November 19, 2009, DIRECTV Group and Liberty Media obtained

stockholders per common share ................ $0.11

stockholder approval of and closed a series of related transactions which we refer to

collectively as the Liberty Transaction. The Liberty Transaction included the

New Accounting Standard split-off of certain of the assets of the Liberty Entertainment group into LEI, which

Goodwill Impairment Testing. In September 2011, the FASB approved a was then split-off from Liberty. Following the split-off, DIRECTV Group and LEI

revised standard that simplifies how entities test goodwill for impairment. The merged with subsidiaries of DIRECTV. As a result of the Liberty Transaction,

revised standard permits an entity to first assess qualitative factors to determine DIRECTV Group, which is comprised of the DIRECTV U.S. and DIRECTV

whether it is more likely than not that the fair value of a reporting unit is less than Latin America businesses, and LEI, which held Liberty’s 57% interest in DIRECTV

its carrying amount as a basis for determining whether it is necessary to perform Group, a 100% interest in three regional sports networks, a 65% interest in Game

the two-step goodwill impairment test. The standard does not address impairment Show Network, LLC, approximately $120 million in cash and cash equivalents and

69