DIRECTV 2011 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2011 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DIRECTV

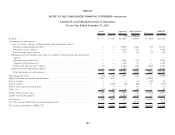

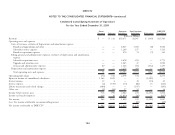

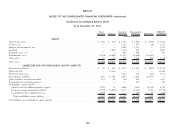

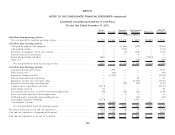

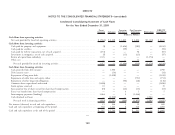

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

reversed an accrual for the uncertain tax position and recorded a net benefit of the propulsion system were to permanently fail, we would be required to de-orbit

$39 million in ‘‘Income tax expense’’ in the Consolidated Statements of Operations the satellite and record an impairment charge for its remaining book value, which

during the year ended December 31, 2010. was approximately $267 million at December 31, 2011. DIRECTV U.S. currently

has sufficient backup capacity to continue broadcasting most of the channels

Satellites broadcast from this satellite; however, we would lose some of our HD pay-per-view

channels if this satellite has to be de-orbited before additional capacity becomes

We may purchase in-orbit and launch insurance to mitigate the potential available. We do not believe the loss of such channels would materially affect our

financial impact of satellite launch and in-orbit failures if the premium costs are results of operations or financial position.

considered economic relative to the risk of satellite failure. The insurance generally

covers the unamortized book value of covered satellites. We do not insure against Other

lost revenues in the event of a total or partial loss of the capacity of a satellite. We

generally rely on in-orbit spare satellites and excess transponder capacity at key As of December 31, 2011, we were contingently liable under standby letters of

orbital slots to mitigate the impact a satellite failure could have on our ability to credit and bonds in the aggregate amount of $136 million, primarily related to a

provide service. At December 31, 2011, the net book value of in-orbit satellites was judicial deposit in Brazil for the ECAD matter discussed above.

$1,913 million, all of which was uninsured.

During the third quarter of 2011, the propulsion system used to maintain

DIRECTV U.S.’ D10 satellite’s position in orbit temporarily ceased to function. If

99