DIRECTV 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

SIGNIFICANT EVENTS AFFECTING THE COMPARABILITY OF THE In March 2011, we sold a 5% ownership interest in GSN for $60 million in

RESULTS OF OPERATIONS cash, reducing our ownership interest to 60%. We recognized a $25 million gain,

or $16 million after tax, on the sale in ‘‘Other, net’’ in the Consolidated Statements

Change in Accounting Estimate of Operations, which represents the difference between the selling price and the

Depreciable Lives of Leased Set-Top Receivers carrying amount of the portion of our equity method investment sold. For

additional information regarding the GSN sale, refer to Note 8 of the Notes to the

We currently lease most set-top receivers provided to new and existing Consolidated Financial Statements in Item 8, Part II of this Annual Report.

subscribers and therefore capitalize the cost of those set-top receivers. We depreciate

capitalized set-top receivers over the estimated useful life of the equipment. As a Malone Transaction

result of the completion of an extensive evaluation of the estimated useful life of

the set-top receivers, including consideration of historical write-offs, improved In April 2010, we entered into an agreement with Dr. John C. Malone and

efficiencies in our refurbishment program, improved set-top receiver failure rates his family, or the Malones, under which they exchanged 21.8 million shares of

over time and management’s judgment of the risk of technological obsolescence, we high-vote DIRECTV Class B common stock, which were all of the outstanding

determined that the estimated useful life of HD set-top receivers used in our DIRECTV Class B shares, for 26.5 million shares of DIRECTV Class A common

DIRECTV U.S. business has increased to four years, from three years, as previously stock, resulting in the reduction of the Malone’s voting interest in DIRECTV from

estimated. We will continue to depreciate standard-definition set-top receivers at approximately 24% to approximately 3% on June 16, 2010.

DIRECTV U.S. over a three-year estimated useful life. We are accounting for this We accounted for the exchange of DIRECTV Class B common stock into

change in the useful life of the HD set-top receivers at DIRECTV U.S. as a change DIRECTV Class A common stock pursuant to accounting standards for induced

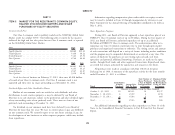

in an accounting estimate beginning July 1, 2011. This change had the effect of conversions, whereby the $160 million in incremental DIRECTV Class A common

reducing depreciation and amortization expense and increasing both net income stock issued to the former DIRECTV Class B stockholders has been deducted from

attributable to DIRECTV and earnings per share in our consolidated results of earnings attributable to DIRECTV Class A stockholders for purposes of calculating

operations for the year ended December 31, 2011 as follows: earnings per share in the Consolidated Statements of Operations. As a result of this

transaction, diluted earnings per DIRECTV Class A common stock in the

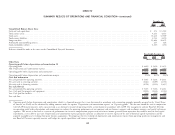

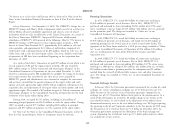

(Dollars in Millions,

Except Per Share Amounts) Consolidated Statements of Operations was reduced by $0.18 for the year ended

December 31, 2010. See Note 14 of the Notes to the Consolidated Financial

Depreciation and amortization expense ............. $(141)

Statements in Item 8, Part II of this Annual Report for additional information.

Net income attributable to DIRECTV ............. 86

Basic earnings attributable to DIRECTV Class A

Acquisitions

stockholders per common share ................ $0.12

Diluted earnings attributable to DIRECTV Class A Globo Transaction. In connection with our acquisition of Sky Brazil in 2006,

stockholders per common share ................ $0.11 Globo was granted the right, until January 2014, to require us to purchase all or a

portion (but not less than half) of its 25.9% interest in Sky Brazil. In June 2010,

Divestitures Globo notified us that it was exercising its right to exchange 178.8 million shares

representing approximately 19% of the ownership interests in Sky Brazil. During

In April 2011, we sold an equity method investment for $55 million in cash.

the fourth quarter of 2010, we paid cash for the approximate 19% ownership

We recognized a $37 million gain ($23 million after tax) on the sale in ‘‘Other,

interest, which was recorded as a reduction to ‘‘Redeemable noncontrolling interest’’

net’’ in the Consolidated Statements of Operations.

in the Consolidated Balance Sheets. We and our subsidiaries now own

approximately 93% of Sky Brazil and Globo retains the right to sell its remaining

36