DIRECTV 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

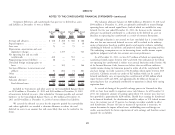

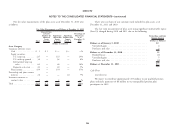

obligations, if any, of DIRECTV to the extent of the value of the assets securing 2010 Financing Transactions

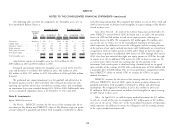

the obligations. DIRECTV will not be subject to the covenants contained in each On August 17, 2010, pursuant to a registration statement, DIRECTV U.S.

indenture of the senior notes and our guarantees will terminate and be released on issued the following senior notes:

the terms set forth in each of the senior notes.

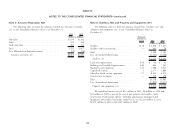

Proceeds, net

As of December 31, 2011, DIRECTV U.S. had the ability to borrow up to Principal of discount

$2 billion under a revolving credit facility discussed below. (Dollars in Millions)

3.125% senior notes due in 2016 ................. $ 750 $ 750

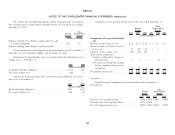

2011 Financing Transactions 4.600% senior notes due in 2021 ................. 1,000 999

6.000% senior notes due in 2040 ................. 1,250 1,233

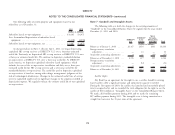

On March 10, 2011, DIRECTV U.S. issued the following senior notes:

$3,000 $2,982

Proceeds, net

Principal of discount

We incurred $19 million of debt issuance costs in connection with these

(Dollars in Millions)

transactions.

3.500% senior notes due 2016 ................... $1,500 $1,497

5.000% senior notes due 2021 ................... 1,500 1,493 On August 20, 2010, DIRECTV U.S. repaid the $1,220 million of remaining

6.375% senior notes due 2041 ................... 1,000 1,000 principal on Term Loans A and B of its senior secured credit facility. The

repayment of Term Loans A and B resulted in a 2010 pre-tax charge of $7 million,

$4,000 $3,990

$4 million after tax, resulting from the write-off of deferred debt issuance and other

We incurred $24 million of debt issuance costs in connection with this transaction costs. The charge was recorded in ‘‘Other, net’’ in our Consolidated

transaction. Statements of Operations.

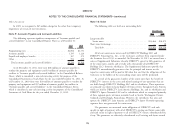

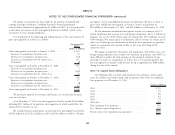

On March 17, 2011, DIRECTV U.S. purchased, pursuant to a tender offer, On March 11, 2010, DIRECTV U.S. issued the following senior notes:

$341 million of its then outstanding $1,002 million of 6.375% senior notes due in Proceeds, net

2015 at a price of 103.313%, plus accrued and unpaid interest, for a total of Principal of discount

$358 million. On June 15, 2011, DIRECTV U.S. redeemed, pursuant to the terms (Dollars in Millions)

of its indenture, the remaining $659 million of its outstanding 6.375% senior notes 3.550% senior notes due in 2015 ................. $1,200 $1,199

due 2015, at a price of 102.125%, plus accrued and unpaid interest, for a total of 5.200% senior notes due in 2020 ................. 1,300 1,298

$694 million. The redemption of the 6.375% senior notes resulted in a 2011 6.350% senior notes due in 2040 ................. 500 499

pre-tax charge of $25 million, $16 million after tax, primarily for the premiums $3,000 $2,996

paid. The charge was recorded in ‘‘Other, net’’ in our Consolidated Statements of

Operations. We incurred $17 million of debt issuance costs in connection with these

transactions.

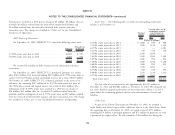

On March 16, 2010, DIRECTV U.S. repaid the $985 million of remaining

principal on Term Loan C of its senior secured credit facility. The repayment of

77